SUMMARY

Building a strong business credit profile is crucial for the long-term financial health and growth of any company. This article provides a concise guide outlining the key steps on how to build business credit and improve business creditworthiness.

Just as individuals rely on personal credit scores, businesses need to establish a solid credit profile to access capital, enhance credibility and open doors to new partnerships. This guide helps business owners understand how to build business credit, providing practical steps to establish a strong credit foundation. By following these fundamentals, you can position your company for long-term success and secure the financial resources needed to fuel your growth.

What's business credit and do I need it?

Building business credit is essential for business owners who have current or future borrowing needs. Business credit refers to the credit score that applies specifically to businesses and is used by creditors to assess creditworthiness. It plays a crucial role for financial institutions and other creditors when evaluating business loan applications. Businesses may apply for financing for various purposes like working capital, inventory, equipment purchases and real estate acquisitions.

Establishing business credit sets the groundwork for future growth and enables businesses to meet immediate financial requirements. It also positions business owners for future borrowing needs and instills confidence in lenders they can provide financing for potential growth opportunities. Maintaining a good credit score helps businesses be prepared for unexpected financial demands as they arise.

What’s the difference between personal and business credit?

While business credit and personal credit function similarly, they serve different purposes. Here’s a quick breakdown of the differences between them:

| Personal Credit |

- Tied to personal finances.

- Used for individual financial needs, such as personal loans and credit cards.

- Score is determined by personal payment history, the ratio of debt to total available credit, credit mix and credit history.

|

| Business Credit |

- Tied to a business entity.

- Designed for business-related expenses, such as business loans and lines of credit.

- Score is determined by the business’s payment history, age of credit history, debt and debt usage, industry risk, company size and in most cases your personal credit score for business borrowers.

|

How's business credit score measured?

Here at Johnson Financial Group, we assess your FICO Small Business Scoring Service (SBSS) when reviewing loan applications. This comprehensive score considers your complete financial picture and how your personal and business aspects intertwine. The SBSS is determined by factors such as your personal credit score, business credit score, total cash flow and revenue of your business, length of time in operation and any other outstanding liens against the business.

The SBSS score ranges between 0–300, with a higher score indicating lower financial risk to the bank. A higher SBSS score increases your chances of securing financing for essential business needs. While specific requirements and considerations may vary among banks, the current minimum SBSS score to qualify for a U.S. Small Business Administration (SBA) loan is 155.

Note: If your business is a sole proprietorship, loan decisions will be based on your personal credit score.

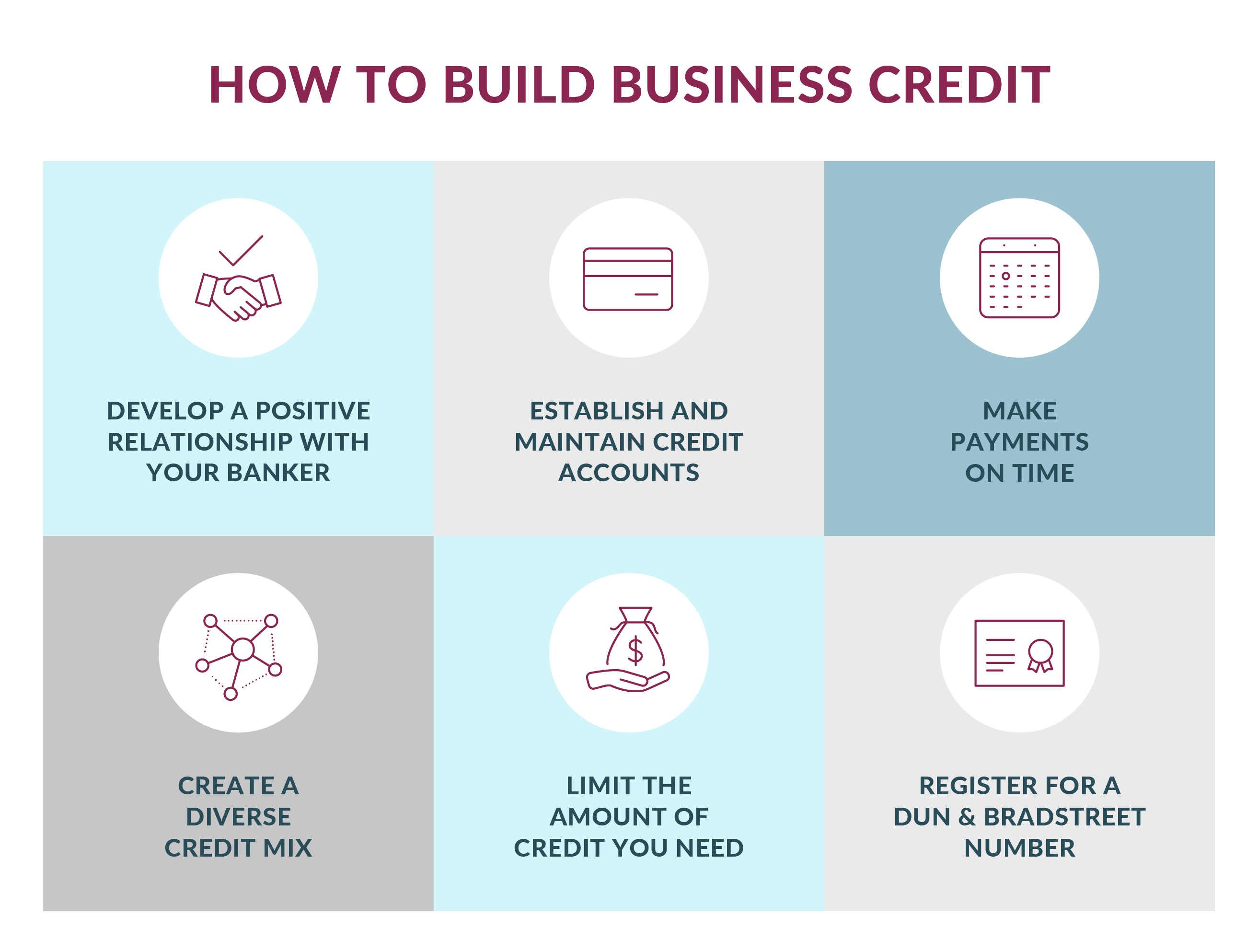

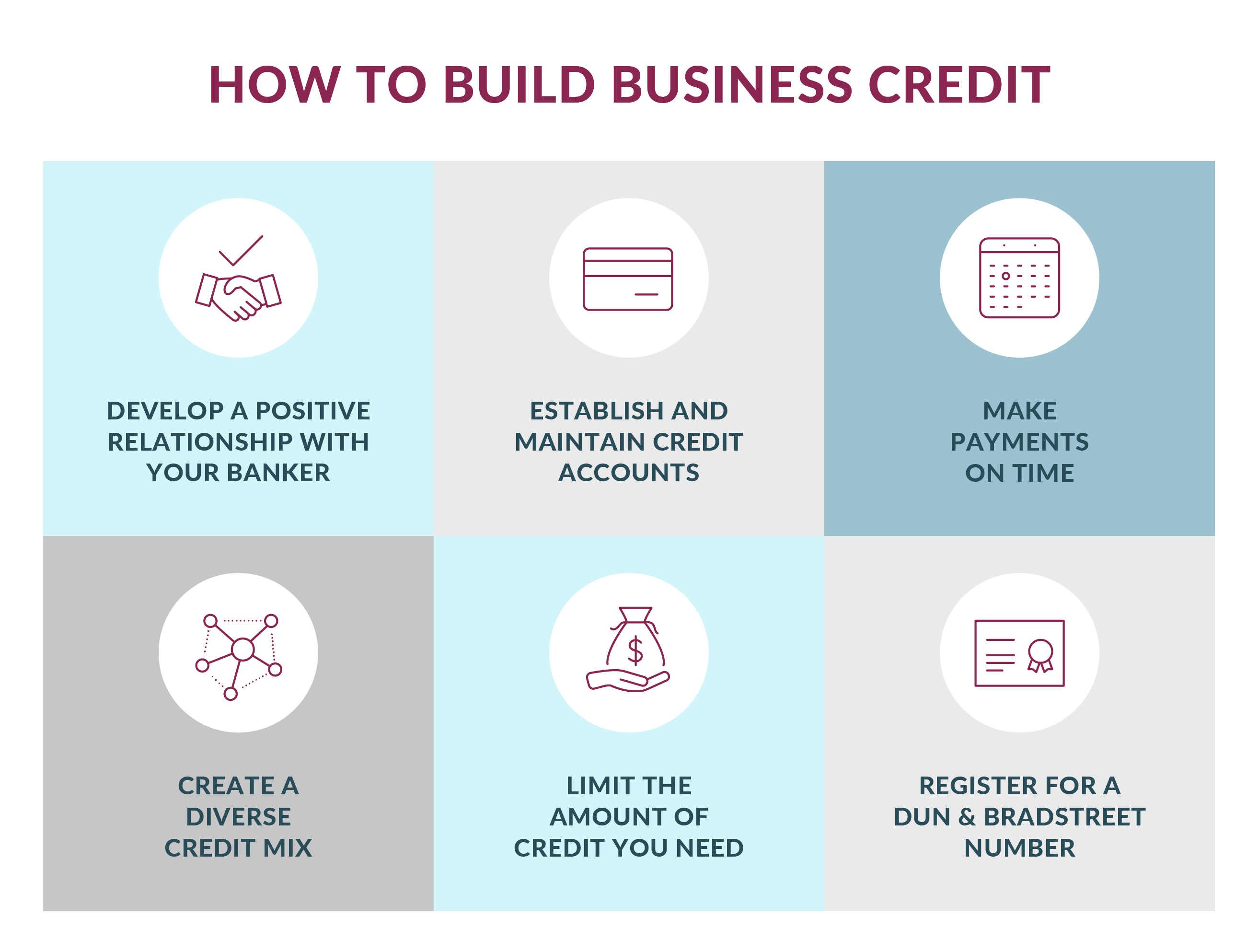

How to Build Business Credit

1. Develop a positive relationship with your business banker

Building a relationship with a trusted banker is invaluable. They can provide guidance, share credit-building strategies and answer specific questions about the business credit landscape. Consistent, open communication with your banker can also keep you informed about new opportunities and potential risks. By fostering a collaborative relationship with your banker, you can build trust and confidence, increasing your chances for future financing.

2. Establish and maintain credit accounts

To build business credit, it’s essential to establish credit accounts in your company’s name. Start by opening accounts with suppliers, vendors and service providers who report payment history to credit bureaus. These accounts can include trade credit, business credit cards and lines of credit. Be sure to choose partners who report to major credit bureaus, such as Dun & Bradstreet.

3. Make payments on time

Consistently making payments on time is crucial for building a positive credit history. Late payments can have a detrimental impact on your credit score and may hinder your ability to secure future credit. Set up reminders or consider automating payments to ensure you never miss a due date. Timely payments demonstrate your ability and financial responsibility, which are key factors in building strong business credit.

4. Create a credit mix

Having a diverse credit mix can enhance your creditworthiness. Aim to have a combination of different types of credit accounts, such as revolving credit (business credit cards) and lines of credit. This demonstrates your ability to manage various credit obligations and can positively impact your credit score.

5. Limit the amount of credit you need

While it’s important to establish credit accounts, it’s equally crucial to avoid excessive borrowing. Lenders and credit bureaus assess your credit utilization ratio, which is the amount of credit you’re using compared to the available total credit. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management. Avoid maxing out credit cards or lines of credit, as it can negatively impact your creditworthiness.

6. Register for a Dun & Bradstreet Number

Dun & Bradstreet (D&B) is a leading business credit bureau that provides credit scores and ratings to companies. Registering for a D&B Number, also known as a DUNS Number, is free and allows you to establish a credit file with D&B. It provides a high-level overview of your company’s financial strength and creditworthiness and is widely recognized by lenders, suppliers and partners.

You can also monitor your business credit profile by obtaining a Dun and Bradstreet membership. With this membership, you can set up alerts to conveniently track any changes in your business credit score. This allows you to stay informed about fluctuations and you’ll be able to review your score before applying for a loan.

Tip: We recommend proactively setting up a DUNS Number because the SBA and government agencies may request it in the future.

Building Business Credit FAQ

How long does it take to build business credit?

You can start building and improving your business credit right away by following the steps above. However, financial institutions generally prefer to see a track record of two full years of profitability in addition to reviewing your business credit when reviewing a loan application.

How can I improve my creditworthiness?

To improve your creditworthiness, it’s important to focus on both your personal and business credit health. Familiarizing yourself with the 5 Cs of Credit can provide valuable insights into understanding credit health:

-

- Capacity: The capacity criterion assesses your business’s financial strength and growth potential, focusing on its ability to meet loan repayments while maintaining operational stability.

- Capital: Lenders are fundamentally interested in financing well-capitalized businesses. They seek businesses that have a substantial amount of their own money invested in their operations.

- Collateral: Collateral serves as a form of insurance for the lender. It's the tangible asset or assets that a business owner pledges to secure the loan.

- Conditions: Here, “conditions” doesn't refer to the conditions of the loan itself, but rather to the economic and industry conditions that your business operations within. ·

- Character: Pertains to your reliability and trustworthiness. It’s primarily gauged through a detailed examination of your personal credit history and credit score.

By focusing on these aspects and maintaining a strong credit profile, you can enhance your creditworthiness and increase your chances of securing favorable financing options.

Building business credit is a gradual process that requires consistent effort and responsible financial management. By following these six steps, you can lay a strong foundation for your business credit profile. Remember, building good credit takes time, but the benefits it brings to your business are well worth the effort.

At JFG, we have a team of business bankers who are dedicated to helping develop a plan focused on your business goals. Connect with a business banker to learn more and start building business credit today.

ABOUT THE AUTHORS

SVP, Business Banking Manager | Johnson Financial Group

As Senior Vice President, Business Banking Manager, Matt leads a team of relationship managers who are dedicated to delivering exceptional service to businesses across Wisconsin. He and his team focus on developing and maintaining long-term, meaningful relationships with closely held businesses. Matt takes time to understand each client’s business, specializing in developing customized solutions to meet their comprehensive financial needs.

VP, Small Business Underwriting Manager | Johnson Financial Group

As Vice President, Small Business Underwriting Manager, Mike manages the credit needs of existing business customers and new applicants across Wisconsin. Drawing upon his extensive credit background, Mike takes great pride in crafting solutions to both simple and complex credit situations in a straightforward and efficient manner. This builds a successful future for our customers, community and JFG.