Investment Commentary

The Psychology of Investing

6 minute read time

I usually devote this space to writing about the bond market, but in addition to my work on our Fixed Income Team, I have spent a good deal of my time over the past 15 years working directly with clients. These clients’ goals have varied widely, from young couples focused on saving and growing their nest egg for what seems like a long-off retirement to high-net-worth investors well into retirement focused on income generation and preserving a legacy for their family. Helping clients with many individual circumstances has taught me that the greatest value we can provide as financial advisors is to listen, educate, and implement a decision-making framework that can withstand the emotional and psychological toll that is inherent in investing.

My conviction in this regard is not just based on my own experience but also on what I have come to learn about behavioral finance, a diverse and growing field of research that focuses on how psychological influences affect markets and, more importantly, investor behavior. The Wall Street Journal’s Jason Zweig recently wrote a great article celebrating the recently deceased behavioral finance pioneer Daniel Kahneman, author of the bestselling memoir, Thinking, Fast and Slow. Kahneman and his colleagues questioned economic orthodoxy—namely assumptions that people are rational, self-interested, and can make unbiased decisions after considering all available information.

To the contrary, Kahneman and others have shown that we as humans are emotional, impatient, and short-sighted, especially where our money is involved. Losses cause us more emotional distress than gains produce happiness, and our biases cause us to give more weight to “evidence” that confirms what we already believe. Negative market analysis feels more convincing than a positive outlook, even if the facts say otherwise. Herding behavior is more comfortable than staying the course, causing us to rush for the exit at the same time. In short, we are our own worst enemies.

Investor Underperformance

We can see our shortcoming as individual investors in the data. Market research firm Dalbar annually produces its Quantitative Analysis of Investor Behavior (QAIB) report (Figure 1). The report finds that investors consistently cost themselves through emotional decision-making, with the average investor materially trailing the performance of broad stock and bond market indexes.

Morningstar’s “Investor Returns” study similarly found that by selling out of investments during downturns and missing out on rebounds, investors sacrificed about one-fifth of their fund investments over a 10-year span. Market volatility exacerbates the performance gap—something we saw in 2020 and 2023.

![History shows the rewards of investors’ resilience [Figure 2].](/siteassets/images/5_graphs-and-charts/2024/5.6-investment-commentary-graph-02.png)

How We Plan

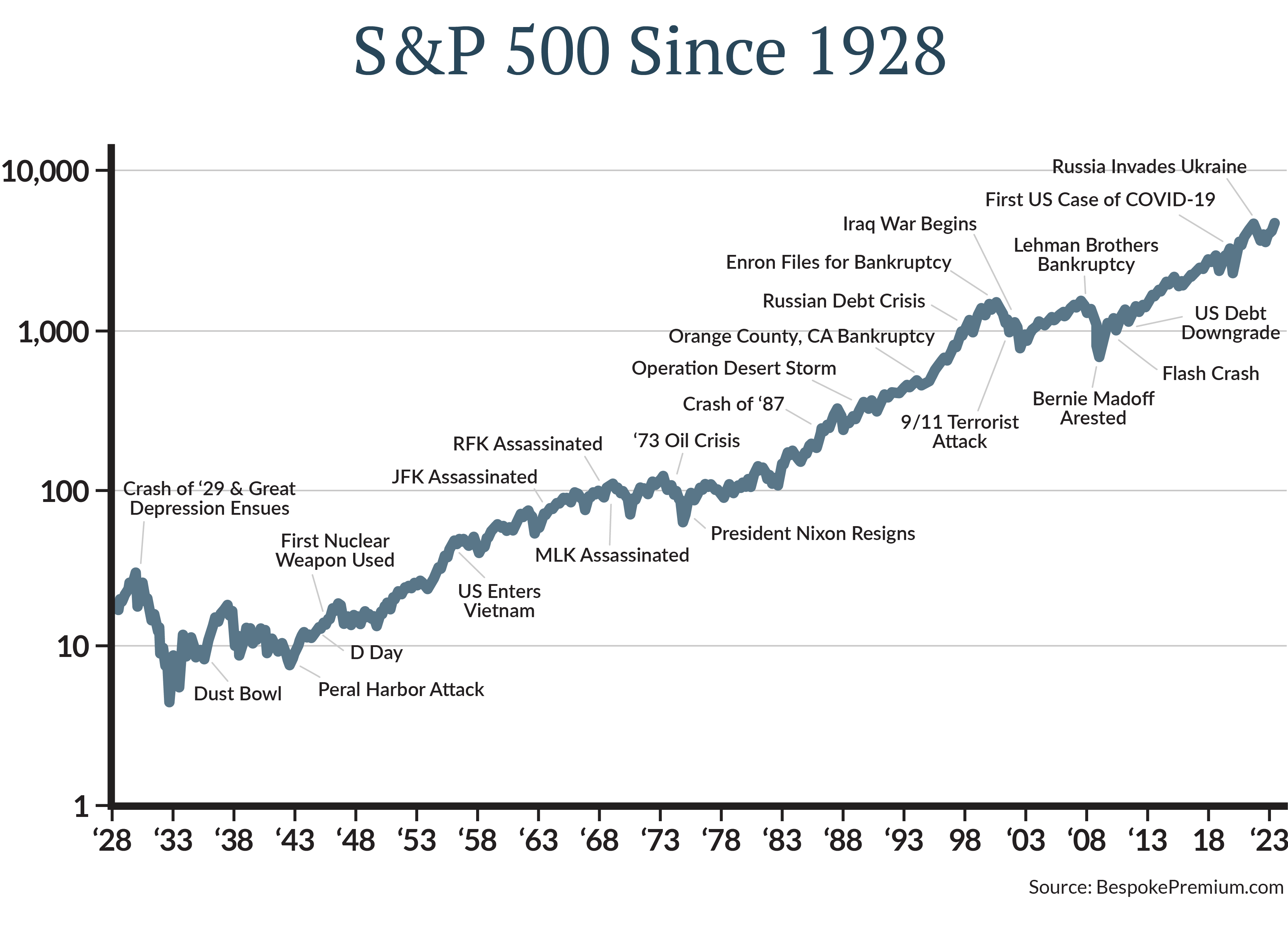

We believe that process, planning, and preparation are the antidotes to emotional decision-making. No amount of financial acumen can prepare us to predict markets or world events. History never stops — and there will always be reasons not to invest. But what we can do is create a plan, or framework, for decision-making that will allow us to stay the course when our emotions tell us to turn the ship awry. History shows the rewards of investors’ resilience [Figure 2].

At JFG, we believe the most important element of the financial planning process is capturing each client’s story. In a sense, we aim to be the clients’ biographers, attempting to understand their motivations, needs, goals, hopes, and dreams. Armed with this knowledge we can then start on the creation of an investment plan that integrates all of JFG’s unique resources to create a plan consistent with our clients’ aspirations while addressing their fears.

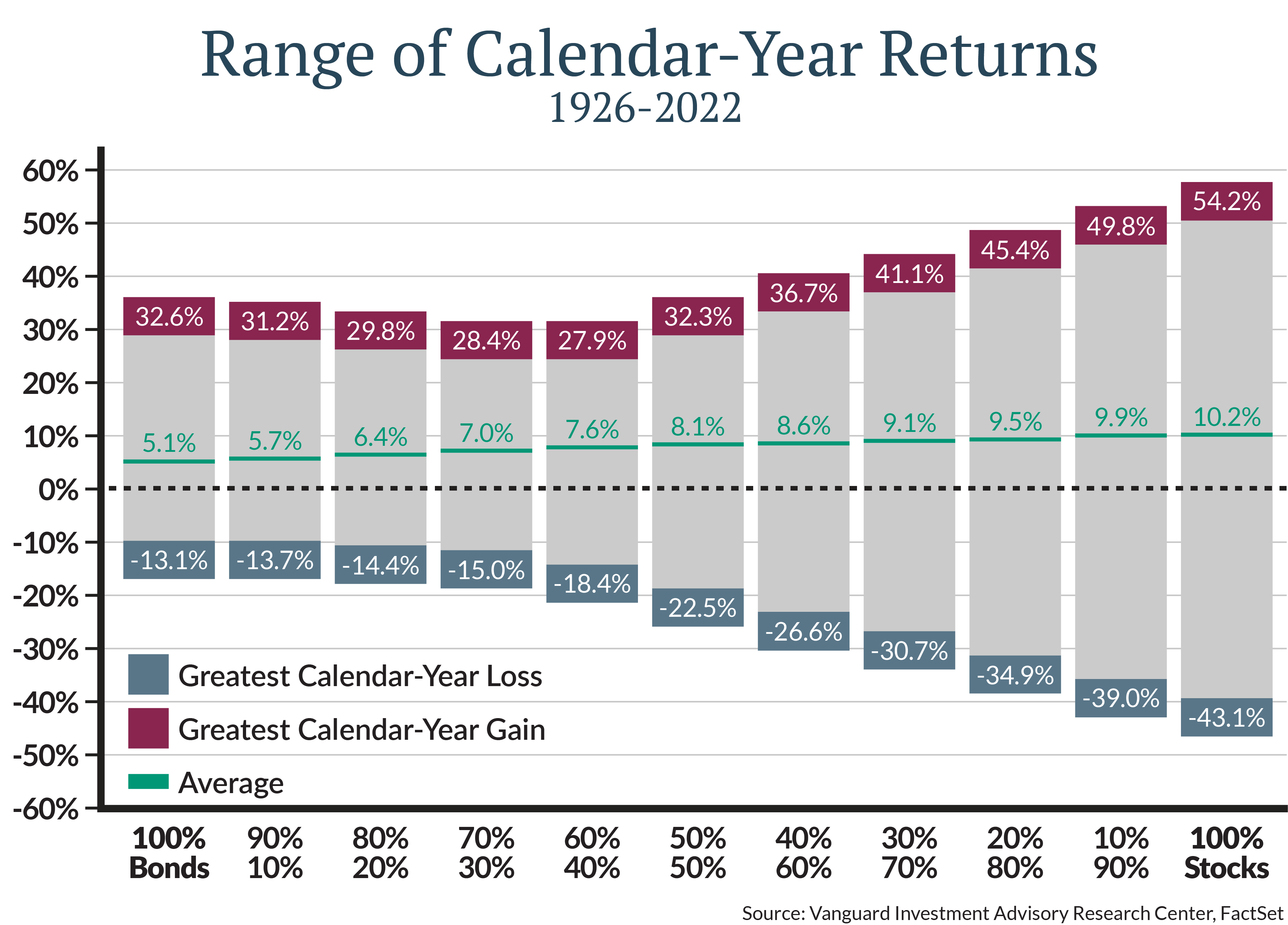

No plan will be complete without an assessment of the clients’ risk tolerance and investment horizon, but that doesn’t end with a questionnaire. Behavioral finance teaches us that what we think is our tolerance for risk often does not align with what we do in the face of losses. The chart [Figure 3] below illustrates the range of calendar-year returns for different asset allocations from 1926-2022. The average return for stocks has been over 10%. Less well documented is that even a 70% equity / 30% fixed-income allocation has forced investors to withstand drawdowns as large as 30% over short periods of time. Our planning process will stress-test your plan for these adverse events and ensure that what feels right today can withstand the scrutiny of experience.

We also believe in using realistic assumptions at JFG. Many advisors will only use historic market returns when making projections about the future. We believe the correct way to run a financial plan is to incorporate long-term capital market assumptions that consider the current levels of interest rates, stock valuations, inflation expectations, and economic growth prospects. This approach does not assume that past performance is indicative of future returns.

The work doesn’t end when the financial plan is created, because we view it as a living document subject to review and revisions as life’s events unfold. Frequent plan updates as well as behavioral coaching along the way are just as important as the fact-gathering, stress testing, and listening we do upfront.

Asking The Right Questions

Every financial advisor has been asked some version of the question, “Is it time to get in the market?” But I would argue that this is the wrong question to ask because it is subject to all the emotional and behavioral challenges pointed out by Daniel Kahneman and others.

I think Charles Schwab’s Chief Investment Officer, Liz Ann Sonders, said it well: “Neither ‘get in’ nor ‘get out’ is an investing strategy… that’s gambling on moments in time … investing should always be a process over time.” Indeed, investing should be a process, and it should incorporate financial planning to help advisors and their clients prepare for the unpredictability of life and the certainty of change.

For those investing and planning with us now, we look forward to reviewing your plan as the year progresses. For those new to JFG or the concepts of financial planning and behavioral finance, let’s start a conversation and invest confidently with a firm planning-focused foundation.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE