Recently a client asked, “Are you scared about the market being up so much?” It’s a natural question, because when stock-market gains outpace earnings growth, valuations should—at least eventually—come back down.

But right now, there’s an unusual dynamic at work, and it gives us some confidence that recent, higher levels of the S&P 500 Index of large-company stocks may be sustainable—at least with respect to stock-price relationships with earnings.

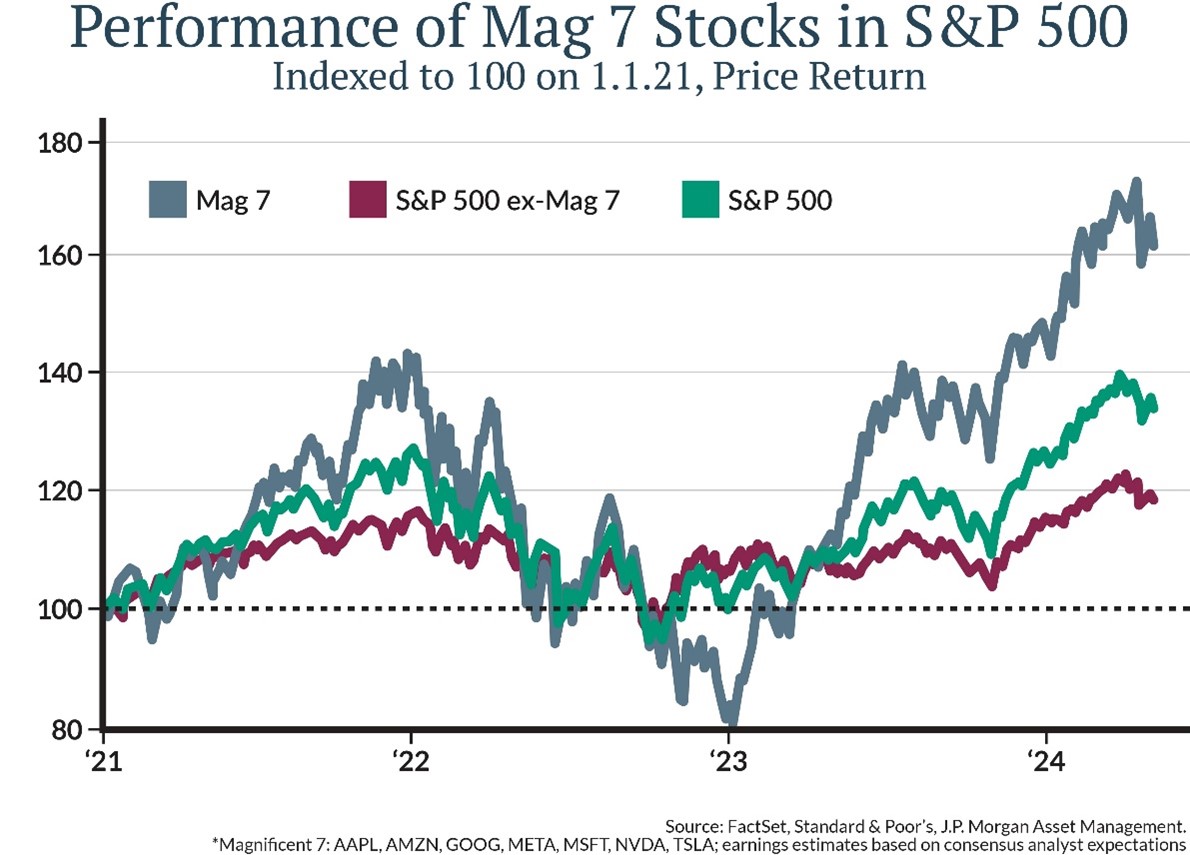

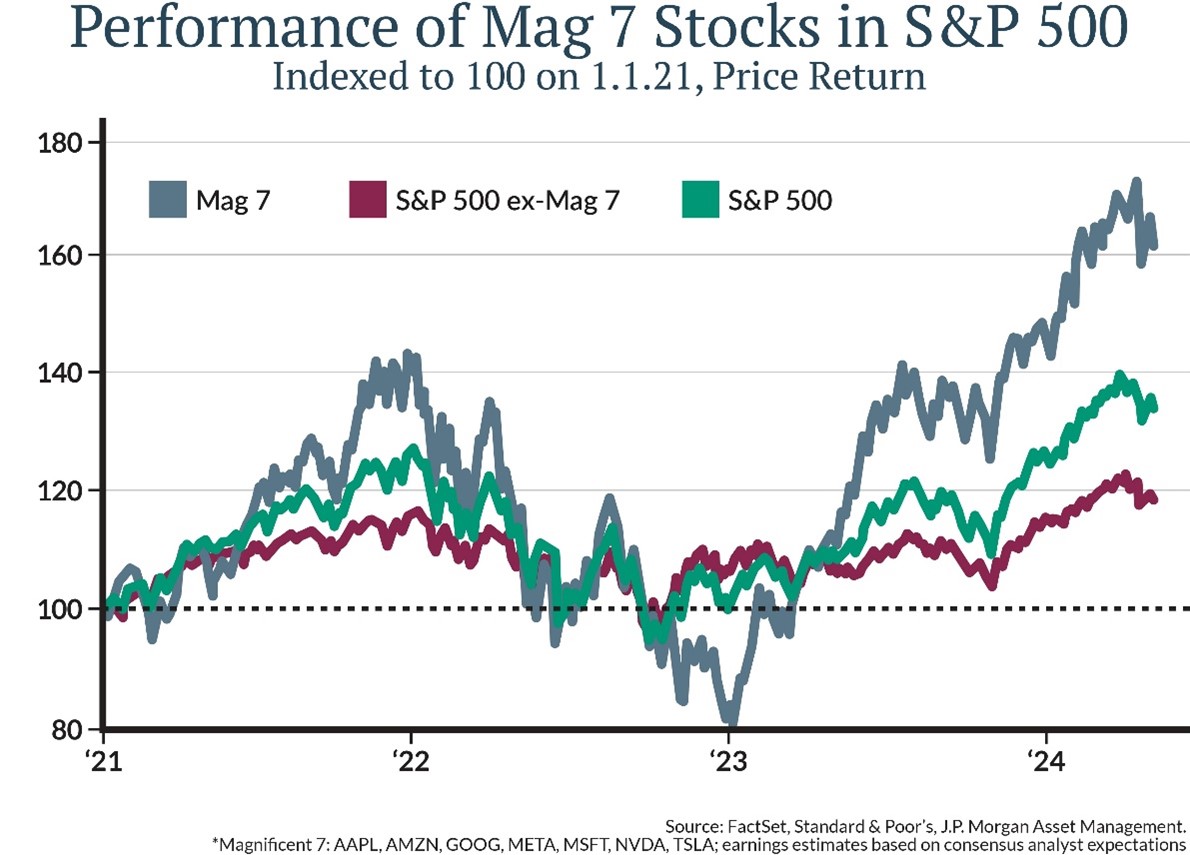

Here’s what’s going on. In 2023, the so-called Magnificent Seven stocks (Apple, Amazon, Google, Meta, Microsoft, NVIDIA and Tesla) dominated returns for the S&P 500 Index. That’s because of strong earnings and sheer size; they now make up about 29.7% of the Index’s weight of the S&P 500 Index. The rest of the Index, by contrast, experienced more normal or average returns last year.

What’s happening now

Now, projected earnings growth for the Magnificent Seven is slowing (see the gray bars in the right portion of the chart below, which are projections for each quarter in 2024) … but earnings growth for the rest of the S&P 500 Index constituents are increasing (see the red bars in that same right-hand portion of the chart below).

The upshot is that average growth across all Index constituents should be strong. This dynamic has the potential to lift many more stocks than the seven that dominated last year.

Performance disparity may adjust

If those estimated changes to earnings hold, then we may see some correction to the historically extreme performance disparity shown in the chart below. The gray line—showing the Magnificent Seven stocks’ performance—has far outpaced the rest of the market (red line).

But if the red line comes up as the gray line comes down, we could still see the market as a whole (green line) do just fine.

What to do with this information?

First and foremost, we suggest don’t be scared about good returns! If our expectations are correct, we see opportunities to invest that do not seem to be overvalued. We look to rebalance portfolios at inflection points to help mitigate the risk from—and take advantage of opportunities created by—major divergences in security returns over shorter periods.

Also, realize that the index numbers are not a great timing tool and have some flaws currently in terms of the information they are conveying. The market can also go down for any number of reasons—not just earnings—but that is a normal part of investing.

As we have written in the past all of this needs to be in the context of your goals and time frame to achieve them.