Investment Commentary

What Really Matters – In Investing

5 minute read time

Last week my colleague Joe Maier wrote a thought-provoking piece about finding your financial purpose and thinking about what money means to you. He recommended maintaining an emotional balance sheet that measures your values, focusing on things like happiness and impact rather than dollars and cents. That is because purpose is the foundation of a financial plan. It’s more likely that you will meet your goals if you have a clear vision of what really matters—the why behind your wealth.

This week I want to talk about what really matters when we put your money to work—the strategies and behaviors that lead to investing success. As a member of our investment team who spends a great deal of time evaluating investment vehicles and looking for relative value, this requires a bit of humility. That is because while picking the right stock, bond, or mutual fund can add material incremental value to a portfolio, I know that the big decisions we make in consultation with clients—like determining the right asset allocation, time horizon, and risk tolerance—are far more impactful to investing success than a well-timed trade. Let me explain.

Activity Does Not Equal Alpha

Alpha—a finance term that describes the ability to beat the market without taking extra risk—is the holy grail of investment management. We strive every day to achieve it. But one of the most pernicious misconceptions and behavioral mistakes in investing is the belief that a lot of activity will lead to outperformance. Investors who fall prey to this are always on the hunt for the next great idea and measure their portfolio manager by how many trades he or she places. Ever-lower trading costs and a proliferation of niche investment products has made frequent trading more tempting than it has ever been. But this is counter-productive … and often costly.

A focus on short-term activity and “idea” generation is akin to making a lot of tactical bets. And perhaps the Wall Street marketing juggernaut has convinced you that money managers are good at making these bets and should run your money accordingly. On average, they are not and should not.

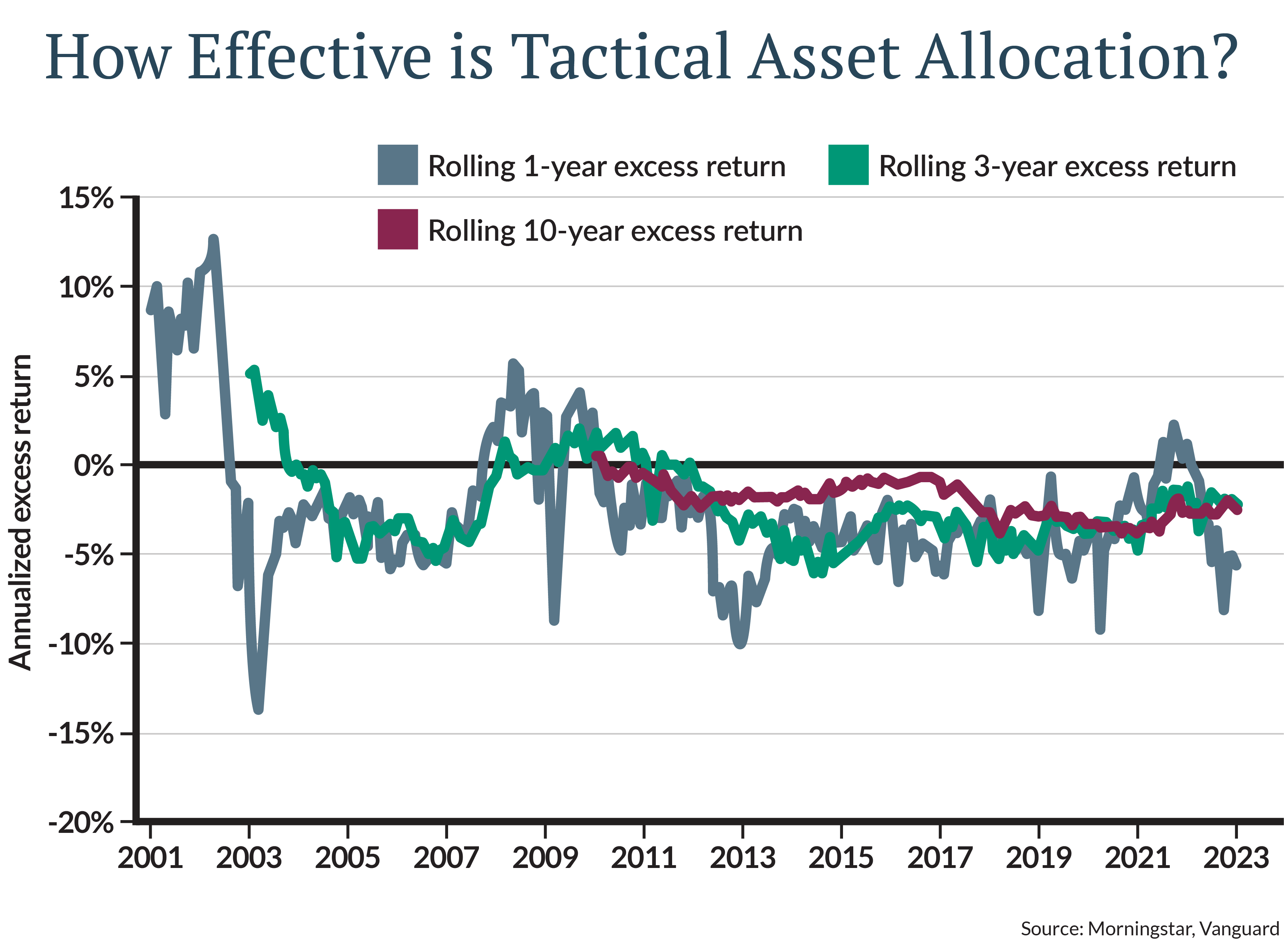

Vanguard looked at the performance of tactical asset allocation mutual funds (which actively and often shift allocations among stocks, bonds, cash, commodities, etc.) from January 1, 2001, to December 31, 2022 [Figure 1]. Rolling 1-, 3-, and 10-year returns were calculated for all U.S. tactical allocation funds, and excess returns (alpha) were calculated for each U.S. tactical fund relative to the fund’s prospectus benchmark. The upshot is that only over a few short periods did the median tactical mutual fund outperform, and in the long run, for all their activity, they underperformed by quite a lot. I can think of one that went out of business altogether.

It's What You Keep

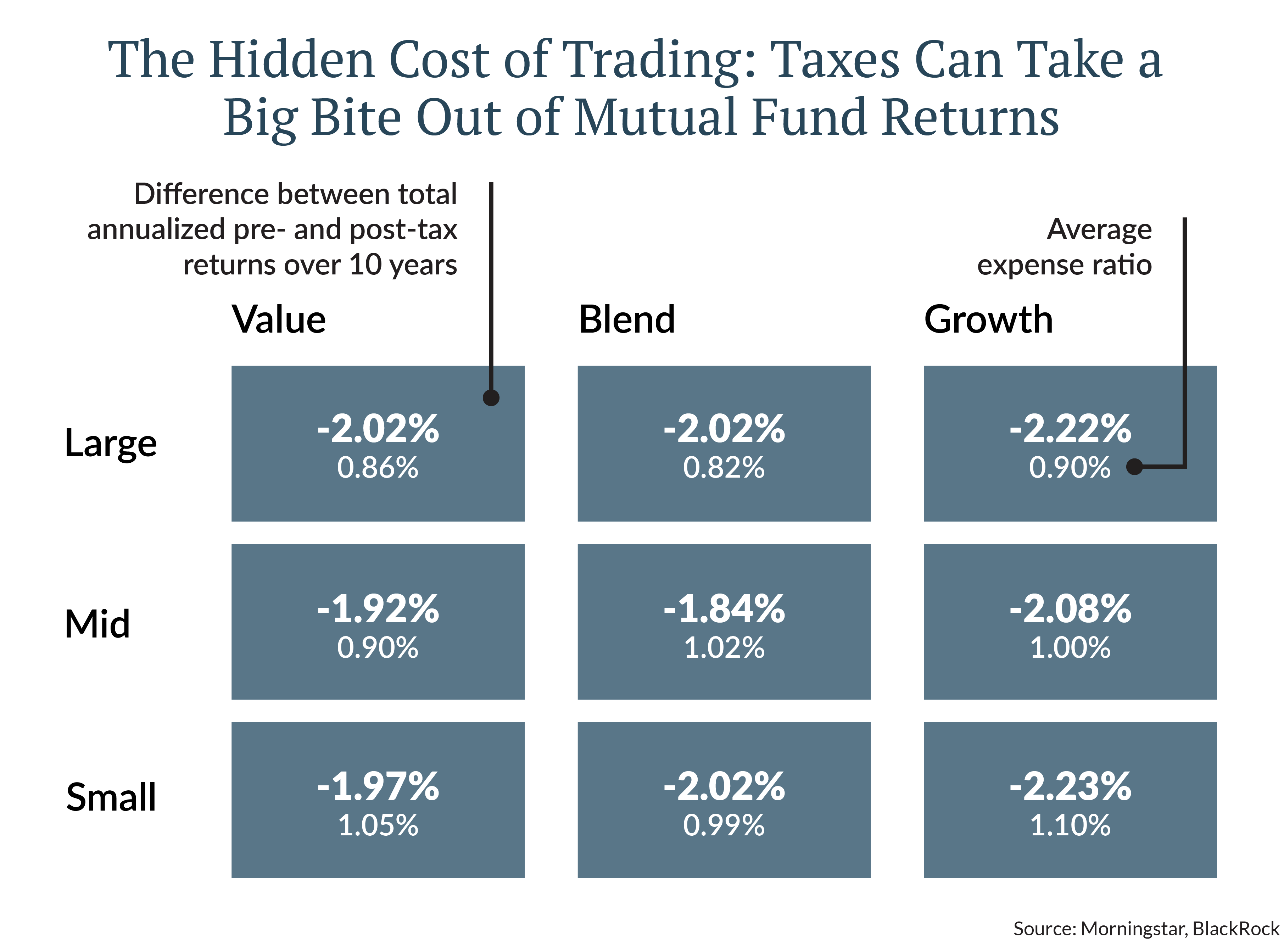

Now, let’s imagine that you do not have the luxury of owning all your investments in tax-advantaged accounts. Here, the focus on the short term becomes not only counterproductive but costly. We know that mutual funds are required to distribute capital gains each year, and we also know that short-term capital gains are taxed at ordinary income rates. It is not surprising, then, that pre-tax and post-tax mutual fund returns can be quite different. BlackRock estimates taxes on distributions shaved 2.02 percentage points off the average annual performance of U.S. Large-Cap Blend mutual funds for taxable investors in the decade ended in 2023 [Figure 2]. The same tax drag would apply if you applied a frequent trading strategy to a separately managed account or ETF portfolio. Frequent trading is costly, and it’s not what you earn that matters but what you keep.

I’m not sharing this to argue that active management is bad. We believe that active management has a place in portfolios, especially in less efficient areas of the market. Our team spends thousands of hours each year researching managers who deliver above-average performance. Further, asset location (placing tax inefficient strategies in tax-deferred accounts), tax-loss harvesting, rebalancing, and the use of alternative investments can mitigate the impact of taxes and add alpha. But what I am saying is that strategic investment management—that is, only making portfolio changes that meet a threshold of materiality and offer enduring value—is far superior to a focus on short-term bets. Fat pitches, when assets are cheap and relative value is clear, are an active manager’s dream but are relatively rare. This is why our investment team’s focus is on consistently hitting singles and doubles, not taking big swings in hopes of a home run.

What Matters Most: Compounding

One of saddest and most frustrating thing I hear sometimes is that the stock market is a casino, implying that the game is rigged against you, or that you must gamble to win big. While I can understand where this sentiment comes from, I believe internalizing it is a tragedy. Markets are underpinned by earnings, with some of the most successful and profitable companies in the world generating great wealth for investors over time. But while the market is not a casino, too many investors treat it like one, focusing on the short term, or making concentrated bets. Similarly, going to cash when things look dire, investing only when one’s favored political party is in power, or waiting for “the correction” before investing may seem logical but is just another form of market timing and equally unlikely to lead to sustained success.

I have become a big fan of financial journalist Morgan Housel this year, and I think his book The Psychology of Money would make a great stocking stuffer for anybody interested in markets, psychology, or becoming a better investor. One of the quotes I will always remember from that book is one he attributes to legendary investor Warren Buffet’s longtime partner, Charlie Munger: “The first rule of compounding is to never interrupt it unnecessarily.” There is no greater force in investing than compounding—reinvesting earnings to generate additional earnings.

If we can help our clients focus on their financial plan and strategic asset allocation, taking as much risk as they need to meet their goals but not so much that portfolio volatility will cause them to interrupt the power of compounding, I believe we have done what matters most and put our clients in the best position to achieve investing success and grow both their financial and emotional balance sheets.

Additional Articles From the "What Really Matters" Series

INVESTMENT COMMENTARY

What Really Matters – In Investing

Investment Commentary

Stocks Post-Election

Investment Commentary

December Investment Commentary Recap Video – “What Really Matters”

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE