While the economic outlook appears more favorable than in prior years, current financial market conditions create a less than certain outlook for traditional portfolios. As my colleague Jason Herried noted last week, investors enter 2025 navigating a landscape of richly valued equity markets and higher interest rates for bonds, with the uncertainty created by significant interest rate volatility.

In such an environment, alternative investments offer a compelling case for consideration.

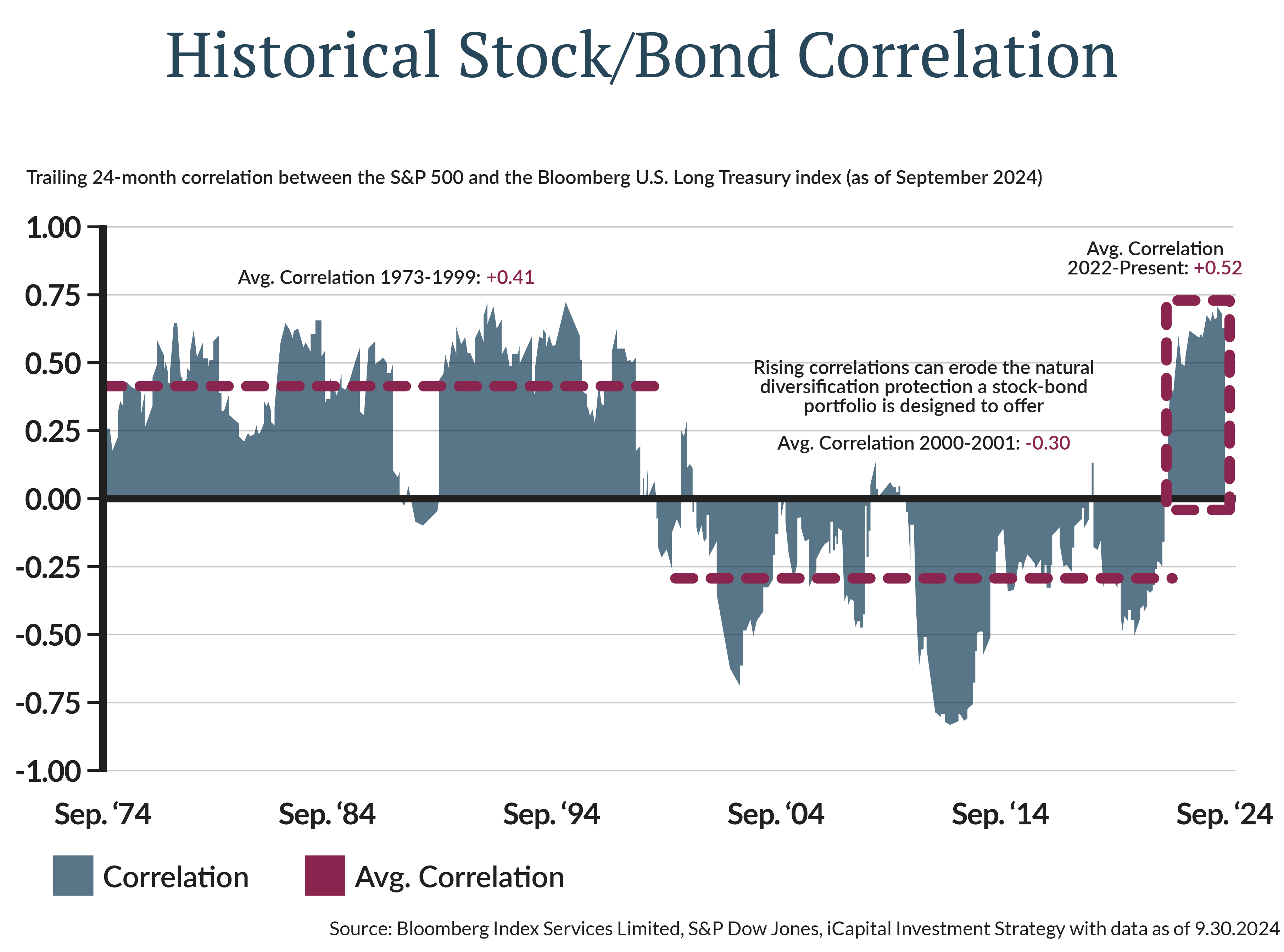

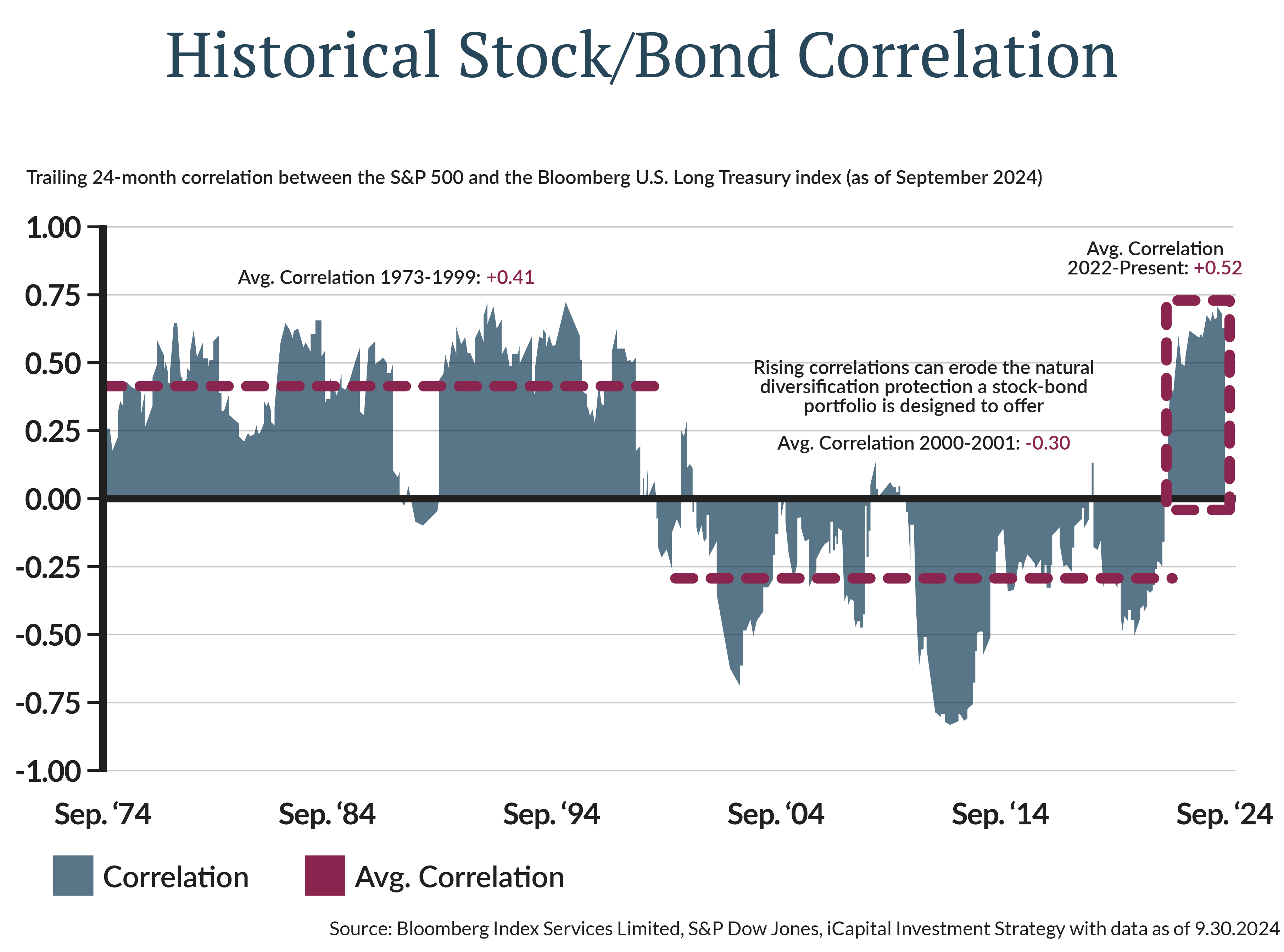

The investment rationale for alternatives remains grounded in their ability to provide diversification, generate attractive risk-adjusted returns, and mitigate the impact of market volatility. With correlations between stocks and bonds elevated (chart), the likelihood of these traditional assets experiencing simultaneous downturns has increased, posing a risk to portfolio performance and achievement of investor goals.

Alternative investments offer unique sources of return that are less tied to the movements of traditional markets, creating an opportunity to build a more resilient portfolio. Think of it as spreading your nest egg among more baskets—diversifying not just within stocks and bonds but beyond them into areas that can weather market turbulence more effectively. While many alternative asset classes have seen their return forecasts recede from a year ago along with equities, significant appeal remains.

Let’s explore three areas of particular interest: real estate, secondaries, and private credit.

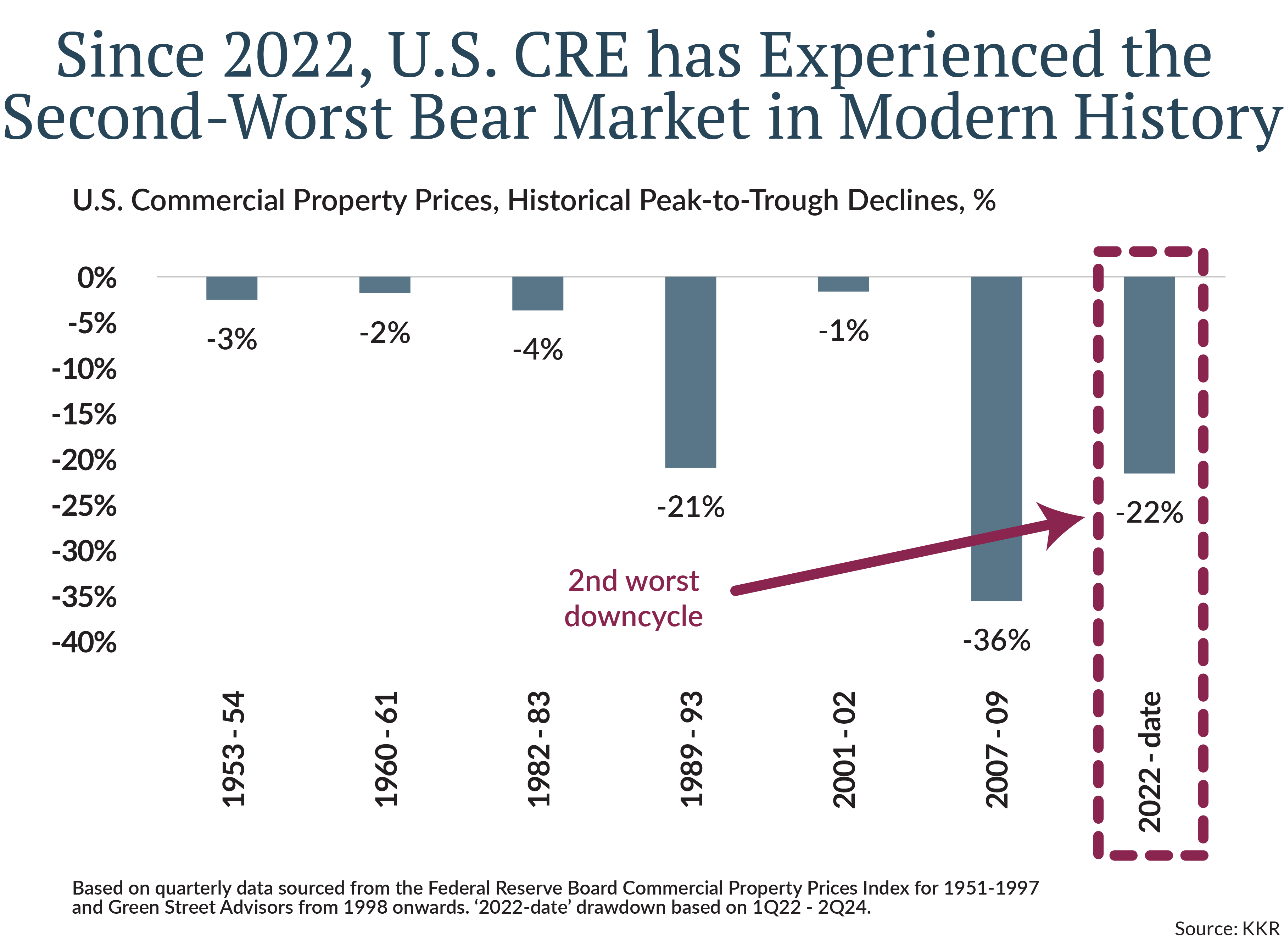

Real Estate: Resilient Fundamentals and Improving Pricing

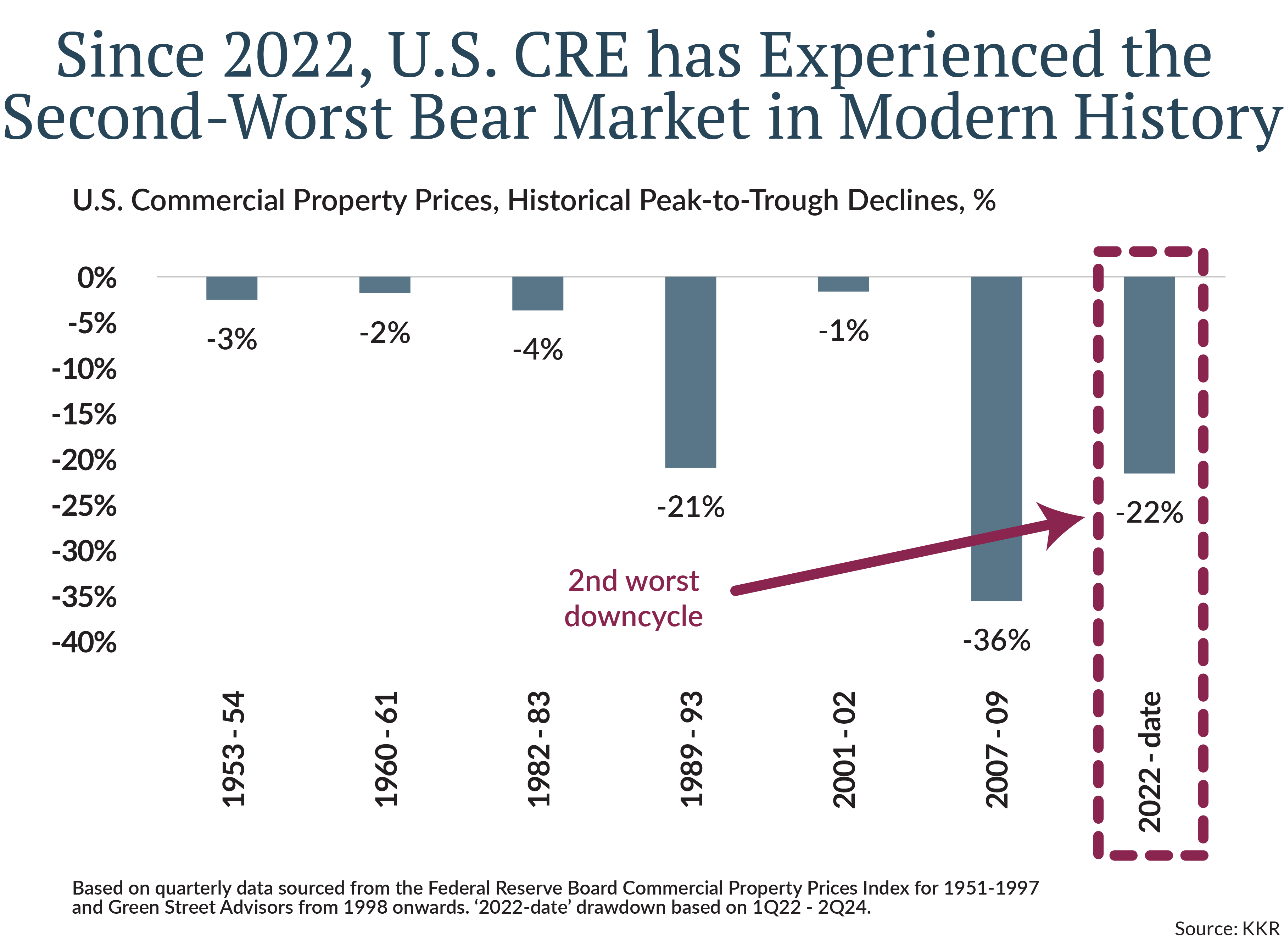

Real estate has suffered its second-worst bear market in modern history over the past two years, with rising interest rates and macroeconomic uncertainty creating headwinds. However, the outlook is improving. Fundamentals remain resilient, underpinned by steady demand in sectors like industrial, multifamily housing, and select retail niches. At the same time, real estate pricing appears to have stabilized and, perhaps, found its bottom, presenting attractive entry points for investors.

Key drivers of this recovery include:

- Stabilized interest rates: With central banks signaling a potential pause or moderation in rate hikes, borrowing costs for real estate investments are expected to stabilize.

- Reshaping of work and living spaces: Continued evolution in work-from-home trends and urban migration patterns create new opportunities in adaptive reuse and mixed-use developments.

- Inflation hedging characteristics: Real estate’s ability to hedge against inflation continues to attract investors in a world of higher prices.

Investors seeking to capitalize on these trends should focus on well-positioned assets with strong cash flow potential and a clear path to value creation.

Secondaries: A Growing and Attractive Asset Class

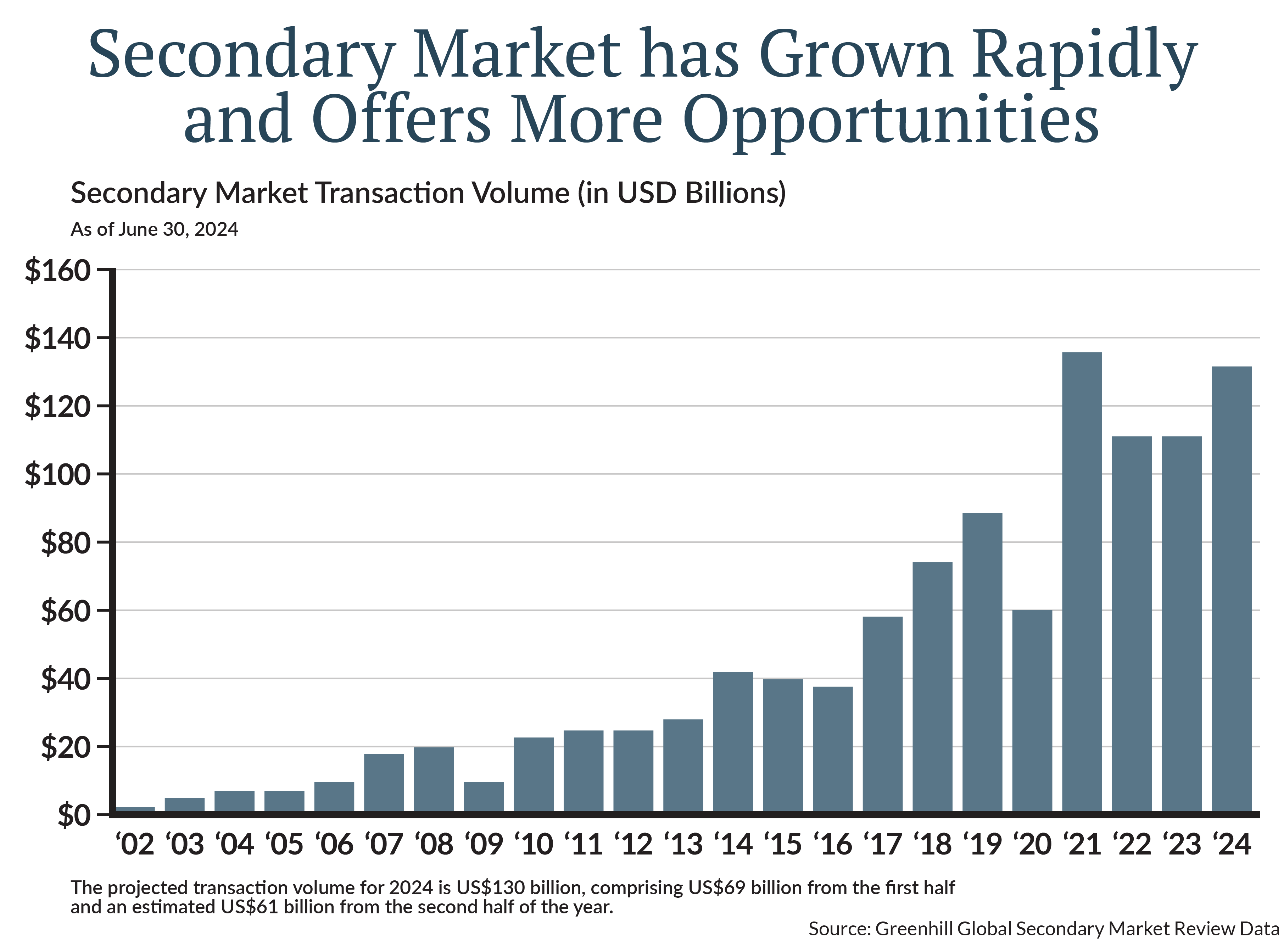

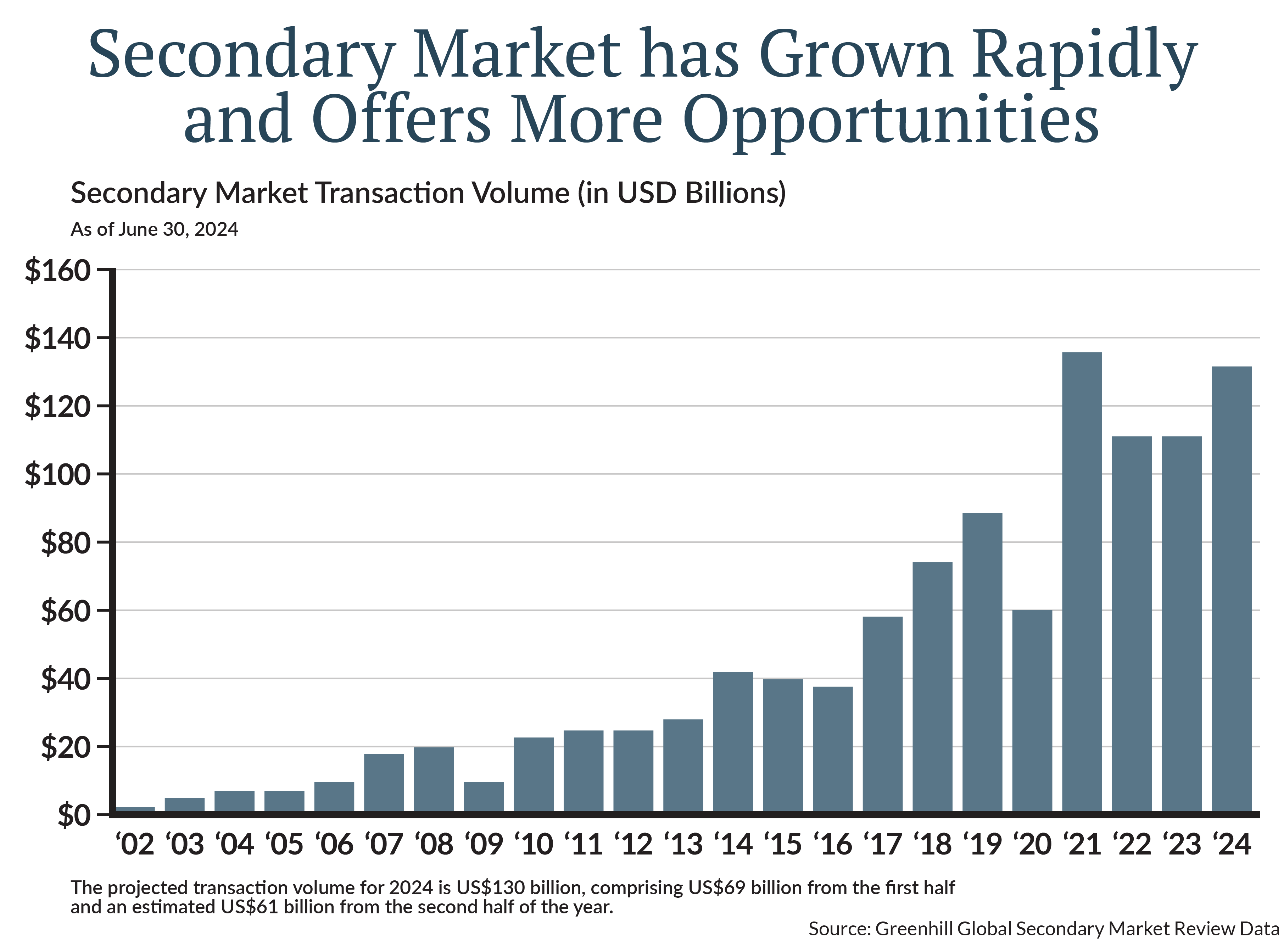

The secondaries market has experienced substantial growth in recent years, gaining increased acceptance as a core component of alternative investment portfolios (chart in Word doc). Acceptance of secondary private fund sales has accelerated with the reduced fund distributions from private fund managers in recent years, a consequence of the slowdown in mergers and acquisitions and the near absence of initial public offerings (IPOs) that typically serve as liquidity events. In the current environment, where limited distributions from private equity and other vehicles are pressuring liquidity, secondaries offer a timely solution for both buyers and sellers.

- Liquidity solutions for LPs: Limited partners (LPs) facing constrained distributions are more likely to turn to the secondary market to exit holdings and satisfy liquidity needs, creating a robust pipeline of opportunities.

- Enhanced efficiency: Secondaries enable investors to gain exposure to mature, well-defined assets with reduced blind pool risk compared to primary investments.

- Attractive tailwinds: The growing sophistication of secondary strategies and favorable market dynamics ensure that the asset class remains appealing for investors seeking diversification and liquidity.

These tailwinds make secondaries an attractive opportunity in 2025, allowing investors to benefit from the evolving needs of the private markets ecosystem.

Private Credit: Expanding Beyond Direct Lending

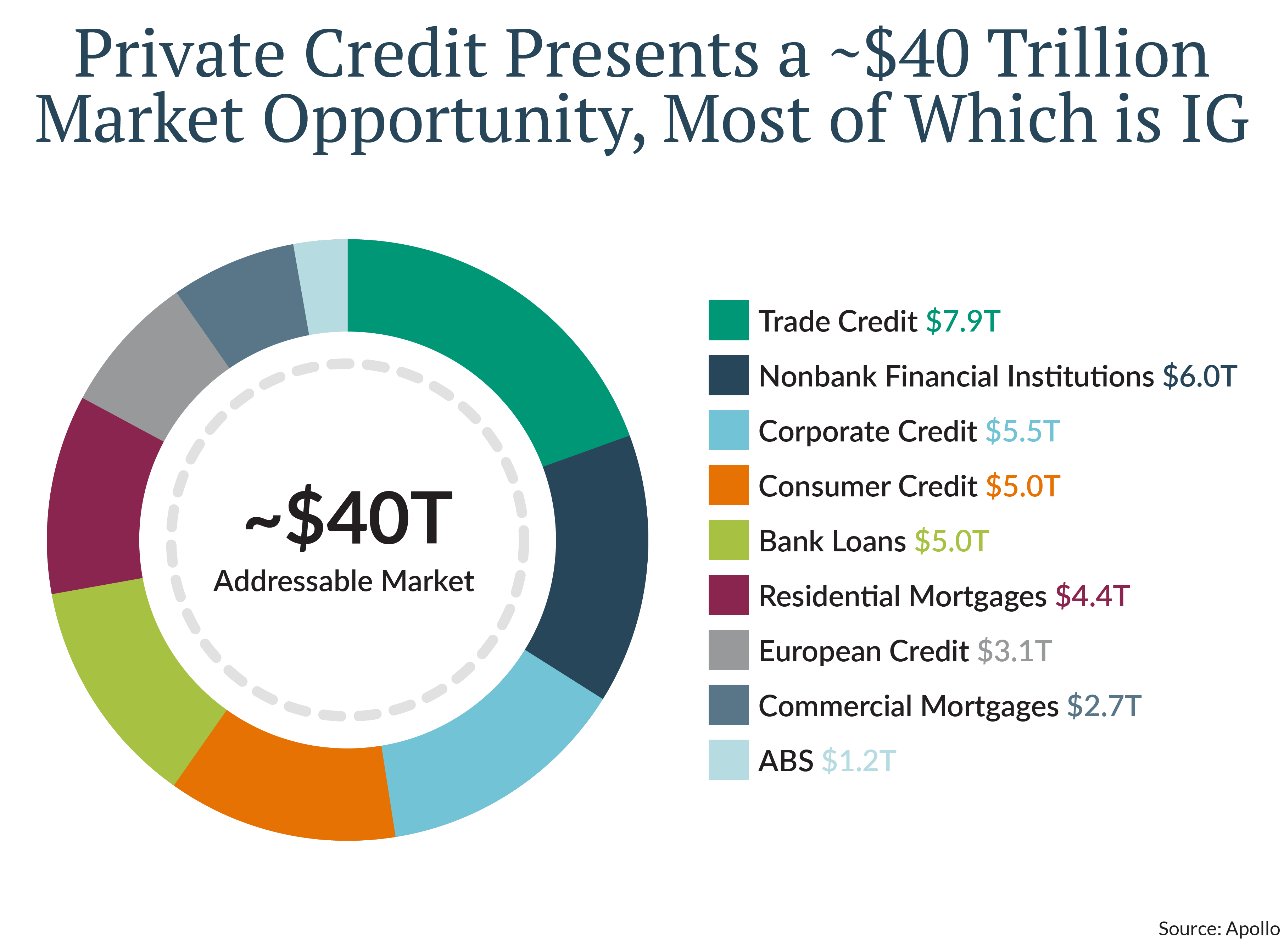

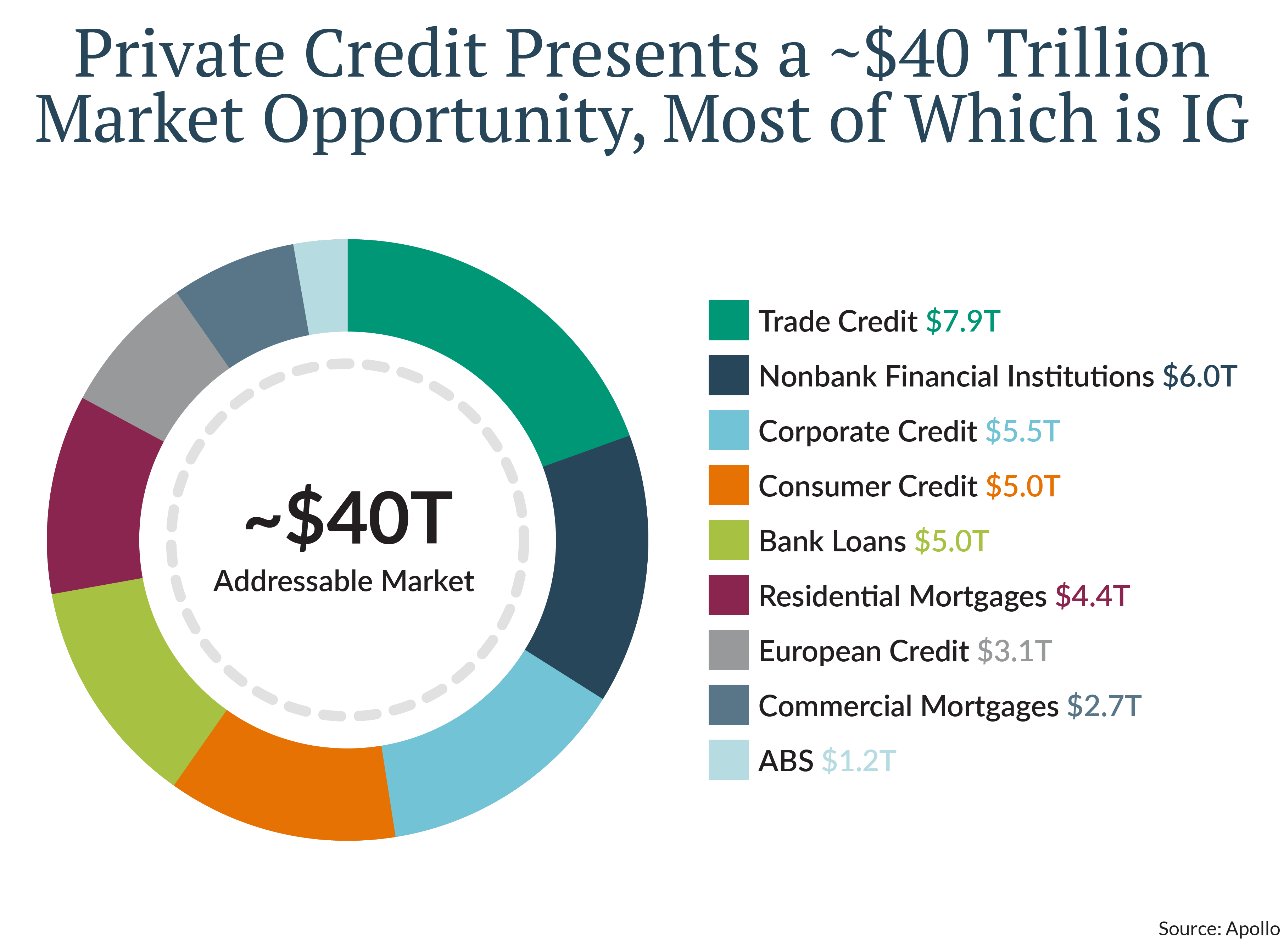

Private credit has emerged as a preferred asset class in the alternative investment universe, and its growth trajectory shows few signs of slowing. Private loans to corporations, known as direct lending, has benefitted from the regulatory constraints that have limited bank lending and become a cornerstone of alternative allocations. However, private credit continues to expand and now includes a broader range of opportunities that merit investor attention. Estimates of this considerable market opportunity vary, with leading alternative investment firm Apollo estimating that the addressable market could be as large as $40 trillion.

- Asset-based lending: Loans secured by physical assets or receivables offer attractive risk-adjusted returns and a level of downside protection.

- Infrastructure financing: With governments worldwide prioritizing infrastructure renewal and development but contending with significant government debt levels, private credit investors are stepping in to bridge funding gaps.

- Special situations: Opportunities in distressed and opportunistic credit strategies are growing as companies navigate a new era of higher rates and higher costs.

Private credit’s appeal lies in its ability to offer steady income streams, lower volatility, and higher yields compared to traditional fixed-income instruments. The asset class is particularly well-suited for investors seeking to navigate the current rate environment while positioning for long-term growth.

Why Now?

While the decision to diversify into alternatives depends on an evaluation of your objectives, risk tolerance, and liquidity needs, their unique attributes make them a compelling consideration for many portfolios. A thoughtfully constructed allocation to alternatives can enhance portfolio resilience and open opportunities that traditional assets may overlook, helping you to navigate an increasingly complex investment landscape.

Looking ahead, the outlook for alternative investments remains positive, even as the broader market faces headwinds. Real estate offers a recovery story grounded in strong fundamentals, secondaries provide a growing and efficient avenue for liquidity and risk mitigation, and private credit continues to innovate and diversify. Together, they represent a powerful toolkit for achieving your financial goals and benefit investors who dare to diversify.