SUMMARY

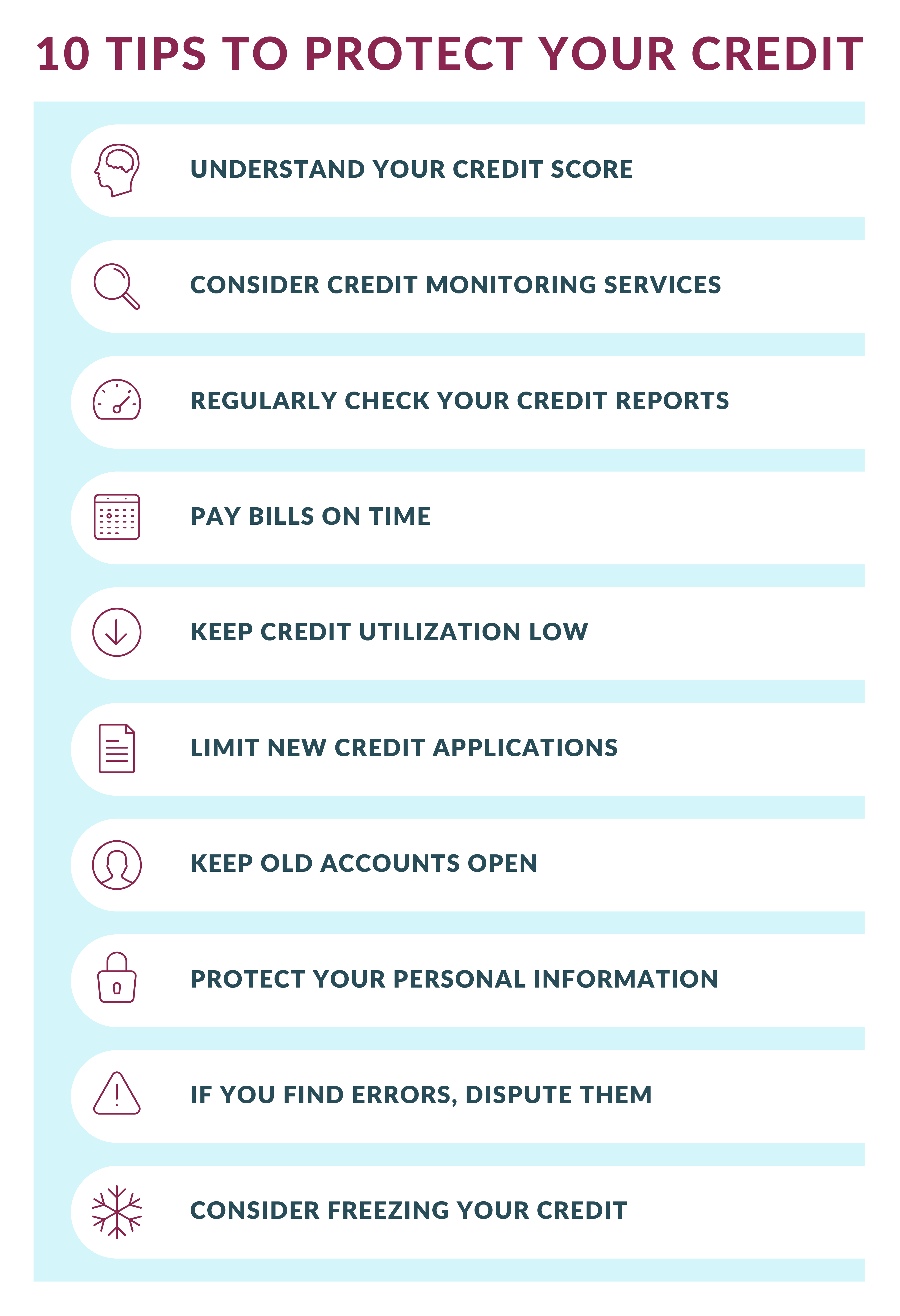

Discover practical steps you can take to protect your credit, including regularly checking your reports, understanding your score and considering freezing your credit to prevent identity theft.

Your Financial Life

4 minute read time

Discover practical steps you can take to protect your credit, including regularly checking your reports, understanding your score and considering freezing your credit to prevent identity theft.

In today's world, maintaining a good credit score is crucial for financial health and opportunities. Your credit score is not just a number – it's a reflection of your financial reliability and responsibility, impacting everything from loan approvals to interest rates. Given its significance, it's crucial to proactively manage and monitor your credit score so you can foster a stronger financial future. Here are some practical, actionable steps you can take to protect and improve your credit:

Your credit score is a numerical representation of your creditworthiness. It's based on factors like your payment history, amounts owed, length of credit history, your credit mix and new credit. Understanding what affects your score can help you make informed decisions.

Credit monitoring services can alert you to changes in your credit reports, helping you catch fraud early. Some services also offer identity theft protection and insurance. Some of these services are free, while others charge monthly. If you have a MyJFG account, you can track your credit score, receive credit reports and educational articles through My Credit Score and Report.

You're entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian and TransUnion) every year through AnnualCreditReport.com. This report provides you with an overview of your credit accounts, balances and payment history so you can monitor your credit history but keep in mind that it does not provide a score.

Payment history makes up 35% of your FICO score, so paying your bills on time is one of the most important things you can do. Set up automatic payments or reminders to ensure you never miss a payment.

Low Credit utilization, or the amount of available credit you're using, accounts for 30% of your FICO score. Try to keep your credit utilization below 30% to maintain a good score. For example, if your credit limit is $10,000, aim to spend less than $3,000 each billing cycle.

Each new credit application can temporarily lower your score, so only apply for new credit when necessary. Also, having too many new accounts can signal risk to lenders.

The length of your credit history makes up 15% of your FICO score. Keeping old accounts open, even if you don't use them, can help maintain a longer credit history.

Identity theft can wreak havoc on your credit. Safeguard your personal information by using strong passwords, being cautious about giving out your Social Security number and monitoring your credit reports for any unauthorized activity.

If you find errors on your credit reports, dispute them with the respective credit bureau. They are required to investigate and remove or correct any inaccurate information.

If you're not planning to apply for new credit soon, consider freezing your credit. A credit freeze restricts access to your credit reports, making it harder for identity thieves to open new accounts in your name. You can freeze your credit for free with each of the three major credit bureaus. When you need to apply for credit, you can temporarily lift the freeze.

Protecting your credit is an ongoing process that requires vigilance and proactive management. By understanding your credit score, regularly monitoring your reports and following the practical steps outlined, you can safeguard your financial health and open doors to better opportunities.

Looking to build or protect your credit? Connect with a relationship banker to learn more.