Kelsey Ellsworth

VP Wealth Portfolio Manager | Johnson Financial Group

As Vice President, Wealth Portfolio Manager, Kelsey works with clients to achieve their unique goals and objectives.

Investment Commentary

3 minute read time

When we were looking to move three years ago, location was near the top of our priority list. I wanted to be close enough to walk to our village’s main drag, but also have a decent sized yard. This was not easy…I looked at what felt like dozens of houses, but we finally found a home that fit our budget and criteria. Just like when buying a house—asset location matters when building a portfolio. When we build portfolios for our clients, we also look at asset location for greater tax efficiency and goals-based financial planning.

An asset location strategy cannot be rigidly employed as clients may have a different goals and time horizon for each account type. A financial plan is key to understanding where assets are best suited for each clients’ unique scenario. According to a study done by Vanguard, asset location can boost returns upwards of 0.30% per year. This may not sound like a lot, but over time, this can be meaningful tax savings.

Many of our clients typically have assets spread across taxable, tax-deferred (e.g., IRA), and tax-exempt (e.g., Roth IRA) accounts. For these clients, we not only consider the appropriate overall asset allocation mix, but also look at which types of assets are suited for each account type. Properly positioning assets can help achieve greater after-tax returns. Here are some of the considerations that go into portfolio construction using asset location strategies:

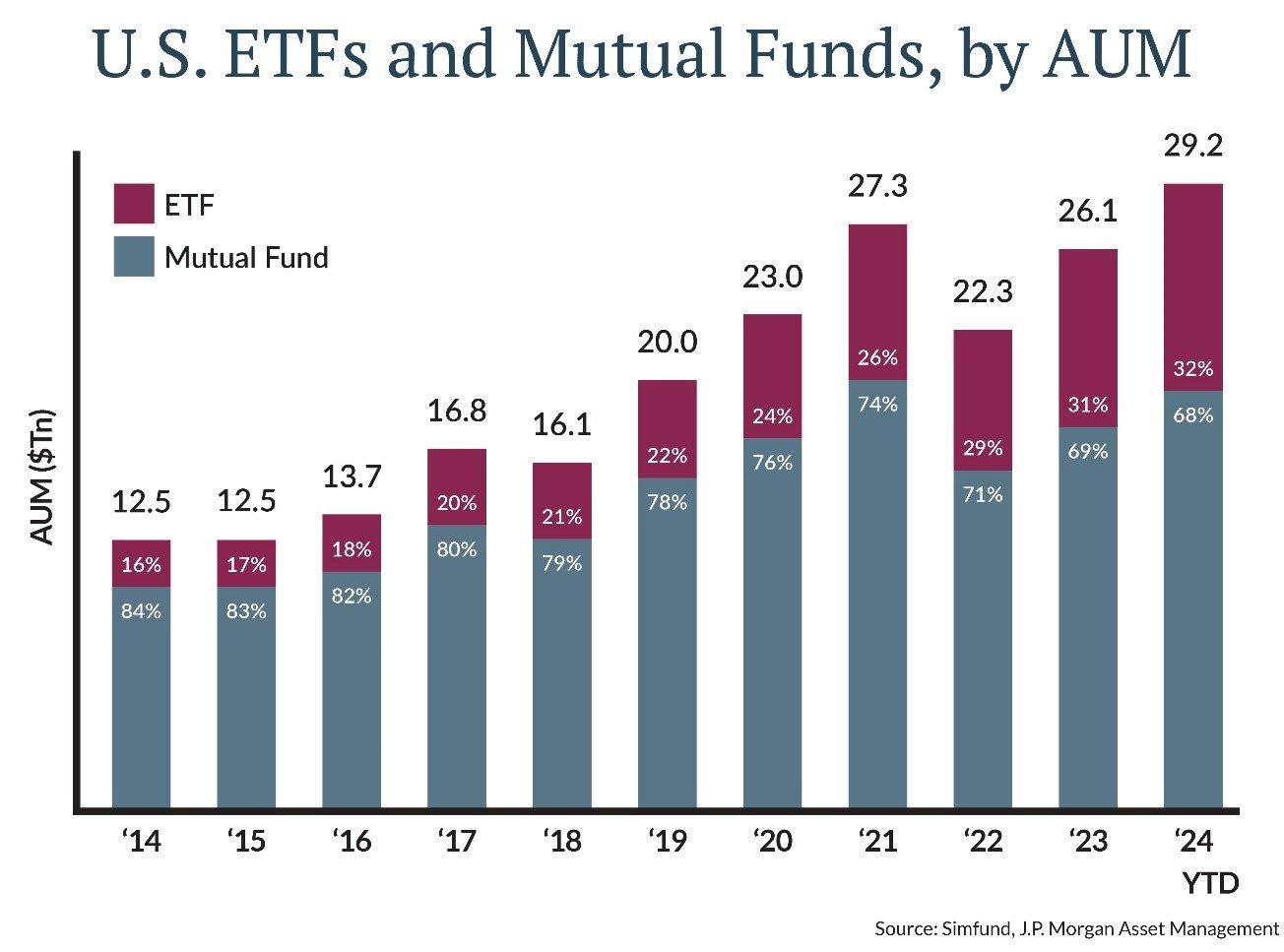

We also look at the vehicle of the investments that we use. Investment strategies can come in a variety of wrappers—ETFs, mutual funds, individual stocks and bonds, and so on. ETFs are generally more tax efficient than mutual funds which kick off capital gains distributions of which are taxable. This is why ETFs may be more suitable in taxable accounts whereas mutual funds can be sheltered in tax-deferred or tax-exempt accounts. For efficient spaces of the market (like the large cap blend area), we prefer to use ETFs whereas in less efficient spaces, mutual funds provide greater opportunity to outperform.

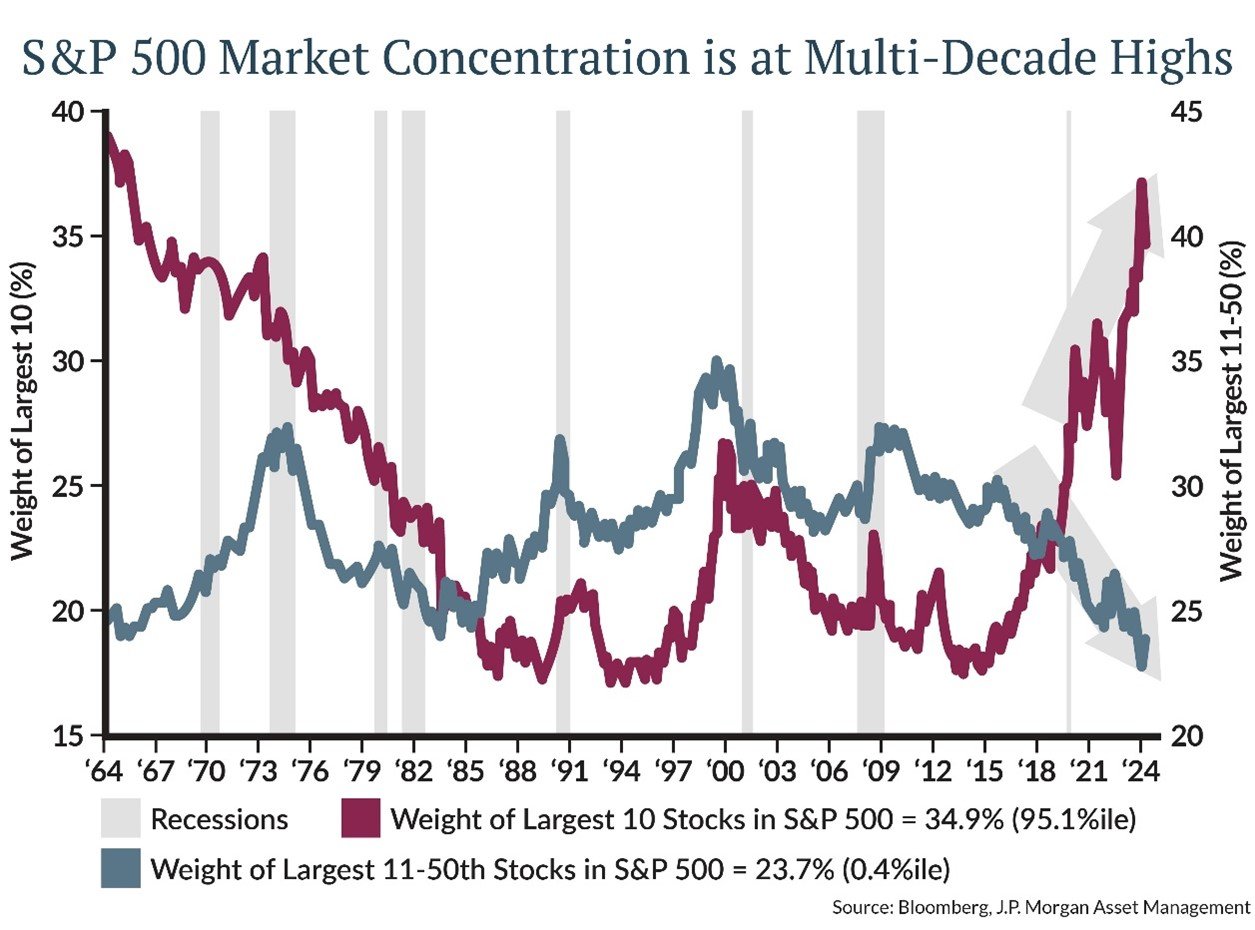

ETFs have become increasingly more mainstream over the past decade, now making up over 32% of the market compared to mutual funds at 68%. Tax efficiency and lower costs are some of the main drivers into what make this vehicle attractive. We must use caution with ETFs, however, as indexes can change relatively quickly. The chart below illustrates the concentration of the top 10 stocks of the S&P 500 Index compared to the weight of the bottom 490. Using a mixture of both mutual funds and ETFs can help us to control for risk. Our Investment Research team also monitors active ETFs which are becoming progressively more popular especially in the fixed income space.

Implementing an asset location strategy can be complex, so it is important to look holistically at all of our clients’ assets and financial goals. There are many factors that go into picking an asset allocation and then implementing proper asset location among the different accounts. Clients who are in high tax brackets and for clients with a diversified mix of account types can benefit the most. If you plan on leaving assets to heirs or are considering charitable gifting, asset location can also help with tax-efficiency. If you have more questions regarding your strategy, you can reach out to your Johnson Financial Group advisor.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE