“Don’t fight the Fed” is an investment-industry mantra that has been relatively effective as a guide to investment decision-making, given asset prices’ historical relationships to interest rates and Federal Reserve monetary policy.

With the Fed now expected to pivot from steady-to-rising rates to falling rates, it’s a good time to think about what “not fighting the Fed” may mean in practice.

What the Fed actually controls

To step back for a moment, let’s discuss what the Federal Reserve actually controls. The main policy tool the Federal Reserve—through its Federal Open Market Committee (FOMC)—has is the Federal Funds interest rate. The FOMC sets the Federal Funds rate with the purpose of influencing inflation and employment at certain levels over time.

The Federal Funds rate is the target interest rate that banks can borrow and lend their excess reserves overnight. That lending rate then impacts the savings rates that we as consumers or businesses receive and flows through to lending rates on credit cards, mortgages and commercial loans. It is not a direct one-to-one relationship but more of a directional change for most of those things.

The importance of these rates to our economy is so great they impact almost everything we do or are thinking of doing. In that way, the importance of the Fed to consumers and businesses cannot be understated. The economic impact of that then filters into asset prices in many ways.

A likely positive push for asset prices

At the time of writing this, the Federal Reserve is expected to lower interest rates, which historically has made borrowing costs more attractive, all else equal. This is stimulative for the economy, so “Don’t Fight the Fed” means to anticipate a positive push on asset prices over time in response to this policy direction.

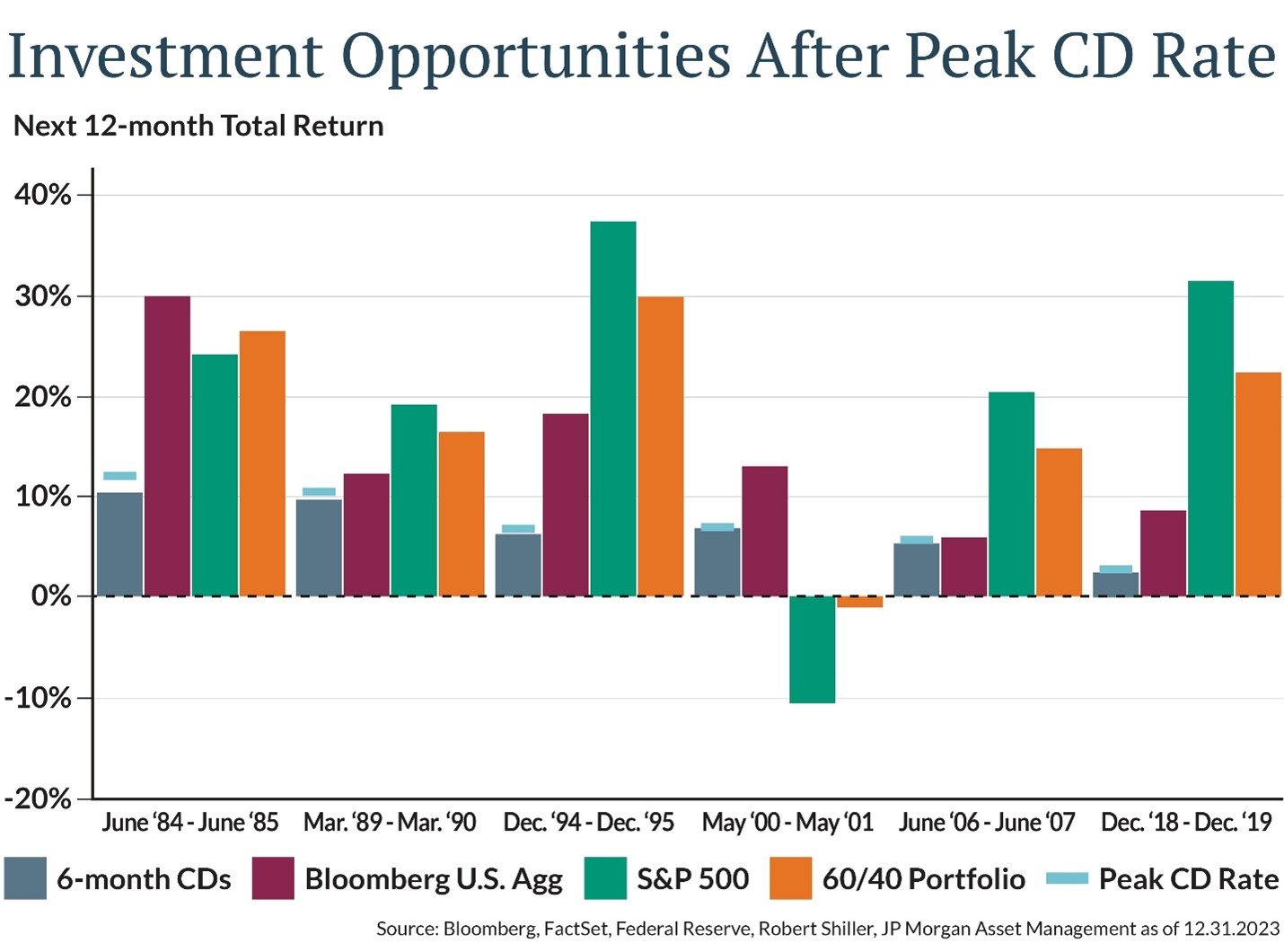

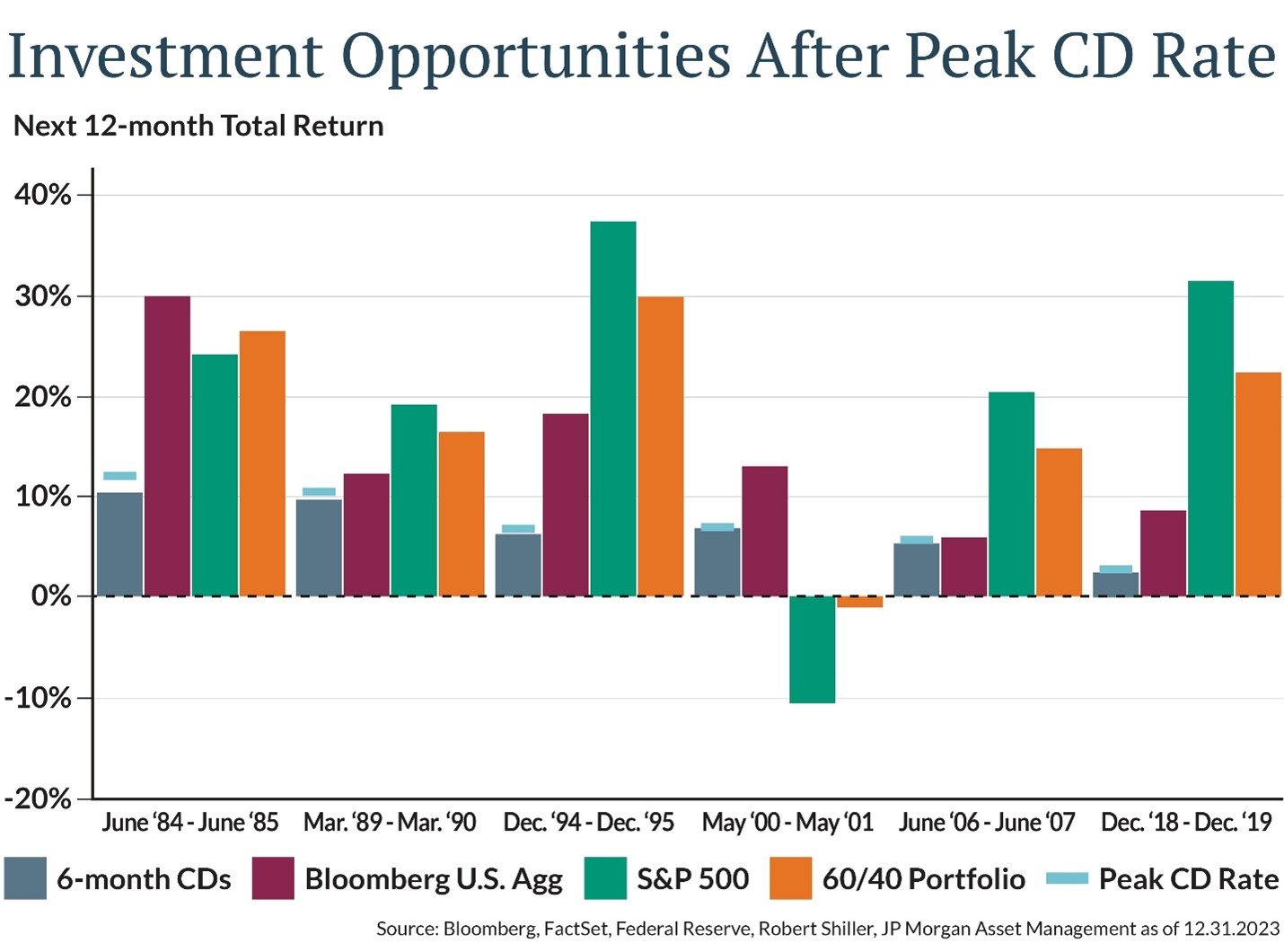

Looking at the chart below and certificated of deposit (CD) rates as a proxy for the level of interest rates shows what the impact has been after rates peaked and started to move back down in response to a policy change. After twelve months in almost every period of time, all asset classes had positive returns after rates peaked in prior cycles. That includes stocks bonds, CDs and balanced portfolios.

This is certainly not the only data point to consider as it can always be different this time. When this article comes out, I would guess the Federal Reserve has already cut rates, by between 0.25 to 0.50 percentage points. We shall see what the impact will be, but it would be wise to at least consider the impact that those rates have over time, and why the adage of “Don’t Fight the Fed” remains an important consideration for our investments!