Investment Commentary

Don’t Wait for Perfection

6 minute read time

Well, I did it. I took the plunge.

No, I didn’t get married. Or buy Bitcoin. Or become a vegan.

A decade after my last foray into the real estate market, I bought a house.

I have written before about my experience purchasing a home before the real estate market collapsed in 2008. That experience soured me on home ownership, and I have been a renter ever since.

One could make the case that my timing is abysmal. Housing has had a terrific run over the past decade, and home affordability is by some measures the worst it has ever been. Both monthly mortgage payments and down payments as a percentage of household income are high. Renting, not owning, is the better value play.

I’m sharing this experience not because I’m bullish on housing but because I think there are parallels between the decision I faced and the choices investors are confronted with today. Stock valuations are high, and the economy is cooling. Many investors are wondering if a recession will cause stock prices to fall, creating a better buying opportunity. But waiting for a bear market in stocks is like waiting for the perfect set up to enter the housing market. The odds of timing it right are low, and the costs of missing out are high.

Rather than sitting in cash waiting for perfection, we believe investors should consider using today’s relatively high interest rates to their advantage. Mixing bonds with stocks can reduce the impact of stock market volatility, and a coming rate-cutting cycle may lead to further price appreciation in fixed-income markets, even as cash yields begin to erode.

Fed Ready to Pivot

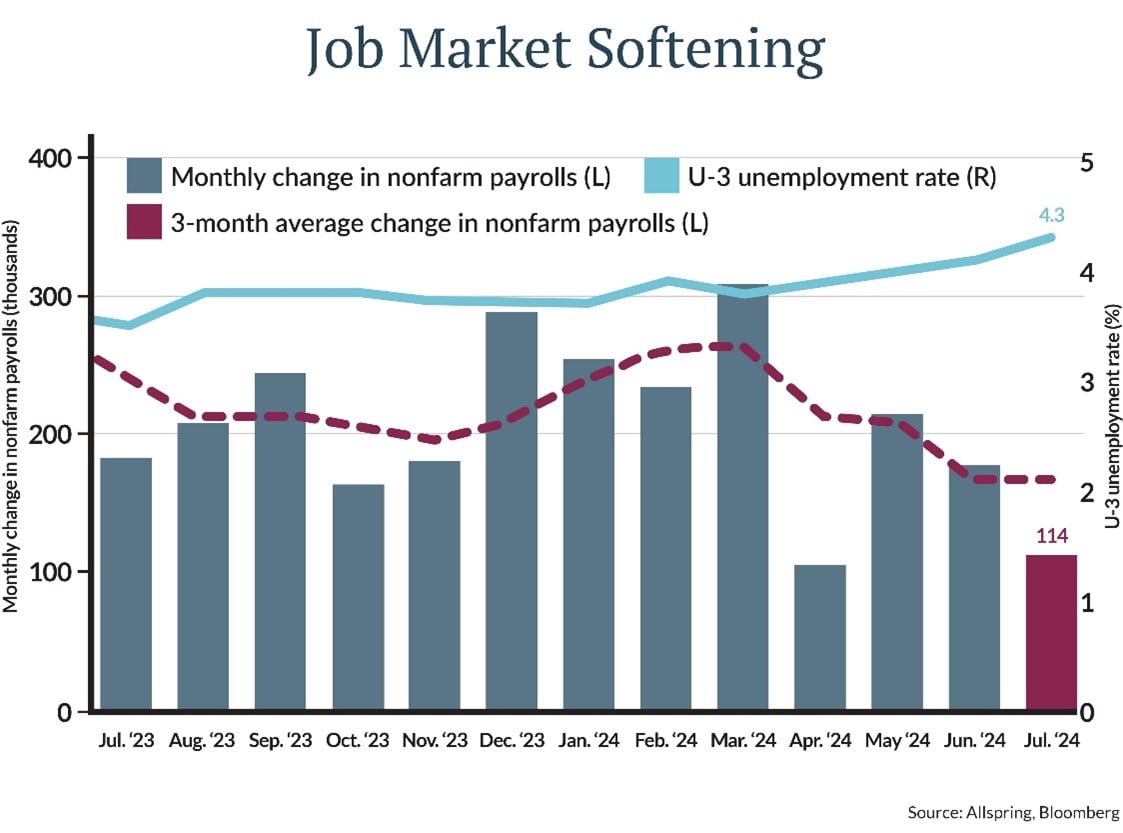

The July jobs report confirmed what many economists had begun to suspect. A cooling economy has dented the job market. Hiring slowed to 114,000 jobs last month, missing expectations, while the unemployment rate rose to 4.3%, its highest level since 2021 [Figure 1].

Last week, more bad news came when the Department of Labor issued a preliminary estimate of revisions that indicated employers might have added fewer jobs than originally reported throughout most of 2023 and early 2024.

The cooling labor market, combined with inflation nearing the Fed’s 2% target, has caused investors to bet that the Federal Reserve will switch its focus from fighting inflation to its other mandate, promoting maximum employment. The two-year Treasury bond’s yield has fallen over 0.8 percentage points since July 1, strong evidence that investors believe interest rate cuts are coming soon. Federal Reserve Chair Jerome Powell confirmed the market’s suspicions with his Jackson Hole speech on August 23. “The time has come for policy to adjust,” Powell said. He added, “We do not seek or welcome further cooling in labor market conditions,” cementing the view that the Fed will cut interest rates at its next meeting in mid-September. In other words, here come the cuts.

The question for investors now is whether the Fed can achieve a soft landing, with inflation continuing on its downward path without a recession, or whether slowing job gains turn into job losses, slowing corporate earnings, and lower stock prices.

Know Your Investment Horizon

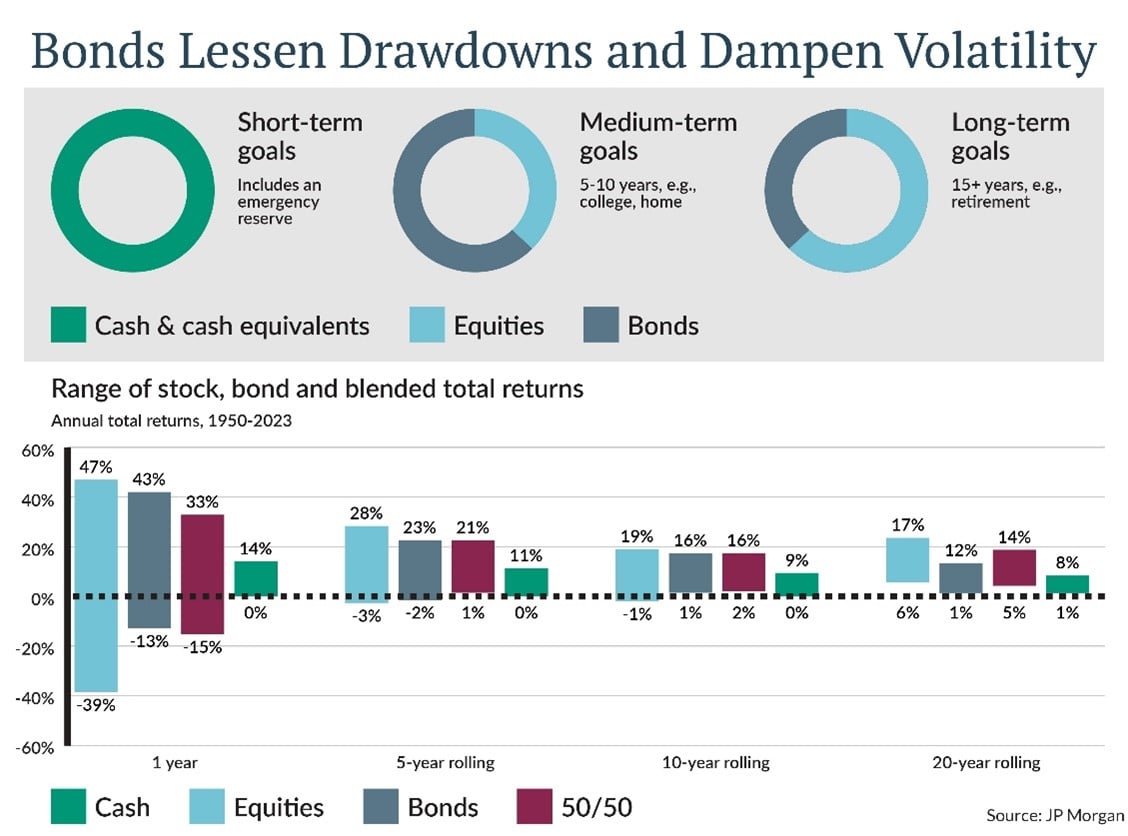

With the path of the economy uncertain, it’s more important than ever that investors know their investment horizon and invest accordingly. Near-term goals should be funded with cash and short-term bonds, while intermediate-term and long-term goals should use a combination of stocks and bonds. The key here is that although bonds typically return less than stocks, they are very good at lessening drawdowns and dampening volatility.

The chart below looks at the range of total returns of different asset mixes over various time horizons from 1950-2023 [Figure 2]. Notice that adding a 50% allocation to bonds reduced the worst one-year drawdown from -39% for a 100% stock portfolio to -15% for a 50% stock/50% bond mix. Over a 5-year horizon, the worst outcome for a 50% equity 50% bond portfolio was positive 1%. While past performance does not guarantee future returns, history suggests that balanced portfolios are poised to weather even a so-called hard landing.

Total Return is What Matters in Fixed Income

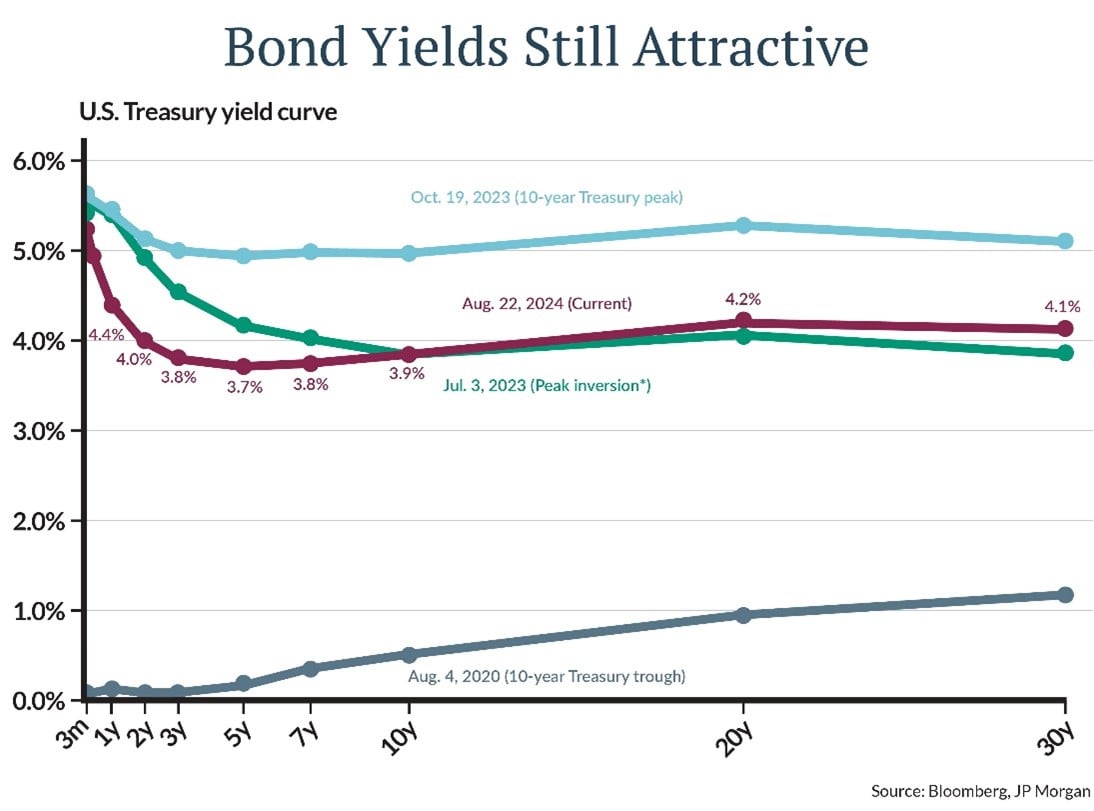

While limiting losses in the stock market is important, bonds today are more than portfolio ballast. Bond yields across the curve—from three-months to 30 years—remain above the rate of inflation and much higher than their lows in 2020 [Figure 3]. Two-year yields remain near 4% while the 10-year Treasury yields about 3.9%. When corporate bonds are added to a portfolio, an intermediate-term, investment grade portfolio still yields well over 4%.

Professional investors look not only at a bond’s coupon income or yield, but also at how a bond’s price changes in response to interest rates. Price change plus income makes up the “total return” of a bond. And total return is what matters.

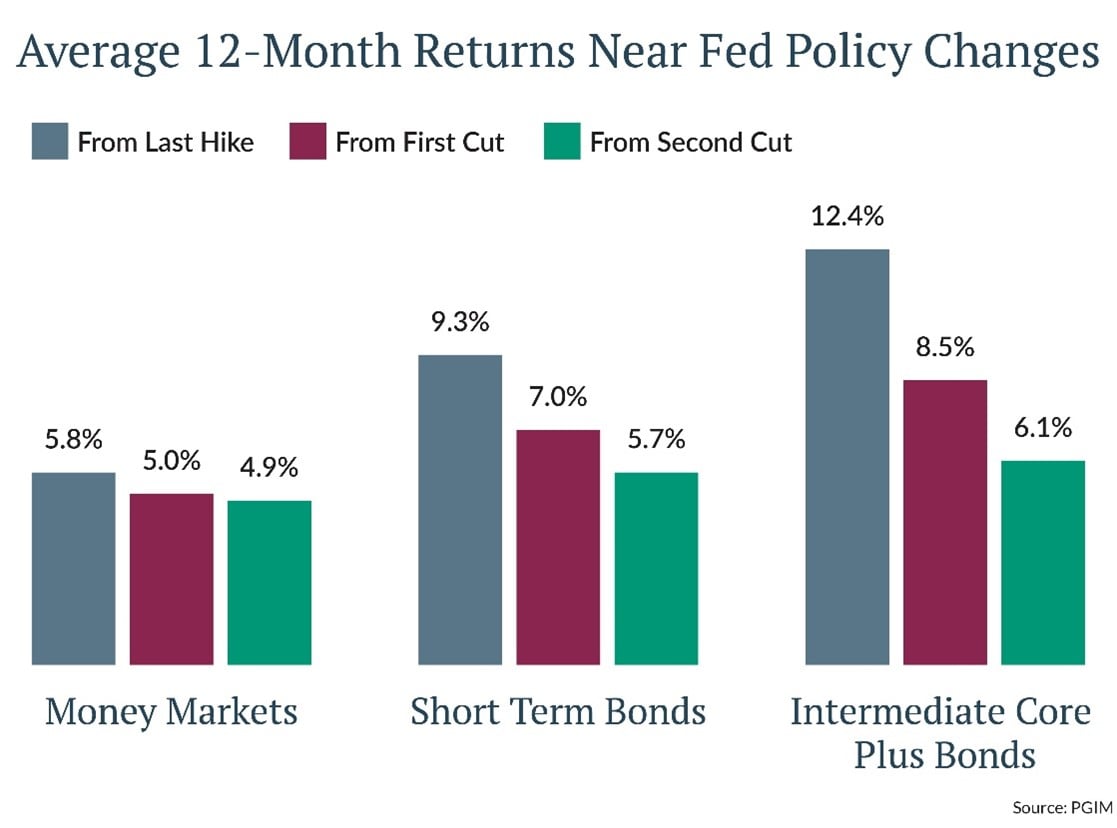

Since prices of existing bonds rise when interest rates fall, there is the potential for above-coupon total returns when interest rates are falling. We believe the current set up of attractive starting yields and looming interest rate cuts offers the potential for attractive total returns in fixed income. When the Fed changes course, short and intermediate-term bonds typically beat cash, making now the time to move out of cash into bonds [Figure 4].

Don’t wait for Perfection

I‘m happy with my home purchase. It was hard to part with cash earning 5%, and I know that economic weakness could reduce the value of my home in the short-term. But my decision was made for the next 5-10 years, not the next 5-10 months. Likewise, we believe that investors with intermediate to long-term investment horizons are better off investing in balanced portfolios of stocks and bonds than remaining in cash, where yields will begin falling as soon as September.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE