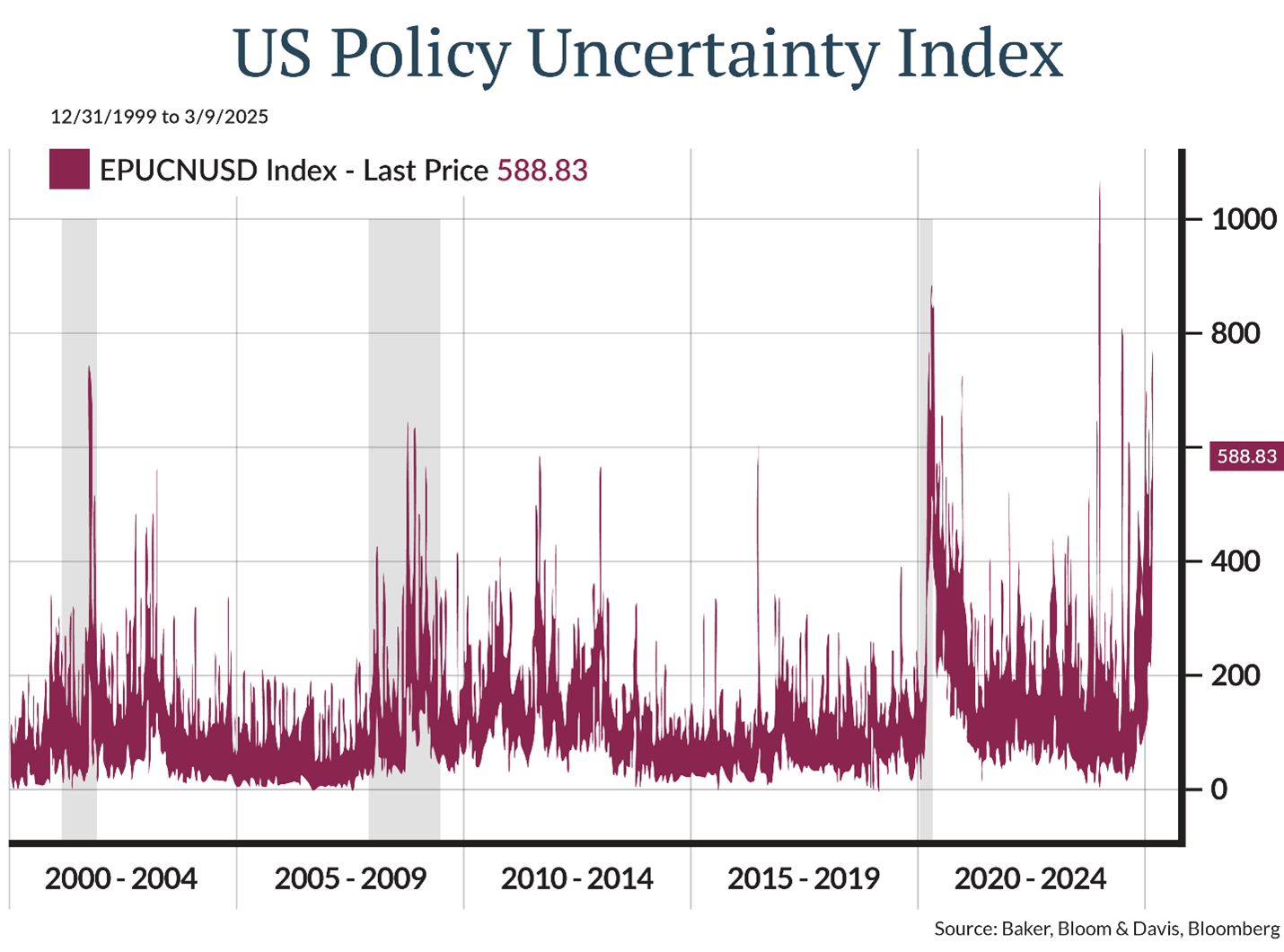

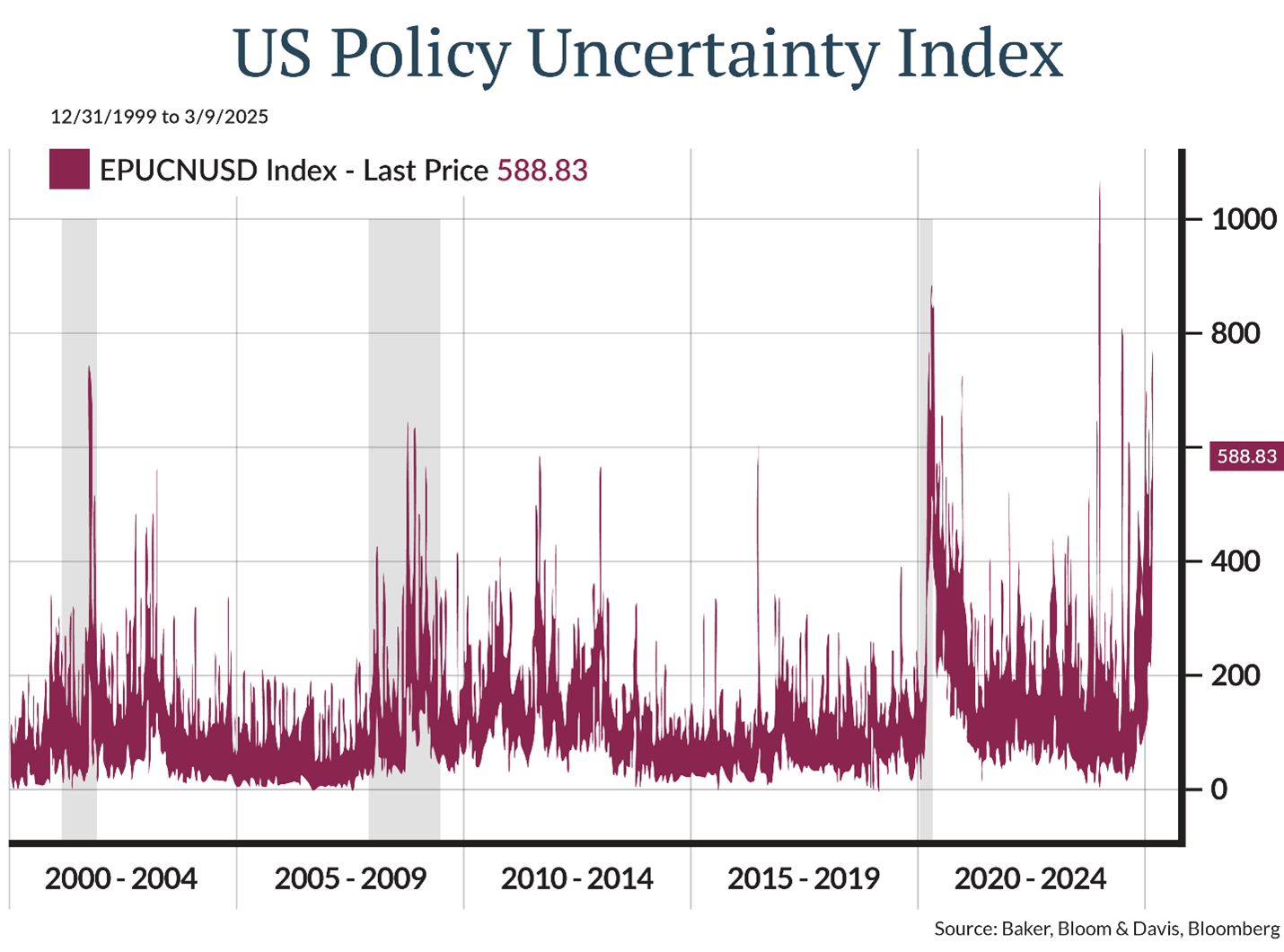

Markets have been volatile recently with the S&P 500 Index declining over 7% from its February high. A progression of worse than expected data points on inflation and economic growth combined with policy uncertainty from the new administration has caused investors to question their growth and inflation outlook for 2025.

Investing in a broadly diversified portfolio with disciplined rebalancing can provide the mindset to play offense as opposed to defense during market declines.

Policy uncertainty

Uncertainty around tariffs and their impact on global trade seems to have created an air pocket in growth, which could spill over into a recession if consumers curb their spending.

AI growth concerns

In addition to policy uncertainty, investors’ concern over the rapid growth of the technology stocks connected to the Artificial Intelligence (AI) theme is slowing ever since Chinese generative AI chatbot DeepSeek revealed that it could compete with ChatGPT at a fraction of the cost.

This means that the rate of growth for capital spending on data centers, for example, may slow. AI-related growth stocks were priced at lofty valuations and have not reacted well to growth concerns. After surging 64% in 2024, the Magnificent 7 darlings are down over 11% YTD and about 20% from their December high.

What should you do about it?

Get ready to play offense, which goes against human instincts. When we are fearful or anxious about the market, we feel a need to take action by selling stocks. However, this selloff is most likely to be one of the normal 5-10% declines we get twice each year on average. In some instances, declines are more severe when stock prices have been at frothy levels or when growth concerns become reality and the economy enters a recession.

However, the long-term view remains clear: economies and earnings tend to increase over time leading to higher stock prices over the long run. Therefore, if you have the appropriate time horizon for your stock investments of 5-10 years or longer, a 5-10% decline is a time to nibble and a 15-20% decline is a time to add exposure as the probability of positive future returns climbs after large declines.

During the large stock market gains in 2023 and 2024, we rebalanced portfolios regularly to keep in line with long term targets. In layman’s terms this means we sold stocks to buy bonds or alternative investments. Rebalancing preserves the long-term diversification strategy of your portfolio and allows flexibility to take advantage of market declines.

Diversification is working now

Investors should also keep in mind that diversification is working so far in 2025. As of March 7th, while the big US technology stocks are down more than 20% from their peak (Magnificent 7) and US stocks are down 7% from their peak, value stocks are up 2% and international stocks are up 8%.

Investors are rotating within the stock market to areas of better value as opposed to outright selling, with eight of 11 S&P 500 sectors positive on a year-to-date basis. In addition, bonds and a diversified mix of alternative investments are up 2% each. This means a diversified portfolio is likely flat or slightly positive on a year-to-date basis even though it feels like your portfolio must be down 10% or more!

What is the stock market outlook for 2025?

We expect another year of gains for the stock market despite recent declines on the back of continued earnings growth. However, we didn’t think another year of 20% gains was likely for US stocks given elevated optimism. The uncertainty related to tariffs, mixed economic data and concerns about AI spending rates will likely keep volatility higher than it otherwise would have been. The market will likely bottom at the unknowable point of maximum uncertainty, which will only be known with hindsight.

In addition to the risks related to an air pocket of growth that may persist as long as uncertainty keeps climbing, 2025 has two converging cycles that tend to contribute to below average returns for the stock market: year one of the presidential cycle and year three of the market cycle.

- The presidential cycle tends to positively influence the stock market in years three and four as the administration does what it can to boost the economy to get reelected. However, markets tend to produce below average returns in year one as the economy feels the hangover from a reduction in pro growth policies.

- The market cycle tends to be weaker in year three after two strong prior years. The tendency of this cycle is that the stock market experiences above average returns after a large decline (S&P 500 – 18% in 2022) as stock prices recover from the selloff and valuations expand due to optimism about an earnings recovery. Year three tends to be the year that fundamentals like earnings growth need to catch up to the higher prices experienced in prior years. In 2025, this cycle may be most relevant for the AI stocks that led markets higher in recent years.

What about beyond 2025?

While any decade’s returns are not smooth, current valuations suggest that stocks will return 6-7% average annual returns for the next 10-15 years. This is below the long-term average of about 10%, but still a couple percent higher than bond yields.

Over the next four years of the Trump administration, the weight of policy uncertainty is likely to be highest in 2025—since year one is when any administration tries to push new legislation based on the momentum from the election.

Aside from tariffs, immigration and deregulation that the executive branch has greater control over, the President and Congress have to work together on the expiring tax cuts from Trump’s first administration. We should know more details by midyear and whether market expectations for tax policy to remain largely intact will prove accurate.

After 2025, the attention of Washington will turn to midterm elections in 2026, and significant policy changes thereafter are unlikely considering the narrow Republican majority in the House and Senate. This will leave policy out of the equation of stock market returns.

Be ready for opportunities

Balanced portfolios own bonds and alternative investments that produce income and are not highly correlated to the stock market. This means that you don’t have to sell stocks during a selloff, but instead can use the decline as an opportunity to accumulate stocks by rebalancing in the other direction.