2024 was another good year for investors with diversified portfolios of stocks, bonds and alternative investments recording a second consecutive year of double-digit gains. This puts most investors on track or ahead of plan to reach their goals and dream bigger.

Stock gains were the main driver of returns supported by falling recession fears and continued excitement about companies benefiting from the Artificial Intelligence (AI) theme. Interest rates traded within a large range and ended the year higher leading to only small gains for bonds during the year. Alternative investments provided returns between stocks and bonds, largely delivering as expected. Over the next three weeks we will provide a more detailed review and outlook for Alternative Investments, Bonds and Stocks, but we thought it important to start with our high-level recommendations and outlook for long-term returns as part of the planning process.

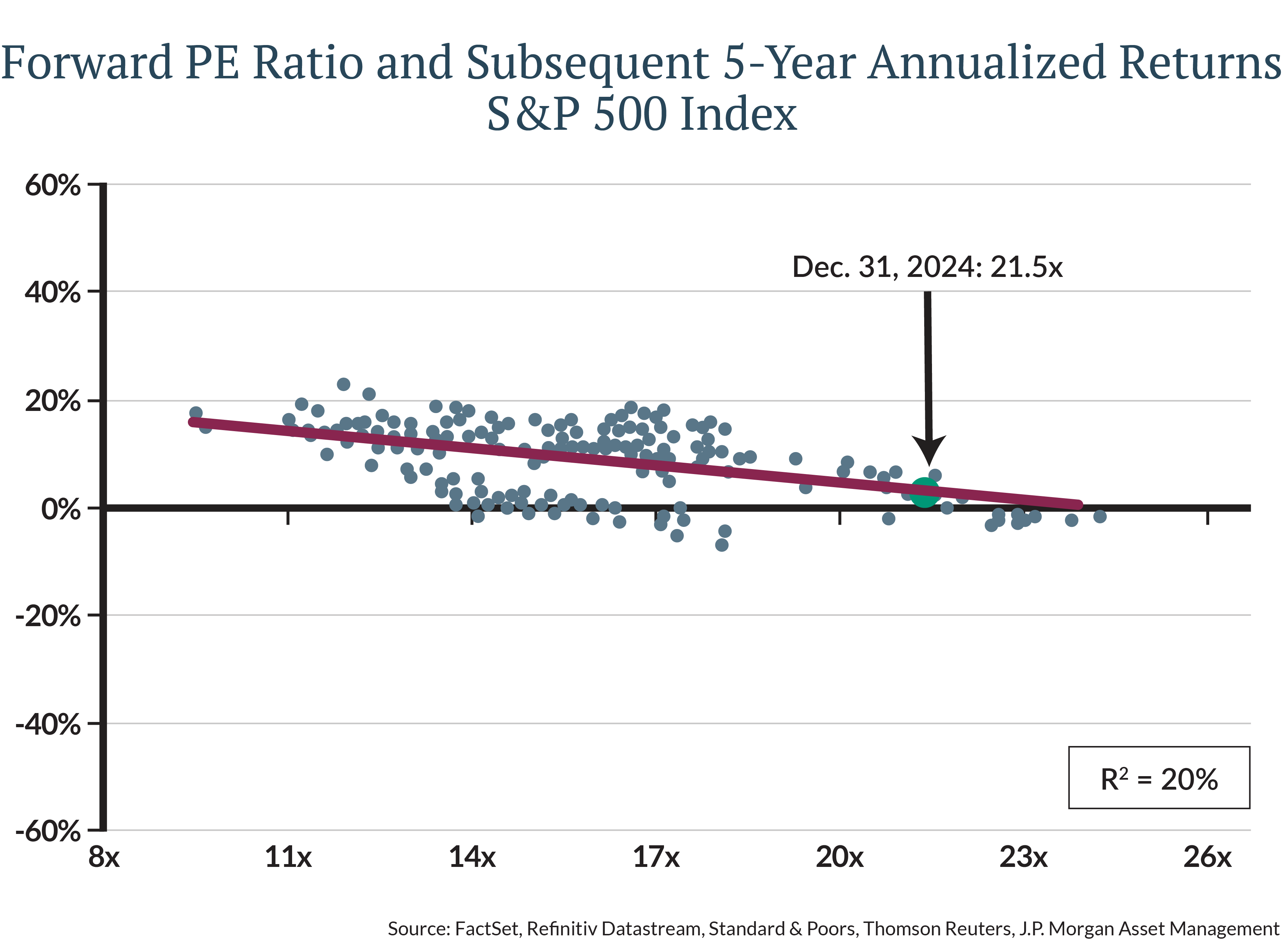

Our underlying theme for 2025 is that investors should dare to be diversified. Stocks have delivered above average returns over the past 10 years with the S&P 500 Index increasing by an average of 13% per year. However, stock returns over the next 10-15 years are likely to be more subdued given elevated valuations. Combine this with the wide range of outcomes that may evolve, and we expect investors will appreciate the benefits of diversification and flexibility offered by their allocations to bonds and alternative investments.

Managing in an Uncertain Environment

The instinct of many investors is to buy the assets with the highest past or projected returns. However, this assumes either the conditions that existed in the past will persist or that the future is predictable. The AI stocks for example have posted strong gains because the growth was unexpected and the potential is large. However, at some point high expectations will be reflected in the price of the stocks and returns will revert to average or below average as investors move on to other areas of the market.

Over the next year and decade, there are numerous scenarios that could develop related to economic growth, inflation, geopolitics or exogenous events like a global pandemic. Therefore, we believe the prudent approach is a diversified portfolio of stocks, bonds and alternative investments that aligns with your goals combined with the following themes:

- Rebalancing – It’s ok to take profits! Rebalancing is the risk management process that realigns your portfolio to your long-term asset allocation target. Furthermore, if you are ahead of plan you may consider changing your asset allocation to take less risk if you want to reduce portfolio volatility or to increase risk to pursue bigger goals.

- Diversification – As uncertainty increases, we recommend more diversification. Diversification helps a portfolio weather different types of investment environments whether it be rising inflation, recession or a boom in growth. Alternative investments should be considered to diversify the growth objective of your stocks and the income and stability objective of your bonds.

- Patience – Using a baseball analogy, wait for your pitch. When the overall investing environment is good (lower risk of recession), but valuations are high, we believe a patient approach that maintains exposure close to long term asset allocation targets is prudent while waiting for dislocations to develop. Dislocations lead to opportunities for long term investors that are prepared.

Expected Returns

Our base case outlook supports expectations for positive returns for stocks, bonds and alternative investment asset classes in 2025. However, the range of returns over the next year are wide considering the many variables related to the policies of the Trump Administration, the path of economic growth and inflation and geopolitics. While near term returns are nearly impossible to forecast, long term return expectations based on valuations, interest rates and expected economic growth and inflation help investors set reasonable assumptions for long-term planning.

The table below provides a summary of the average expected return for major bond, stock and alternative asset classes over the next 10-15 years. We expect diversified portfolios of stocks, bonds and alternative investments to return about 6% on average over the next 10-15 years. This is about 0.5% lower than a year ago as strong stock returns were pulled forward into 2024 (thank you very much!), but about 1% higher than expectations 5 years ago reflecting the benefits of higher interest rates and solid fundamentals within the equity market.

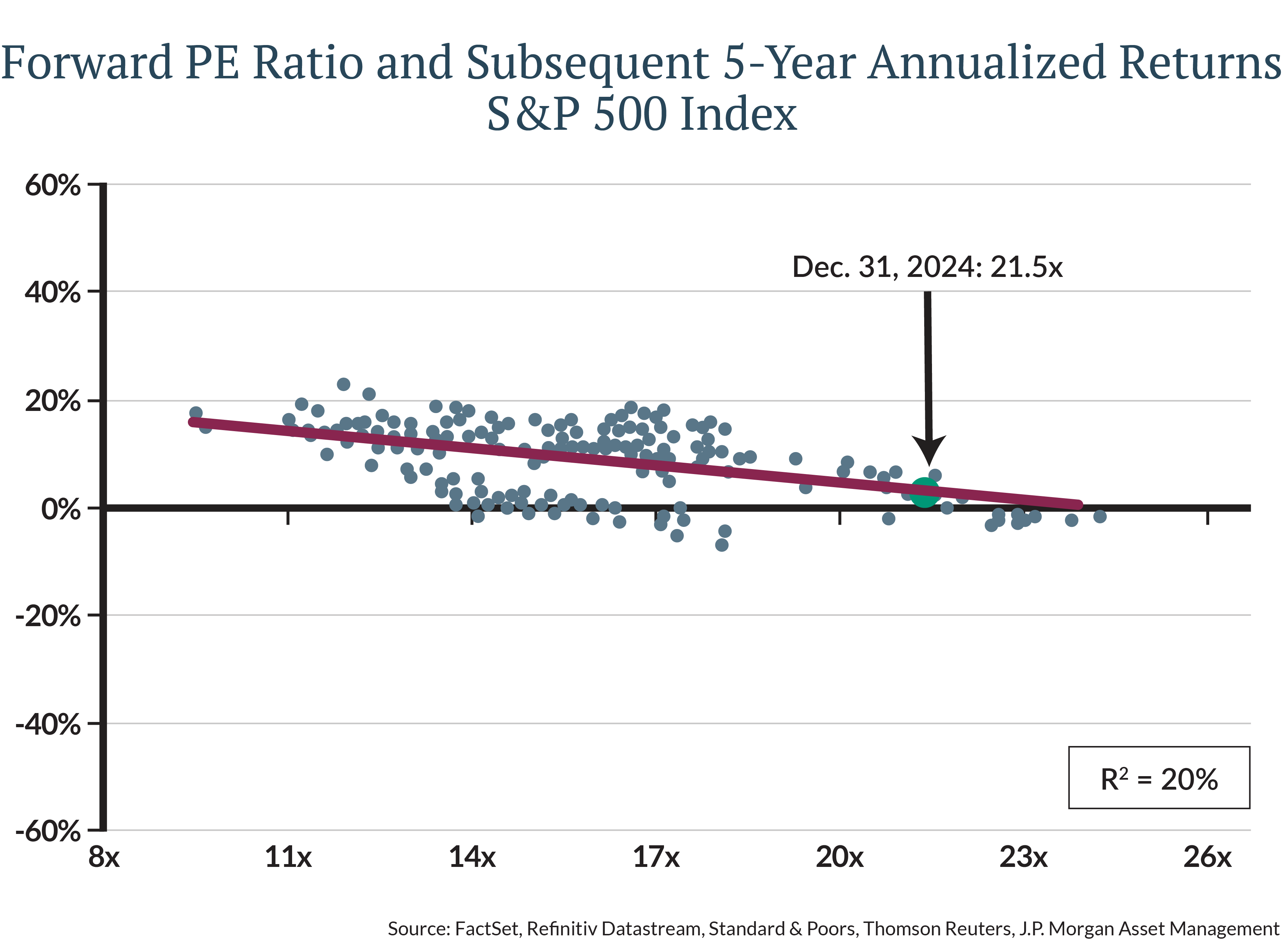

Stocks – The Core to Reach Your Growth Goals

The primary role stocks in your portfolio is capital appreciation and to preserve purchasing power that is eroded by inflation over time. We expect stock returns to average about 7% per year over the next 10-15 years, which should easily outpace inflation. However, this return is below the long-term average of 10% and the 13% annualized return for the S&P 500 Index over the last 10 years. Lower returns are expected because high current valuations, such as the 21.5x earnings for the S&P 500, are likely to move lower toward long-term averages over time.

Below average returns suggest the return on bonds or alternative investments are competitive, especially on a risk adjusted basis. However, stocks remain a valuable component of the portfolio in positive scenarios for the economy and to maintain purchasing power if inflations persists at current or modestly higher levels as companies have the ability to raise prices.

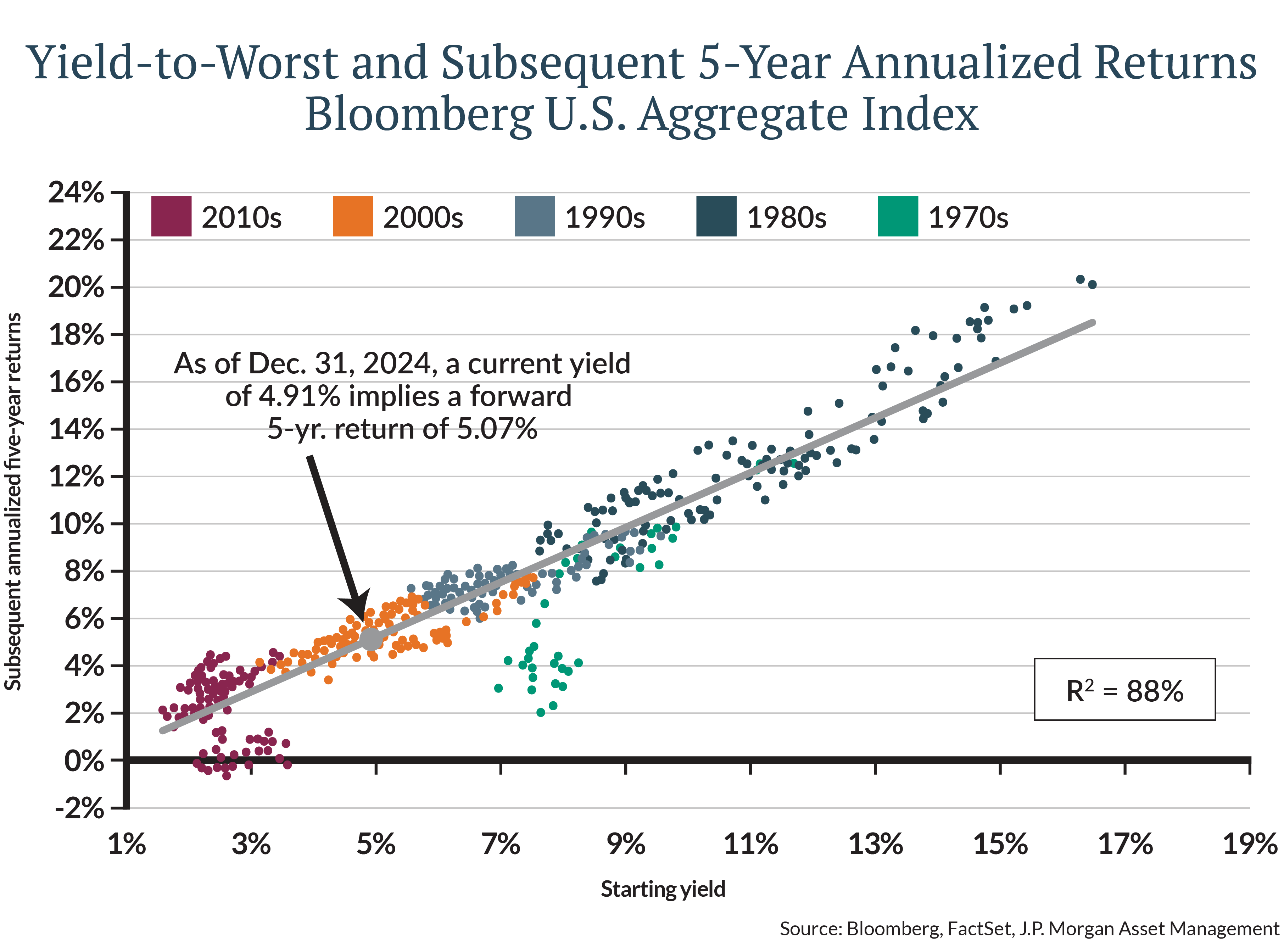

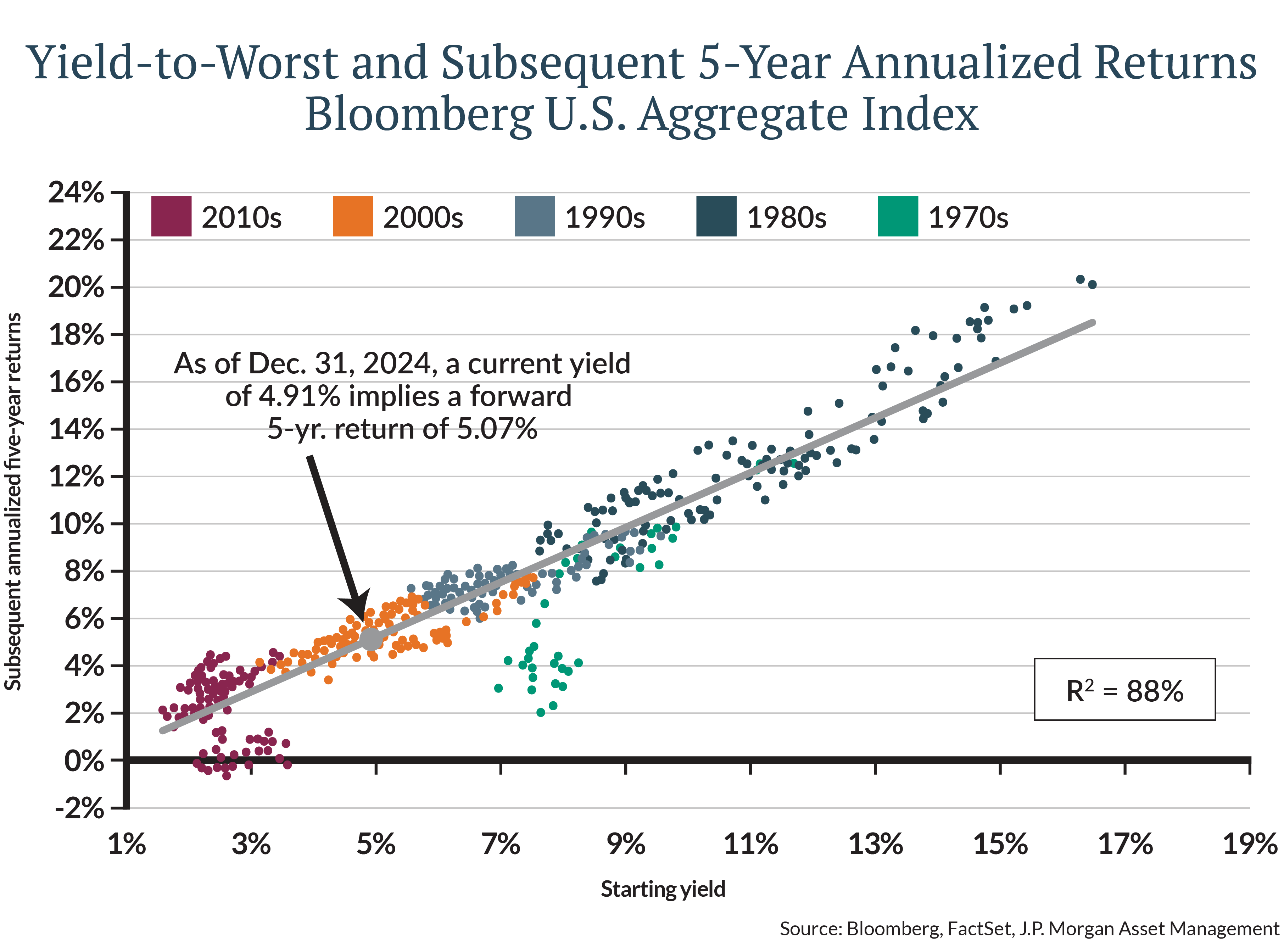

Bonds – Income, Stability and Diversification

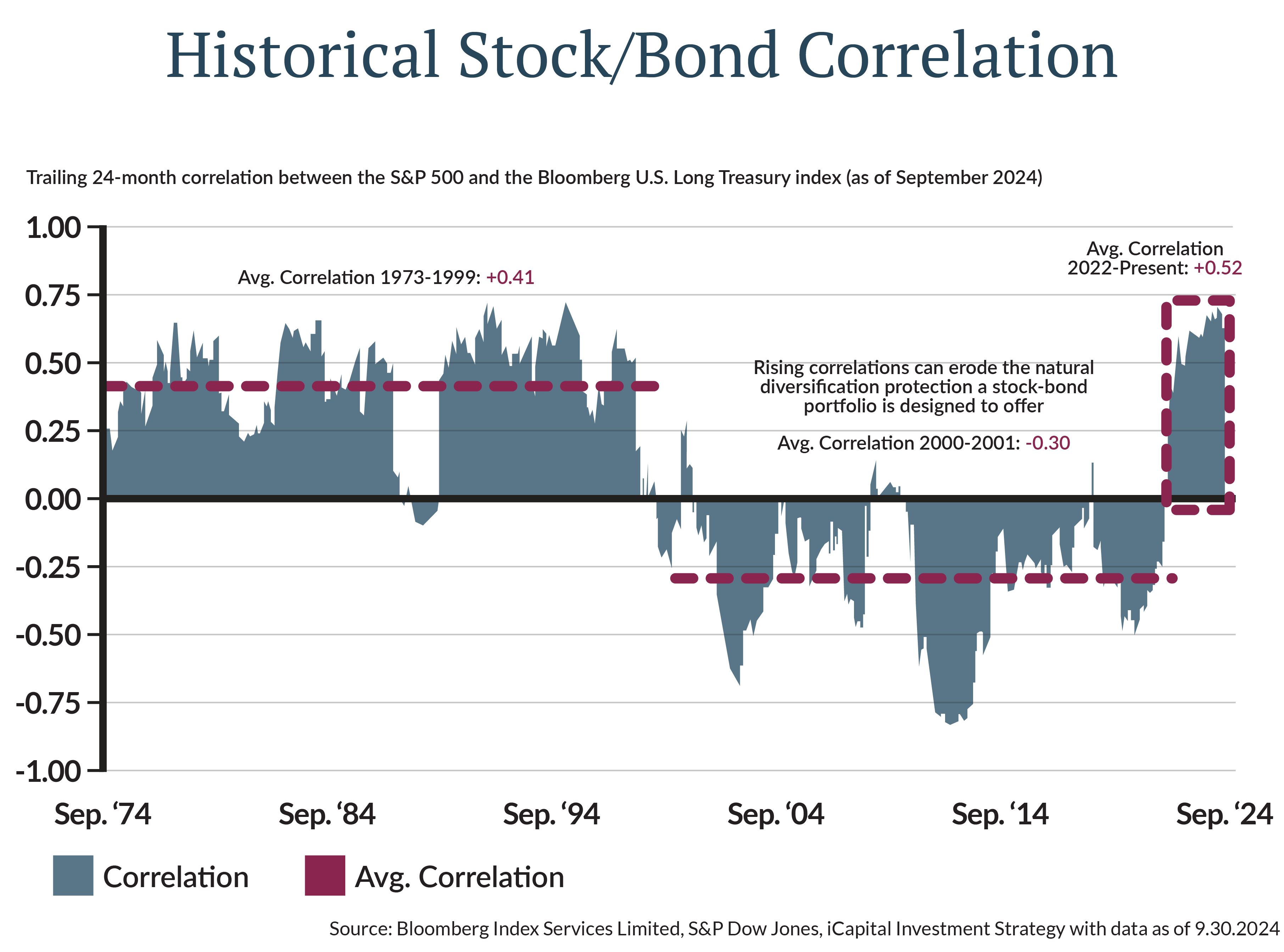

Investors can rely on bonds to provide relative stability of principal over a 1 to 2 year time horizon and an attractive stream of income, although volatility may remain higher than desired if inflation remains a concern. Fortunately, expected bond returns have increased compared to a few years ago and are able to compensate for lower expected stock returns. Investors can expect a 4-5% return from bonds over the next decade considering starting yields are a reliable predictor of future returns. The chart below shows the tight correlation between starting yields and actual returns on bonds over the subsequent 5 years. While both stocks and bonds experienced negative returns in 2022 due to the inflation spike, bonds remain a good diversifier to stocks during recessions as inflation typically falls and the Fed cuts rates in an effort to preserve jobs when economic growth slows.

Alternatives – Additional Return and Diversification

Investors considering alternative investments for the first time may perceive them as higher risk, but this is not entirely accurate. In reality, many alternatives are simply private-market counterparts to traditional publicly traded investments, such as stocks and bonds. Others, like real estate, real assets, or hedge funds, represent investments that don't fall neatly into conventional asset categories. Return expectations for various segments within alternative investments typically range from 5% to 10%, aligning closely with the anticipated returns for stocks and bonds.

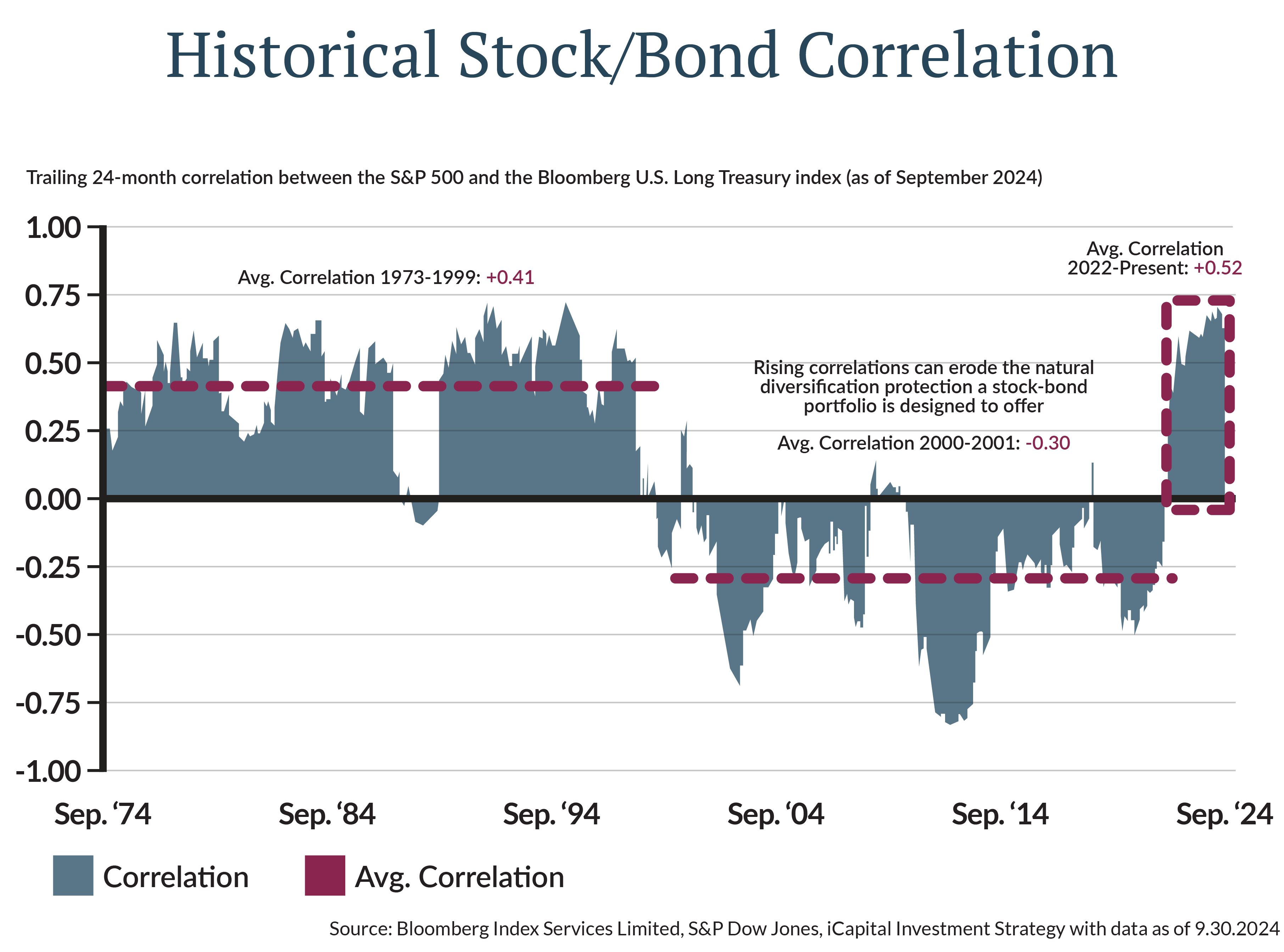

The role of alternative investments in a portfolio can be simplified into two parts: expanded opportunities and additional diversification. With elevated public stock valuations, investors that are willing to accept lower liquidity can consider diversifying, yet compelling, return sources such as private credit, private equity, and real estate. From a diversification point of view, alternative investments include less volatile strategies that are not dependent on daily fluctuations of interest rates. This diversification has proven important since 2021 as the correlation between stock and bond returns has increased with the onset of inflation, the future direction of which remains in question.

Note: Trailing 24-Month Correlation between the S&P 500 Index and the Bloomberg U.S. Long Treasury Index

Portfolios for the next decade

Considering the wide range of potential outcomes, we believe investors should dare to be diversified in 2025 and over the next decade. We recommend rebalancing portfolios to make sure the allocation to stocks hasn’t grown too large for your desired level of portfolio risk. Diversifying your stocks beyond the AI companies that are in favor today, treasuries that are a growing part of the index and including an allocation to alternative investments to broaden your opportunity set. Finally, have patience to manage your risk budget so you have the flexibility to confidently add risk when others are fearful.