2024 Annual Report

"Despite the pace of change in our industry, our core mission to deliver simple, safe, competent and personal service still rings true.” - Jim Popp, President & CEO

A Message From Our CEO

Building to Thrive

At the start of every year, our senior leaders and I gather to discuss the factors we believe will impact our business in the coming year. We consider things like rate forecasts, economic data, consumer confidence, politics and a host of other possible inputs. From those discussions we set expectations for client activity, sales growth – or decline – and the overall direction we will set for our company in the year ahead.

Heading into 2024, we were a little nervous that stubbornly high rates, global unrest and the looming Presidential election might lead the market to take a more cautious approach – which usually means less growth and investment. With that in mind, we focused on attention to fundamentals, active call coverage, execution, and getting “back-to-basics” in our business. I’m happy to report that even with this approach, we were able to produce very strong operating results in 2024, while setting us up with great momentum heading into 2025. Here are a few highlights:

Expanded Branch Network

- We opened a new full-service West Milwaukee branch featuring a community space dedicated to first-time homebuyer and financial literacy training.

- We relocated our west Madison branch to better serve clients from a modern, full-service location.

- We opened a new Fox Cities location in north Appleton, consolidating several of our teams in a larger, full-service location.

Growing Neighborhoods

- We helped 2,006 customers buy new homes, providing over $2.1 MM of down payment assistance or grants.

- Our community lending team continued to make homeownership more affordable and accessible, especially for first-time homebuyers.

Community Engagement

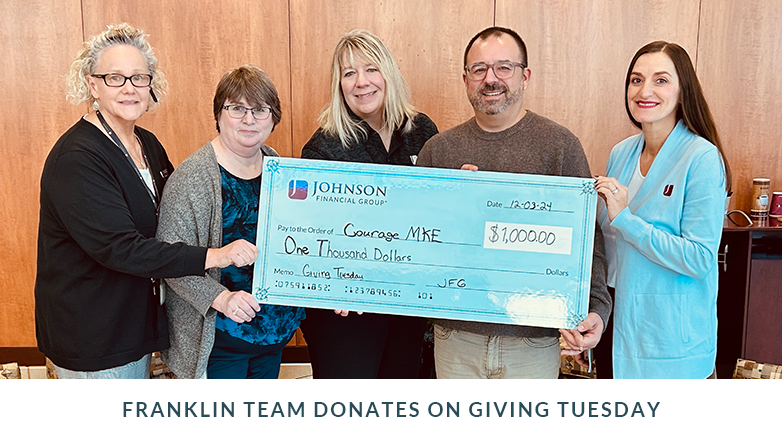

- We held our third annual Giving Tuesday event, with 33 locations contributing $66,000 to 51 local non-profits.

- We achieved record levels of participation and dollars pledged during our annual United Way Giving Campaign, with associates pledging over $412,000, matched dollar-for-dollar by Johnson Financial Group.

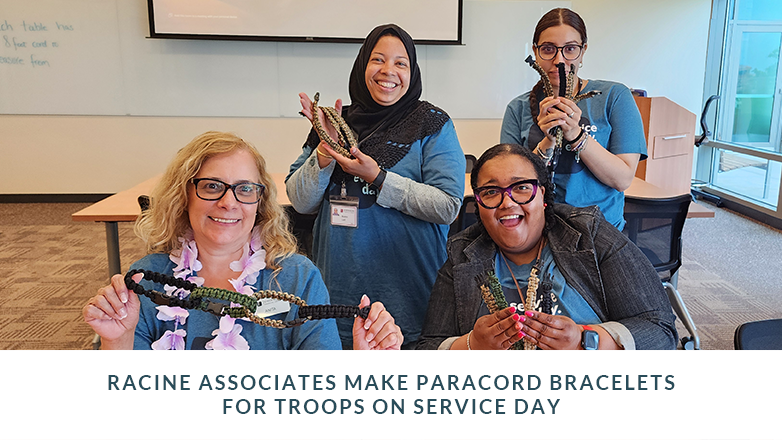

- Our associates logged over 14,000 volunteer hours in 2024, demonstrating their commitment to giving back to our communities.

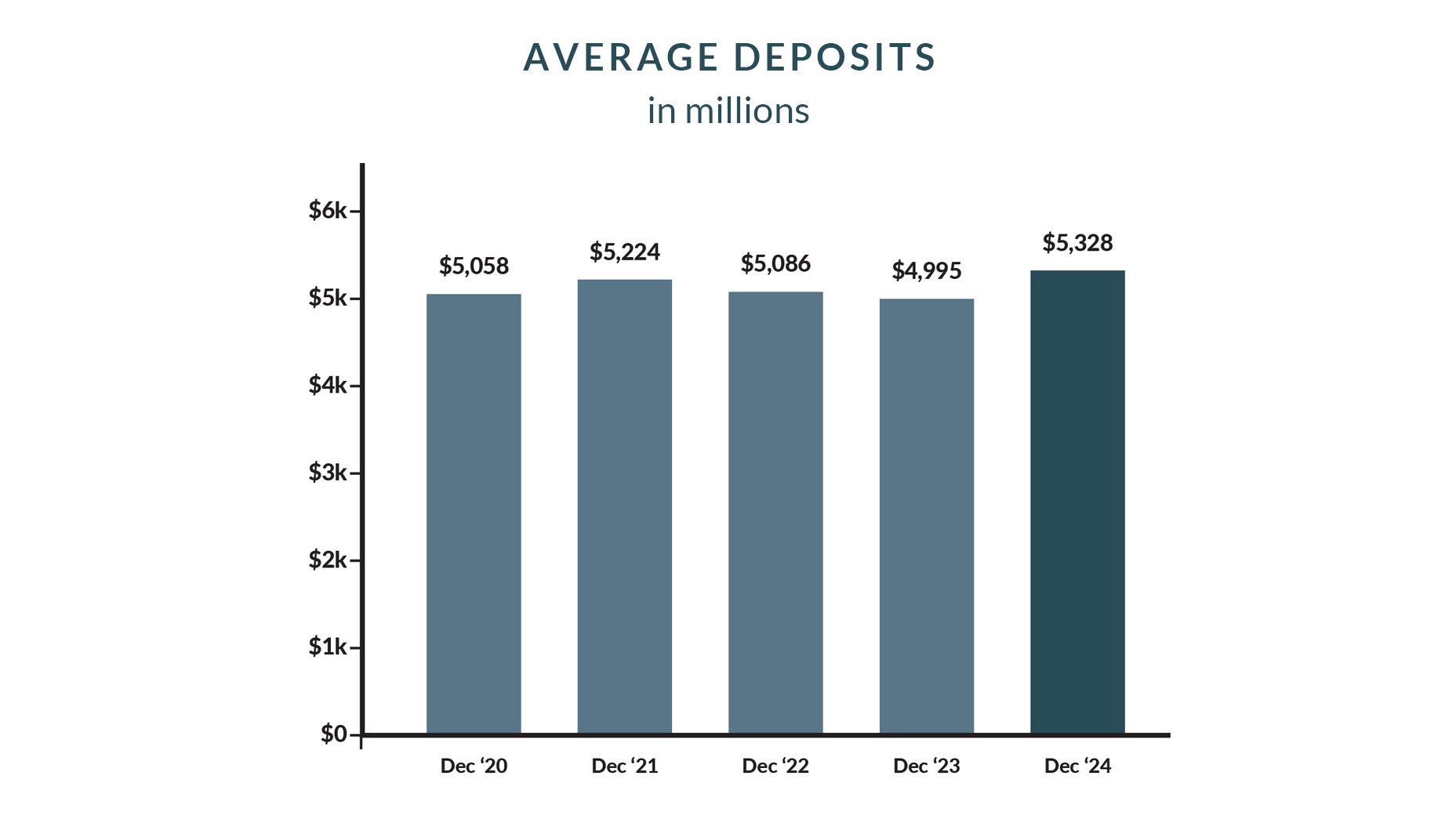

Financially, we exceeded our goals in revenue, pre-tax income, loan growth, deposit growth and new customer acquisition. More importantly, our outreach to and connection with you, our valued customers, has never been stronger. This positions us well to continue growing, welcoming new clients, and deepening our relationships in 2025. We thank you for the trust and confidence you continue to place in Johnson Financial Group every day. Here’s to a healthy, safe and successful 2025!

Best,

Jim Popp

President & CEO

Financial Performance

As we look to 2025 and beyond, we’re grateful to be operating from a position of strength and confidence. In fact, Johnson Bank was recently recognized among the Strongest Banks in Wisconsin by the Milwaukee Business Journal. This underscores our dedication to financial strength, while m aintaining our commitment to customer service and community impact.

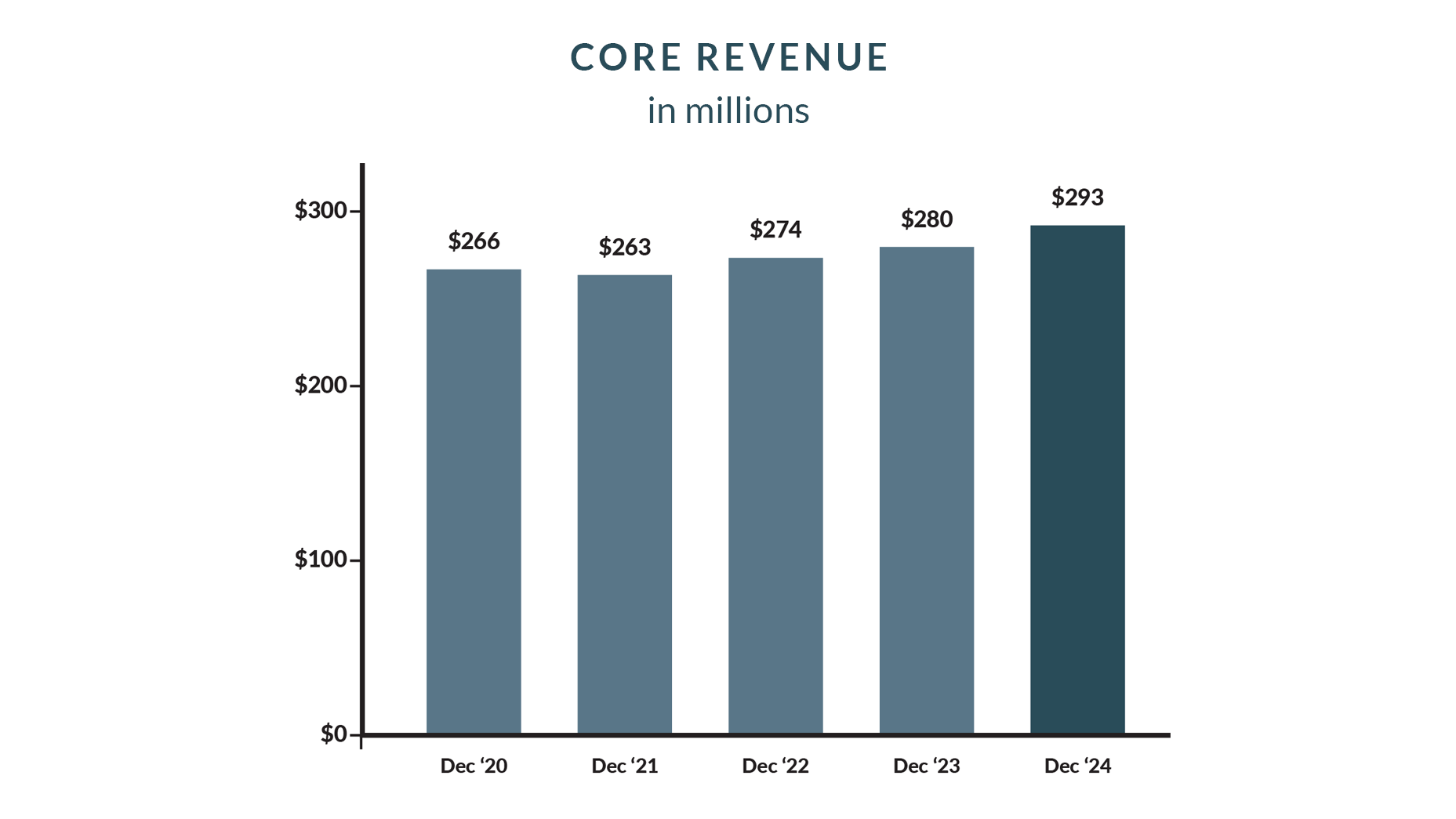

- Core Revenue in 2024 grew by $12.9 million, or 4.6%, to $292.6 million, compared to $279.7 million in 2023.

- Pre-tax income pre-provision was $80.4 million for the year, which is $6.1 million, or 8.3%, higher than 2023.

- Net interest margin increased from 3.31% in December 2023 to 3.42% in December 2024.

- Johnson Financial Group’s mortgage volumes overcame the higher-than-expected rate environment, logging originations of $715 million, versus $573 million for the same time in 2023.

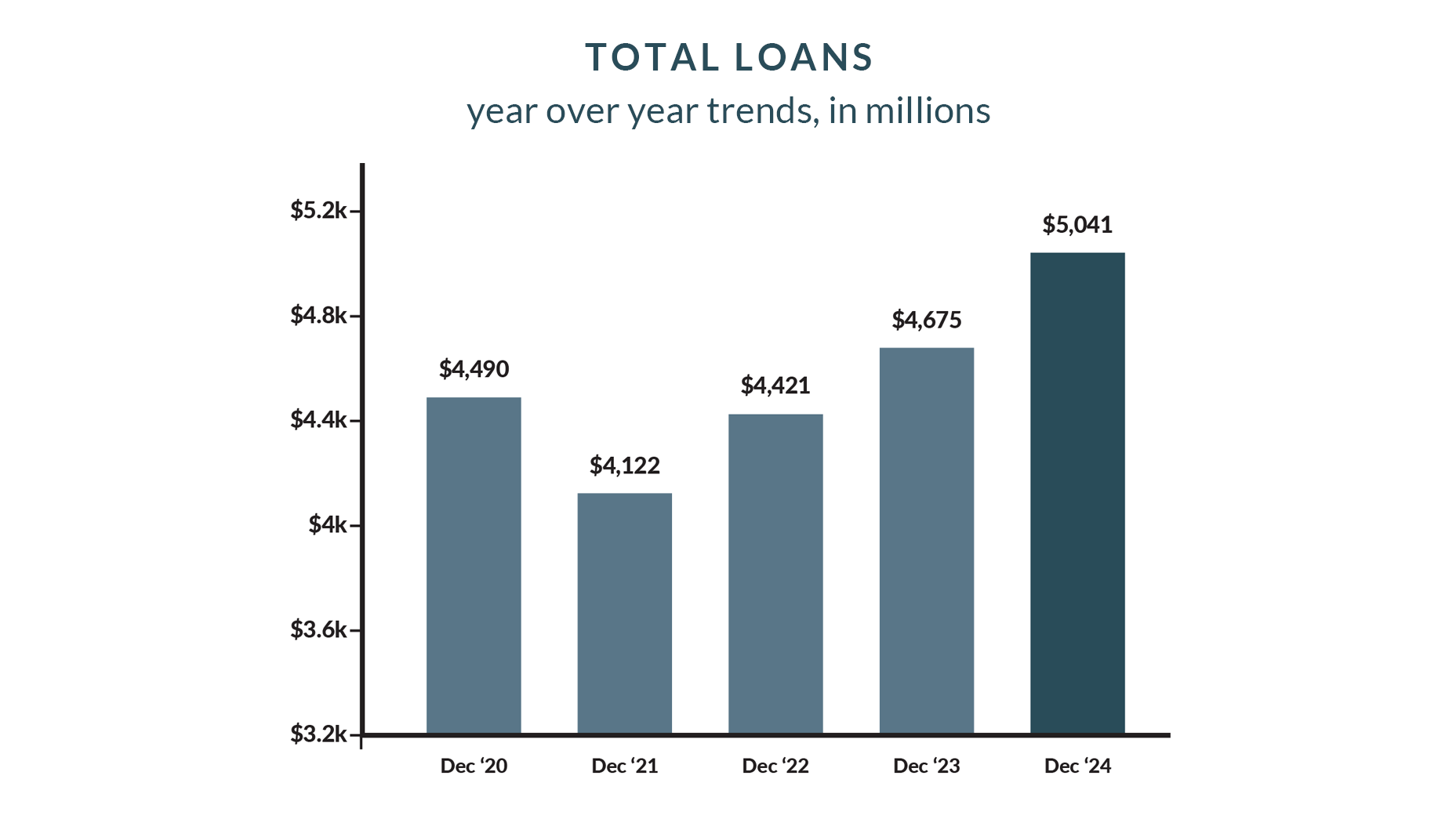

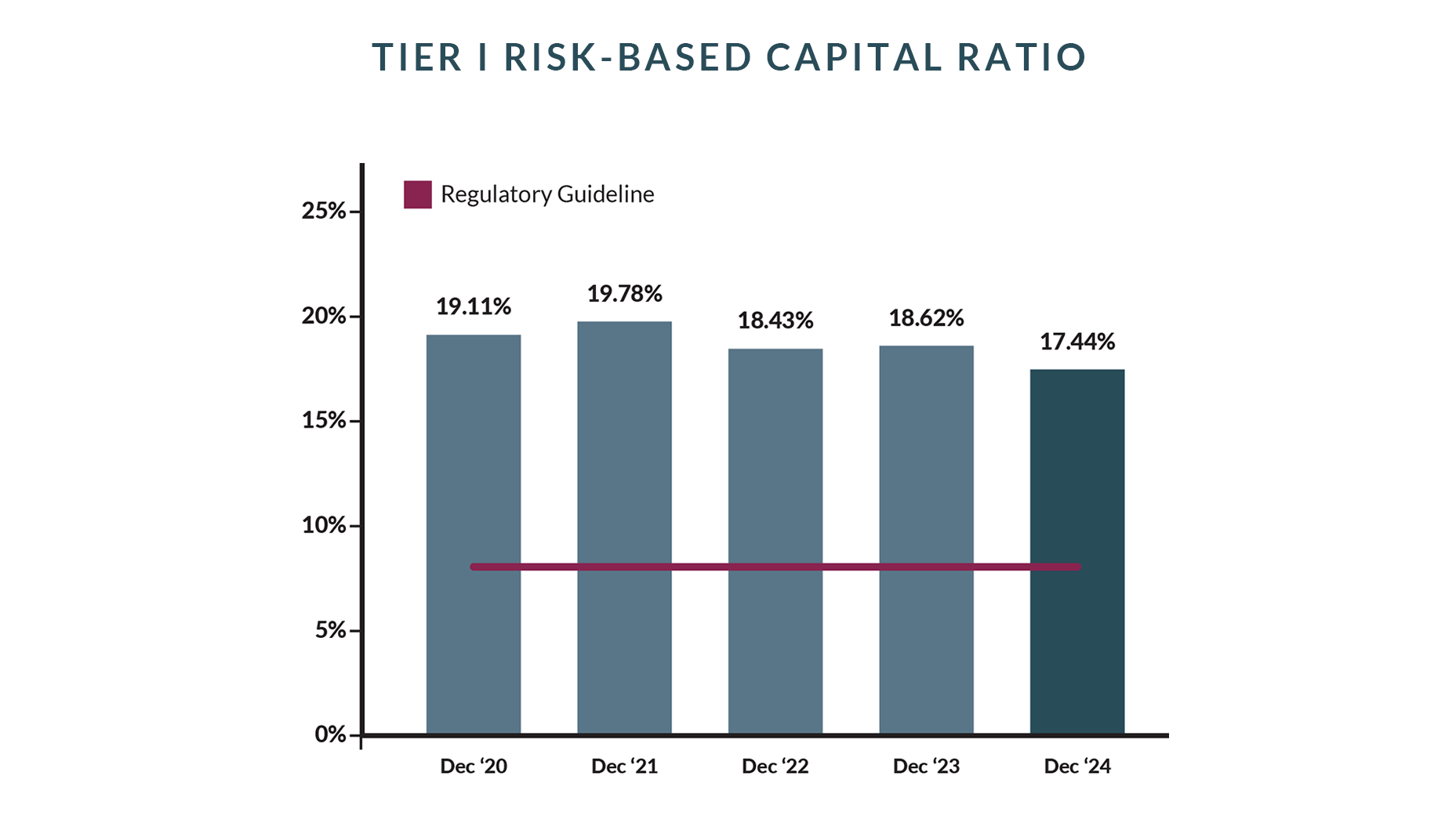

Financial Snapshot

2024 Highlights

Commercial and Consumer Banking

Commercial team played a vital role in the continued success of our Wisconsin companies, facilitating over $275 million in new loans. We also had the pleasure of welcoming 67 new commercial clients and 154 new business banking clients. Additionally, our Consumer and Private Banking clients placed their trust in us, adding nearly $400 million in new deposits to their accounts. Our Commercial Real Estate and Commercial Specialty teams maintained their impressive track record, achieving steady growth in both loans and deposits.

As noted earlier, our branch expansion efforts continued, with the opening of our new West Milwaukee branch and the relocation of our west Madison team to a new location in the West Towne neighborhood. We also completed construction on a new branch in the Fox Cities, which opened in early January 2025. Looking ahead, our branch focus will continue in the Madison area with consolidation of the team to new expanded space on the Capitol Square and a brand-new location in Sun Prairie set to open by October, replacing our existing east side location.

Mortgage

As the rate environment shifted in both deposits and mortgage loans, we remain focused on finding the best solutions to serve our clients. Our Mortgage team proudly helped facilitate over $2.1 MM in downpayment grants and assistance making homeownership possible in a market that has seen intense competition and rate fluctuation. The Mortgage Services team helped a record 2,006 clients secure home financing in 2024.

Wealth

While our Wealth business did well overall, our Johnson Financial Group Financial Advisors had a particularly strong year, posting 7 all-time record months in 2024. This exceptional performance by Jess Dohner and his team not only underscored our commitment to delivering top-tier financial solutions, but also provided our clients with the confidence and support they needed to achieve their financial goals.

Our in-house podcast, Your Money. Your Mission., hosted by Kelly Mould, continues to provide timely and relevant content to help our listeners to align their financial decisions with their personal values and goals. We encourage you to subscribe and listen on Spotify and Apple today and to join conversations about maximizing wealth by turning complex financial situations into actionable advice.

Dominic Ceci, Chief Investment Officer, hosted a series of episodes featuring experts who discussed various aspects of the 2024 election. The series covered topics from pre-election geopolitical issues to post-election economic impacts and included a downloadable scorecard for election night.

Finally, our Wealth team wrapped up a three-year project transitioning our clients to a more streamlined, robust platform offering an improved digital experience with real time account information and analytics, complex planning capabilities and easy to understand statements and reports – all while keeping your accounts safe and secure.

Associate Engagement

For the fifth year in a row, Johnson Financial Group was recognized as a Top Workplace. On average, fewer than 3% of eligible organizations earn a Top Workplaces designation, making this achievement a clear differentiator among peers. We’ve received recognition for Top Workplaces USA, Madison - WI State Journal and Milwaukee -Journal Sentinel.

Johnson Financial Group also scored 100% on the Disability Equality Index and is recognized as a Best Place to Work for Disability Inclusion for the 4th year in a row! The Disability Equality Index is the world’s most comprehensive benchmarking tool for Fortune 1000 scope companies to measure disability workplace inclusion inside their organization and to assess performance across industry sectors.

Keeping Our Communities Strong

Our commitment to strong communities continued, with Johnson Financial Group donating $1.7 million dollars. We continued to give back through our branch network in our third annual Neighborhood Giving Campaign where associates chose to give to charities in their neighborhood. 33 teams received $2,000 to donate to a local organization of their choice on National Giving Tuesday, which allowed us to donate $66,000 to 51 deserving community partners and organizations across our network. As always, we strive to make a meaningful impact in communities where we live and work, with giving directed predominantly toward the arts, financial literacy and community welfare, throughout the entire year.

2025 Outlook

A Look Ahead

For years, I have attended a bank conference called “Acquire or Be Acquired”. As the name suggests, the focus is largely centered around bank mergers and acquisitions – although the topics of FinTech and AI have grown in recent years. This year, we were all reminded of the consolidation that has taken place in our industry. For reference, almost 13,000 banks in 1990 have today been consolidated to just over 4,400. Astoundingly, the largest bank in the US today, JPMorgan Chase, now boasts assets of over $4.3 trillion, making them larger than the smallest 4,300 banks COMBINED!

Clearly, the banking industry – and the world, for that matter – is changing and evolving rapidly. To survive and thrive in this industry, we must continue to invest, change and evolve our business, while maintaining the culture, feel and connection to our customers and communities that both still value so much. It’s a hard balance, but at Johnson Financial Group, we understand the assignment….. We need to do BOTH.

As we look to 2025 and beyond, we’re grateful to be in a position to do exactly that. We have positioned our company with the strength, stability, people and capital to invest for the long term. That allows us to invest in technology, platforms, facilities and capabilities to remain in the best class of banks and wealth advisors in the country, while remaining true to our roots as a privately held, truly local community bank in the State of Wisconsin.

Simple. Safe. Competent. Personal. We talk about these four things a lot at Johnson Financial Group. It’s a simple recipe, but if we can deliver those four things day in and day out for our customers, our associates and our communities, we not only have a right to exist, but we also have the ability to thrive. LET’S GO!

Our Leadership Team

Our Board of Directors

Thank you to our Board of Directors for their continued guidance and support.