SUMMARY

In this article, we focus on the three best ways to save for college: 529 plans, Coverdell Education Savings Accounts and UGMA/UTMA accounts. Discover how each savings plan can contribute to a secure educational future, making transitioning to college smoother and more affordable.

As the cost of higher education continues to rise, starting to save for college early can make a significant difference in managing expenses down the line. Whether you're a parent planning for your child’s future or a student funding your education, understanding effective college-saving strategies can make all the difference. This article explores the three most effective ways to start saving for future college students and their families. From 529 plans to Coverdell Education Savings Accounts, we’ll cover all you need to know to begin your savings journey.

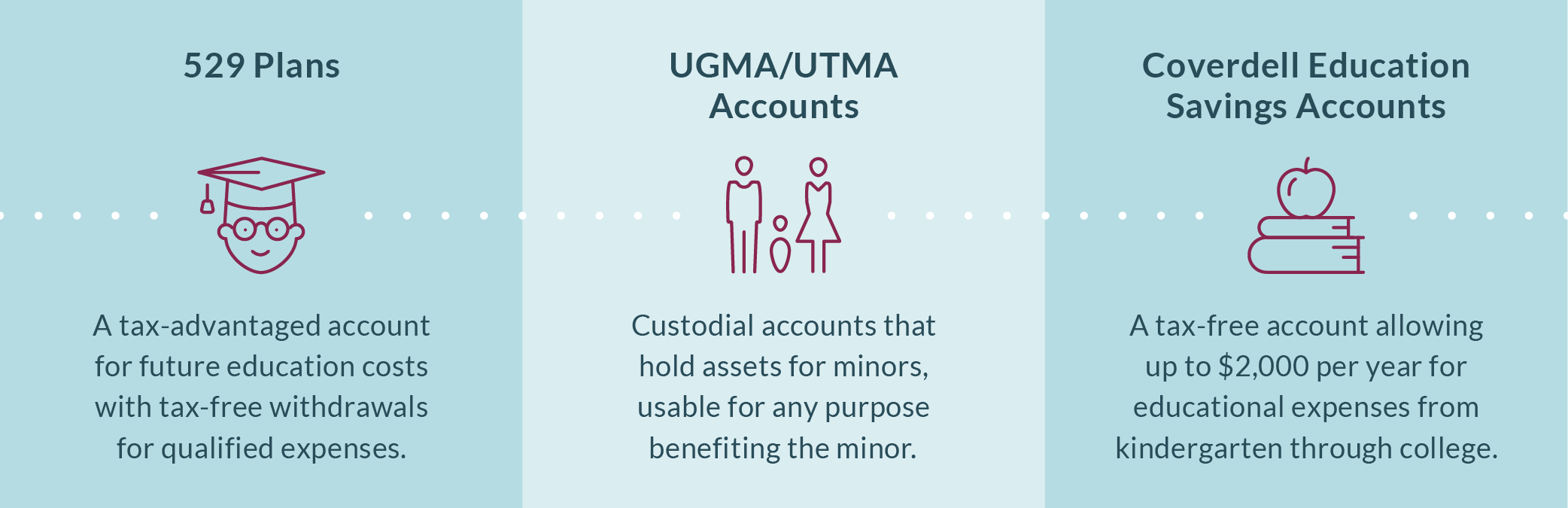

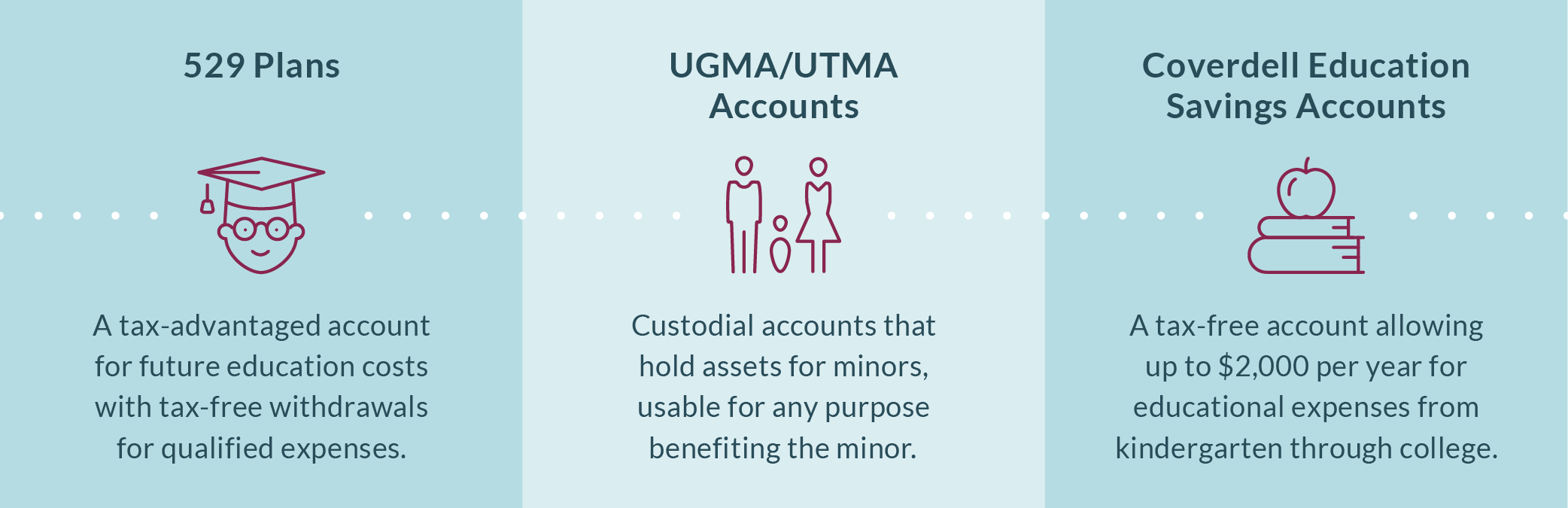

3 Effective College-Saving Tools

529 Plans

529 plans are state-sponsored investment programs specifically designed for educational savings, offering two distinct options: prepaid tuition plans and education savings plans. Prepaid tuition plans enable you to purchase units or credits at participating colleges and universities for future tuition at today's prices, which can be a strategic way to manage future educational costs. On the other hand, education savings plans allow you to open an investment account to save for a variety of future college expenses, including tuition, mandatory fees and room and board.

One of the significant advantages of 529 plans is their tax efficiency. The gains in a 529 plan accumulate without tax and withdrawals are exempt from taxes when used for eligible educational expenses. Additionally, many states offer further incentives, such as state income tax deductions or credits for contributions made to a 529 plan. It's also worth noting the flexibility of 529 plans which extends to the ability to transfer accounts between relatives. If the original beneficiary does not need the funds for college, the plan can be transferred to another child, cousin and/or spouse, ensuring the savings are used for educational purposes.

529 plans also offer an "accelerated" gifting feature, which allows contributors to make a substantial initial deposit by combining five years' worth of the annual gift tax exclusion into one single year. This strategy, provided no additional gifts are made to that student in the subsequent five years, can significantly front-load a 529 plan, allowing for maximum growth of the investment. This flexibility and these features make 529 plans a robust tool for planning and saving for future educational expenses while also providing various options to adapt to changing family circumstances or educational needs.

UGMA/UTMA Accounts

UGMA (Uniform Gifts to Minors Act) and UTMA (Uniform Transfers to Minors Act) accounts are custodial accounts that allow assets to be held in a minor’s name without the need for an attorney to establish a trust. These accounts are used to gift or transfer assets to minors, and the funds can be used for any purpose that benefits the minor, not just educational expenses.

While UGMA/UTMA accounts offer less tax advantages compared to 529 plans and Coverdell ESAs, they provide great flexibility in how the funds can be used. However, because the assets in these accounts are considered the property of the minor, they could have a more significant impact on financial aid eligibility. Once the minor reaches the age of majority (usually 18 or 21, depending on the state), they gain control of the account and can use the funds as they see fit, which may or may not include educational expenses.

Coverdell Education Savings Accounts

Coverdell Education Savings Accounts (ESAs) are tax-advantaged investment accounts designed to cover educational expenses from kindergarten through college. One of the key benefits of a Coverdell ESA is the broad range of educational expenses it covers, including tuition, fees, books, supplies and even computer technology and internet access when used for educational purposes.

Contributions to a Coverdell ESA are limited to $2,000 per year per beneficiary and aren’t tax-deductible, but the earnings grow tax-free. Distributions are also tax-free if used for qualified educational expenses. It's important to be aware that contributions to a Coverdell ESA can only be made until the beneficiary turns 18 and the funds must be used by the time the beneficiary turns 30 to avoid taxes and penalties. Income limits also apply to contributors, which may restrict some higher-income earners from using this account type.

Planning for college expenses is crucial, and choosing the right savings account for you is based on your unique circumstances. Working with an advisor can help you make an informed decision that best suits your needs and supports your educational aspirations. Connect with an advisor today to discuss the best option for you and your family.