So far this year, the S&P 500 Index of large U.S. stocks has charged ahead and produced 23.1% gains as of the end of last week. That adds to its 2023 gains of 26.3%. That’s a tremendously strong period of performance that has defied on-going economic and market uncertainty. Not surprisingly, many clients are asking about our views on future stock-market returns. Can such strong returns possibly continue?

That question has seen even greater investor interest since Goldman Sachs recently released its 10-year stock market forecast. Goldman suggests annualized returns of just 3% over that period.

Putting that in dollar terms, Goldman anticipates that an investor who puts $100 in the stock market today would see that investment grow to approximately $133 through 2034. That would be a historically low rate, more than 10 percentage points lower than the S&P 500 Index’s annualized returns of 13.4% for the 10-year period ended September 30, 2024. In dollar terms, that 13.4% performance over 10 years would have turned a $100 investment into roughly $351.

For market participants who have become accustomed to the substantial investment gains of recent memory, the Goldman forecasts were nothing short of a body blow to positive expectations. Given the headlines that Goldman generated and questions we’ve received, we felt it appropriate to share some thoughts about our own long-term views. The right place to start is our investment process, which has been previously discussed by my colleague Brian Schafer in his commentaries “The Psychology of Investing” and “Financial Advisors Have Feelings Too.”

Process

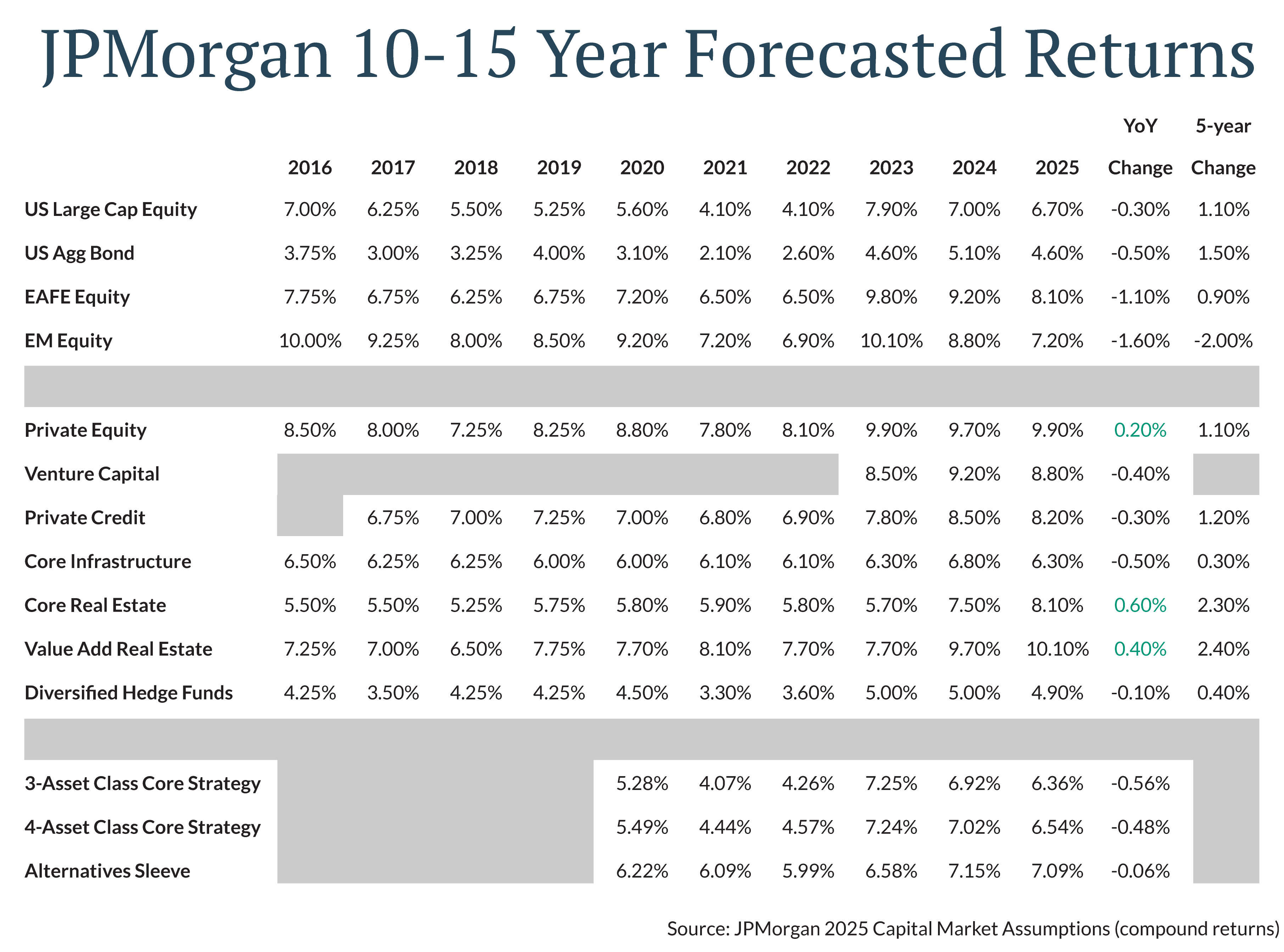

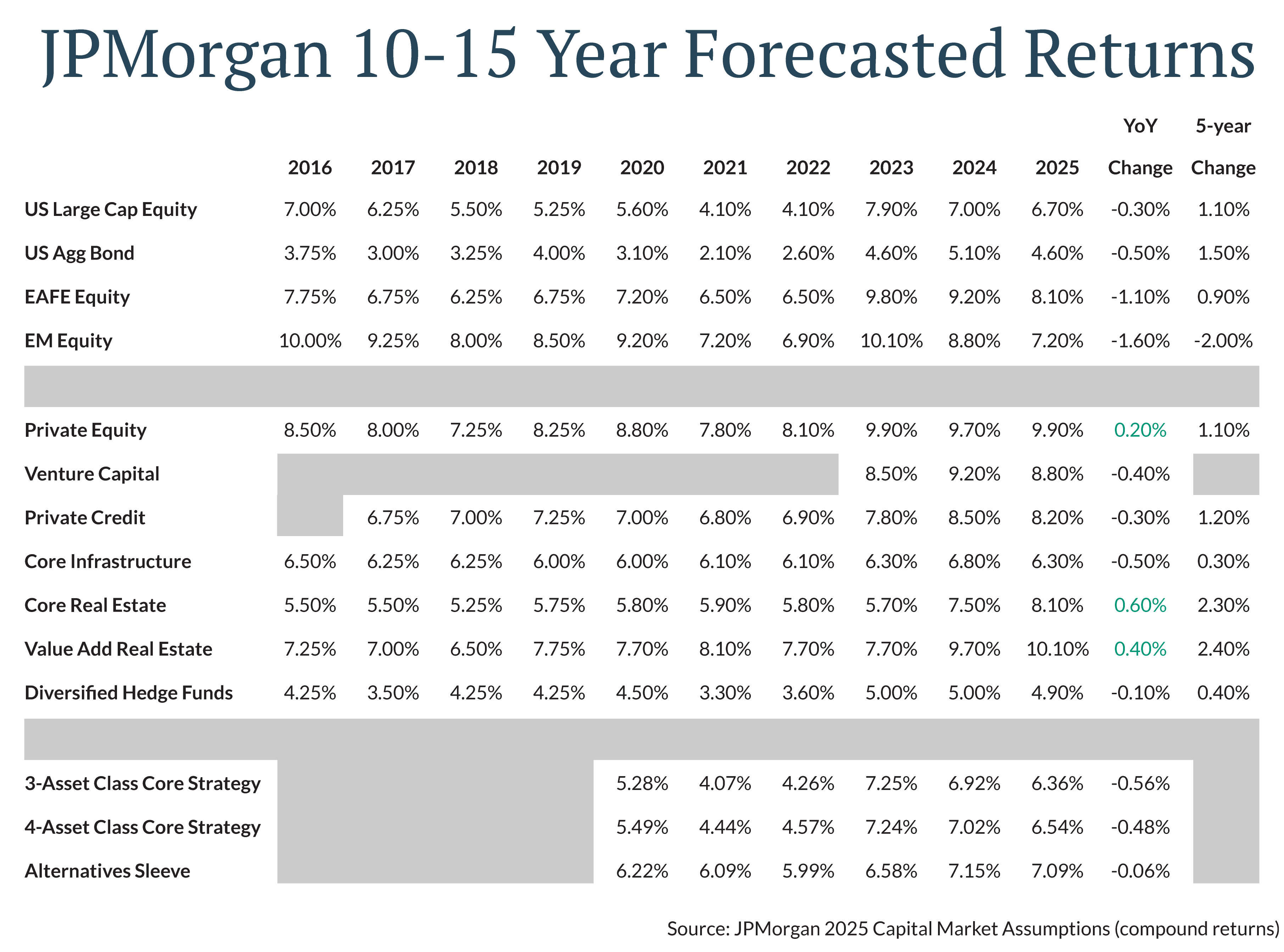

At JFG, we strive to maintain a balanced and reasoned long-term perspective to portfolio construction and investment selection. We review the forecasts from Goldman and many other respected investment firms such as JPMorgan and Invesco, among others, and consider the underlying economic assumptions represented. While it’s early in the forecast release season and many prognostications are still to come, other market forecasters have more favorable return expectations.

We use the forecasted returns (and other key assumptions) as inputs in our financial modeling tools to evaluate portfolio returns over the forecasted horizon and perform scenario analysis with different asset class allocations. While we don’t anticipate the forecasts precisely predict future returns, changes from one year to the next are informative and influence our views on portfolio construction. As a result of the strong performance of equities and the decline of interest rates since this time last year, the return expectations for a traditional 60/40 stock-bond portfolio have slightly declined.

For many of our clients, a modest reduction in forecasted 10-year performance may be disappointing but would not derail them from achieving their financial goals. Consultation with their advisor and sticking with their financial plan will likely keep them on the path to reaching their goals and dreams. For some, however, it may be appropriate to discuss their financial situation with their advisor and determine whether changes are recommended.

Alternative Considerations

A possible portfolio consideration is the inclusion of alternative investments, a topic we have increasingly discussed with our clients in recent years, including in past investment commentaries such as “How Private Equity’s Rise Affects Investors” and “Alternatives Focus: Reinsurance Securities Now in the Mix.” Alternatives include a diverse set of asset classes that expand the investable opportunity set, including less constrained approaches to public securities and investment in private companies and real estate.

For investors who are aware of the unique risks and find alternative investments appropriate for their risk and return objects, these investments have the potential to introduce numerous portfolio benefits, such as inflation protection and additional portfolio income. Importantly, investment forecasts suggest favorable impacts on portfolio diversification and return.

As reflected in the table below, many alternative asset classes are forecasted to generate attractive returns over the coming 10-15 years. In the 2025 column, compare, for example, the 6.70% figure for U.S. large-cap stocks I mentioned with 8.2% for private credit and 8.1% for core real estate, among others.

Because they have somewhat unique ways of earning returns (lower correlation to stocks and bonds), alternatives have historically been less dependent on the market movements of the stocks and bonds most investors hold. As a result, alternative investments have the opportunity to increase portfolio resilience and assist investors in reaching their financial objectives, particularly when returns for traditional stocks and bonds have declined.

Although we actively monitor current economic and market data and consider various published market predictions, we maintain focus on our established processes and core investment principles. While the market landscape presents challenges and projections are less favorable, it is important that investors remain true to their financial plans and consider a diversified approach, including alternative investments, where appropriate for an investor’s risk and return objectives. By staying informed and engaged with their advisors, clients can navigate these uncertainties and confidently work towards achieving their long-term financial goals.