Kelsey Ellsworth

VP Wealth Portfolio Manager | Johnson Financial Group

As Vice President, Wealth Portfolio Manager, Kelsey works with clients to achieve their unique goals and objectives.

Investment Commentary

4 minute read time

It’s hard to believe we’re almost halfway through the year. The S&P 500 Index is up about 14% this year and continues to make record highs. While these recent highs may give investors pause, the historical record shows that almost two-thirds of record highs have wound up acting as market floors. Perhaps that will be true this time—or not. As always, we need to accommodate different scenarios as we construct investment portfolios to meet clients’ long-term goals.

In this week’s commentary, I’d like to share a bit about our current equity posture, starting with how our Investment Committee uses scenario analysis as part of our risk management and portfolio positioning process. First, some basics:

Having established a shallow recession or soft landing as the most likely directions, we can apply that perpsective to portfolio construction.

Within the equity sleeve of our portfolios, we are underweight highly valued growth stocks, specifically the tech-oriented Magnificent Seven, and prefer to maintain a balanced approach between growth and value areas of the market.

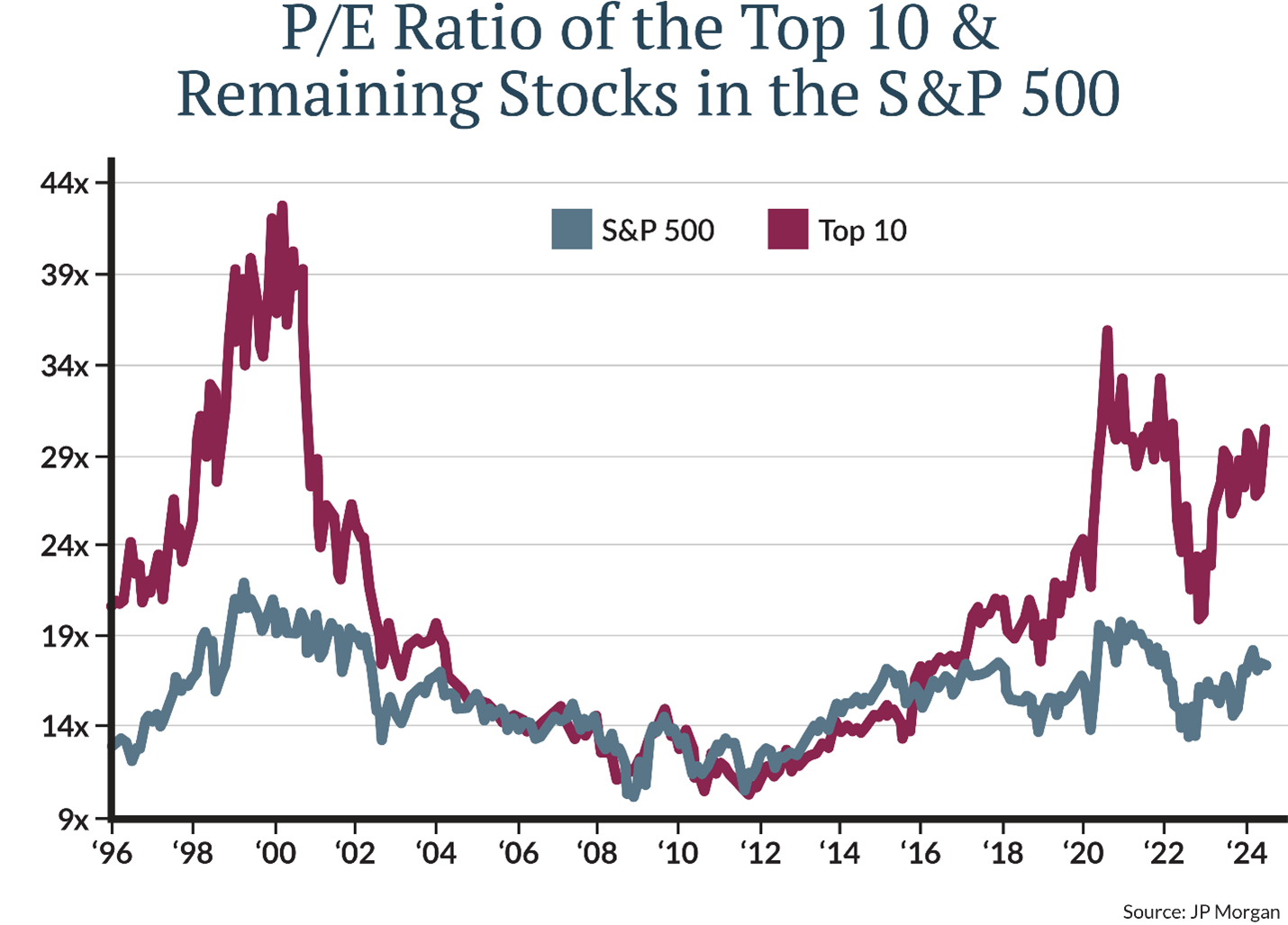

At the moment, the top 10 stocks in the S&P 500 Index skew towards growth. The chart below shows the average price/return ratios, a proxy for valuations, for these top 10 stocks is elevated, at around 149% of the long-term average for those companies. By contrast, the price/return ratios for the remaining 490 stocks in the index are closer to their long-term averages.

Valuations in and of themselves, though, are a poor market timing too. We believe that, overall, equities continue to be supported by healthy earnings growth. We have seen a broadening out in the market this year compared to last year, and growth continues to lead the way marginally.

Over the past five years, 53% of individual tech stocks posted positive returns while 47% lost money. Furthermore, 34% of those that lost money also lost over 25% of their value cumulatively over the last five years. The lesson here is that while it is easy to get caught up in the tech excitement right now, knowing what you own is extremely important in today’s environment.

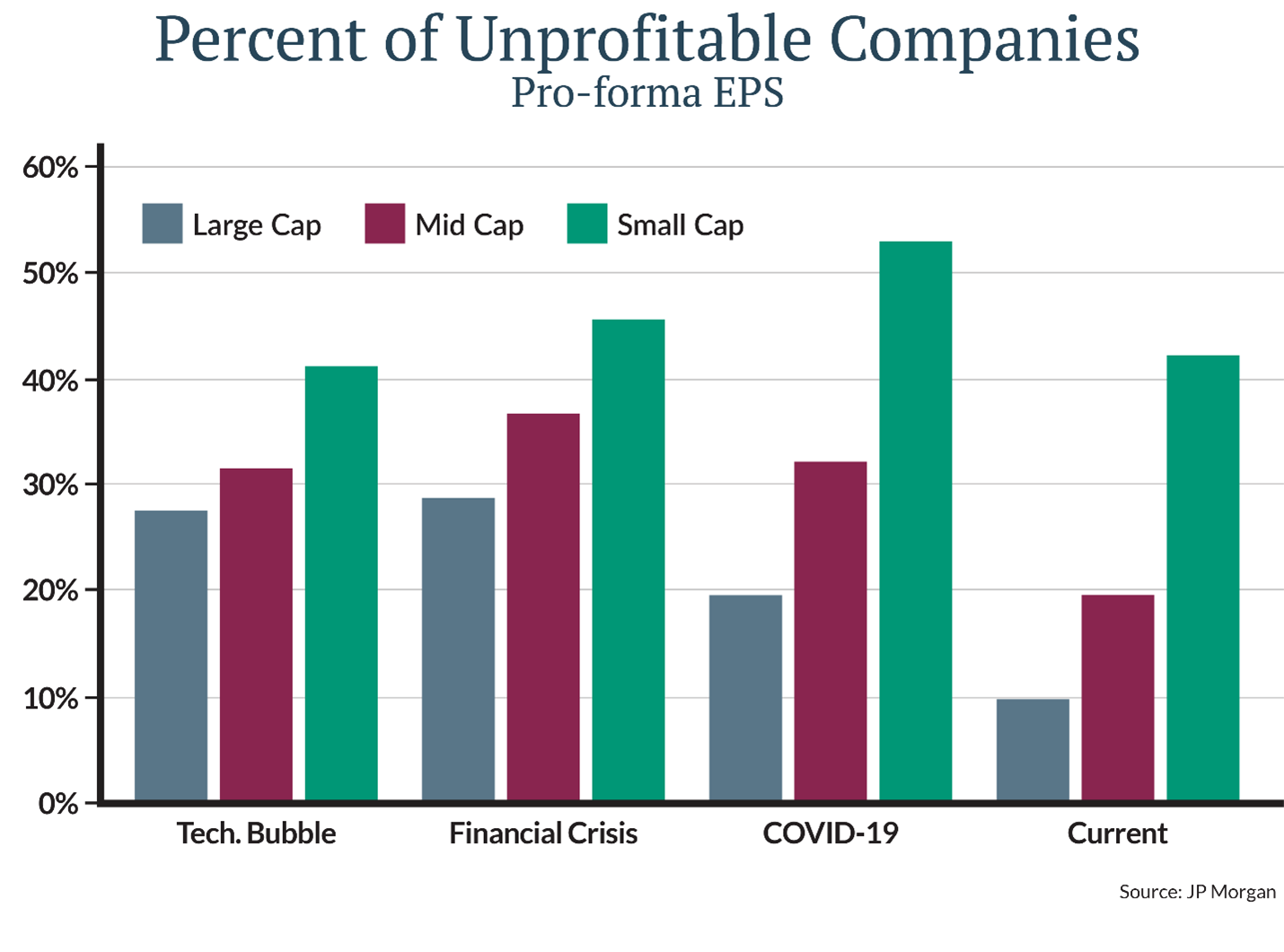

We are underweight small cap in favor of large cap. Small cap companies, generally those with a market capitalization between $300 million and $2 billion, tend to be the most cyclical and are most sensitive to swings in the business cycle. As we head into the election season, which is typically coupled with short-term volatilty, we see further reason for less cyclicality in portfolios.

Within the small position in small cap stocks, we believe active management within the space can pay off. The chart below shows that about 42% of small-cap stocks are unprofitable. In less efficient spaces of the stock market, we prefer active management over passive indexing. (The same rings true in fixed income, where over 70% of active managers outperformed the core bond index over the past five years.)

Within large caps, we have gradually become a bit more passive with our investment selections. However, with with 37.5% of the S&P 500 Index now concentrated within the top 10 stocks, we are again active with our positioning in the space.

Stocks have been supported by a resilient economy and better than expected earnings in 2024 as the anticipated slowdown in growth and inflation has been delayed. Consumer spending and investment spending have remained strong despite higher interest rates. As new data comes out, our Investment Committee continuously reevaluates our scenario probabilities.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE