Wealth Wise: Choosing the Right Advisor for Your Financial Future

In this episode:

00:00 – 4:49: Introduction to Evamarie and Her Vision for JFG Wealth

4:50 – 6:37: What You Should Look for in an Advisor

6:38 – 9:12: How We Serve Our Clients

9:13 – 11:51: Why Young Professionals Should Work With an Advisor

11:52 – 14:18: Empowering Women With and Within Wealth Management

14:19 – 21:06: The Importance of Having a Close Relationship With Your Financial Team

21:07 – 22:15: Closing and Thank You for Listening!

When it comes to managing your financial future, finding the right advisor can make all the difference. A trusted financial partner can help you navigate life's complexities and achieve your goals, whether you’re planning for retirement, managing multi-generational wealth, or starting your investment journey. But what should you look for in a financial advisor? In this episode, we are joined by Evamarie Schoenborn, Executive Vice President of Wealth Management at Johnson Financial Group, who shares insights to help you make an informed decision.

1. A Strong Listener

One of the most critical traits of an effective financial advisor is their ability to listen. As Evamarie shares, a great advisor seeks to understand your values, priorities, and aspirations. Your financial journey is unique, and an advisor who listens deeply can tailor advice to align with your goals.

2. Holistic Approach to Wealth Management

Financial planning is more than just numbers; it’s about life goals, family dynamics, and personal dreams. Advisors like those at Johnson Financial Group focus on holistic wealth management, which includes investments, estate planning, tax strategies, and connecting clients to a network of professionals such as legal and tax advisors. This comprehensive approach ensures that all aspects of your financial life are aligned.

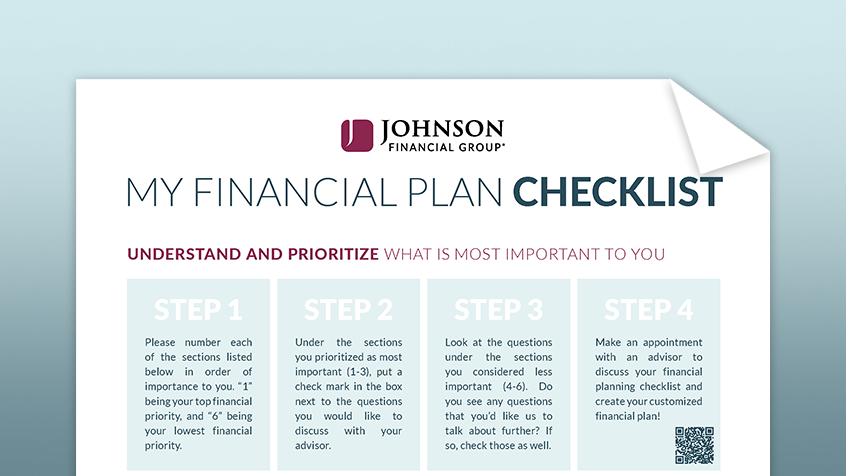

Download Your Financial Checklist

Download the checklist to start understanding and prioritizing what is most important to you.

DOWNLOAD3. Knowledge and Experience

When entrusting your wealth, you want to ensure your advisor has the knowledge and experience to manage complex situations. For instance, Johnson Financial Group boasts a team with over 500 years of combined investment management expertise. Whether you’re dealing with sophisticated investment instruments or navigating generational wealth transitions, a knowledgeable advisor is essential.

4. Community Connections

A standout feature of Johnson Financial Group is its community-centric approach. By focusing on the state of Wisconsin, the team tailors services to the unique DNA of each local community. Advisors who are deeply connected to their communities can provide relevant advice and connect you with valuable local resources.

5. Trusted Guidance for Every Stage

Whether you’re a young professional or managing significant wealth, a financial advisor can offer tailored guidance for every stage of your journey. Early career professionals can benefit from advice on budgeting, insurance, and financial planning, while more established clients might need expertise in succession planning or philanthropic giving. As Evamarie noted, even small early steps can set the foundation for long-term success.

6. Building Relationships Beyond Transactions

In today’s fast-paced, tech-driven world, personal relationships still matter. While robo-advisors can provide generic advice, they lack the human connection that a dedicated advisor offers. Post-pandemic, the importance of genuine relationships has become even clearer. An advisor who truly knows and cares about you can provide not just financial guidance but also emotional support during major life decisions.

7. A Partner in Abundance

Sometimes, the most valuable service an advisor can provide is permission to enjoy your wealth. As Evamarie shared, many clients are hesitant to spend or donate money, even when they have plenty. A good advisor can provide clarity and confidence, helping you transition from a mindset of scarcity to one of abundance, enabling you to make a meaningful impact with your resources.

Conclusion

Choosing the right financial advisor is about more than just their credentials—it’s about finding someone who listens, understands, and partners with you to achieve your goals. Whether you’re planning for the future or navigating life's complexities, a trusted advisor can make the journey not only manageable but also rewarding.

Let's start a conversation

Fill out the form below and one of our advisors will get back to you.