Investment Commentary

Stocks Post-Election

5 minute read time

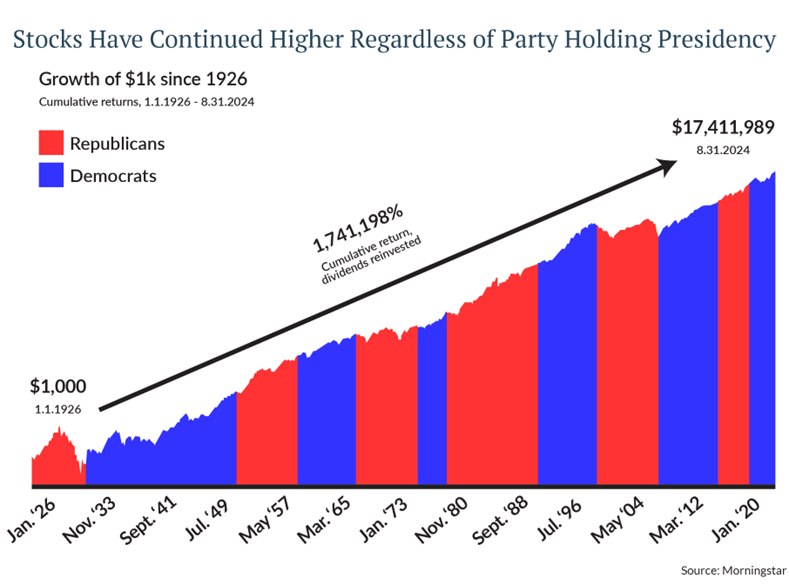

Politics don’t belong in investment portfolios. Elections create uncertainty, but historically their outcomes don’t have long-term effects on stock-market performance. We believe an investor is much better off rewatching It’s a Wonderful Life (see my colleague Joe Maier’s comments earlier this month ) than trying to time the market based on election outcomes.

While we know clients may have a preference of who’s in office, we believe biases should not be reflected in one’s portfolio. The markets’ excitement over prospects of big changes in Washington seems to be overdone, but there are a few potential policy changes that we are watching.

Policies to Watch

There are only a few areas of policy proposals where the president has real authority through executive action—trade, immigration, and energy. All other policy proposals such as taxes, healthcare, and monetary policy require significant congressional authority. Enacting significant tax policy changes will require supermajority, which is unlikely. Major changes require legislation, generally with 60 votes in the Senate—so take the discussions so prominent in the media now with a grain of salt. Tariffs and tax policy are dominating the news right now, so we’ll take a deeper look at those.

Tariffs

In the short term, we may see some volatility while the markets digest a rising probability of tariff increases. There are certain trade statutes that allow the president the power to impose tariffs, but a majority of the statutes require approval by other government agencies or officials. Trump is proposing a 60% tariff on China (up from about 11% today) and 10% across other trade partners such as Mexico, Vietnam, Taiwan and Germany.

According to Piper Sandler research, a 10% across-the-board tariff would initially raise broad prices about 1% but is unlikely as it will require Congressional approval. Tariffs on China (which are expected, but not to the extent that is proposed) will likely raise prices temporarily. Tariffs will cause price and demand shifts but are not broadly inflationary as the impact would fade quickly due to substitutions and demand destruction. (However, if the government chooses to support the consumer, in a period of adapting to higher tariffs, that spending could boost inflation.)

Tax policy

We are closely monitoring changes in tax policy that could affect our clients. Right now, chief among these is the possible sunsetting of the 2017 Tax Cuts and Jobs Act. While we don’t see a lot of changes that could affect our clients’ investment portfolios, there may be changes that can affect financial plans such as the estate tax exemption. While it is still uncertain what will remain of the TCJA, we know that if the entire policy sunsets, then taxes will go up for about 75% of Americans and for 85% of households in the middle-income quintile according to Piper Sandler. Once we get more clarity around this (likely sometime next year), we will ensure our clients’ financial plans are updated accordingly.

Portfolio Implications

Within client portfolios, we have made small adjustments towards quality focused companies and non-cyclical sectors. Looking ahead, we see opportunity in small and mid-cap equities due to lower interest rates. The election outcome does not change our long-term capital market assumptions and as a result, we do not make drastic shifts based upon the results. Staying the course is the most important factor behind financial-plan success. Regardless of who is in office, stocks historically have continued higher.

Additional Articles From the "What Really Matters" Series

INVESTMENT COMMENTARY

What Really Matters – In Investing

Investment Commentary

Stocks Post-Election

Investment Commentary

December Investment Commentary Recap Video – “What Really Matters”

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE