Decision 2024: China’s Global Ambitions and U.S. Positioning

In part one of my conversation with geopolitical expert Dr. Alex Vacca, we discussed China and its ambitions as an emerging world power. Here are some of the key takeaways from our conversation:

- China has been dissatisfied with its place in the world for quite some time.

- China is likely testing the U.S. to see how far we are willing to go to defend an ally.

- It is unlikely that China will knowingly escalate to armed conflict, but China does not know where the line is.

- China’s interest in certain manufacturing assets is likely a deterrent to armed conflict.

Here are a few simple market facts that we consider in our evaluation of this issue:

- 7.75% of S&P 500 revenues are derived from China.

- China’s weight in the MSCI All Country World Index is currently 2.57%.

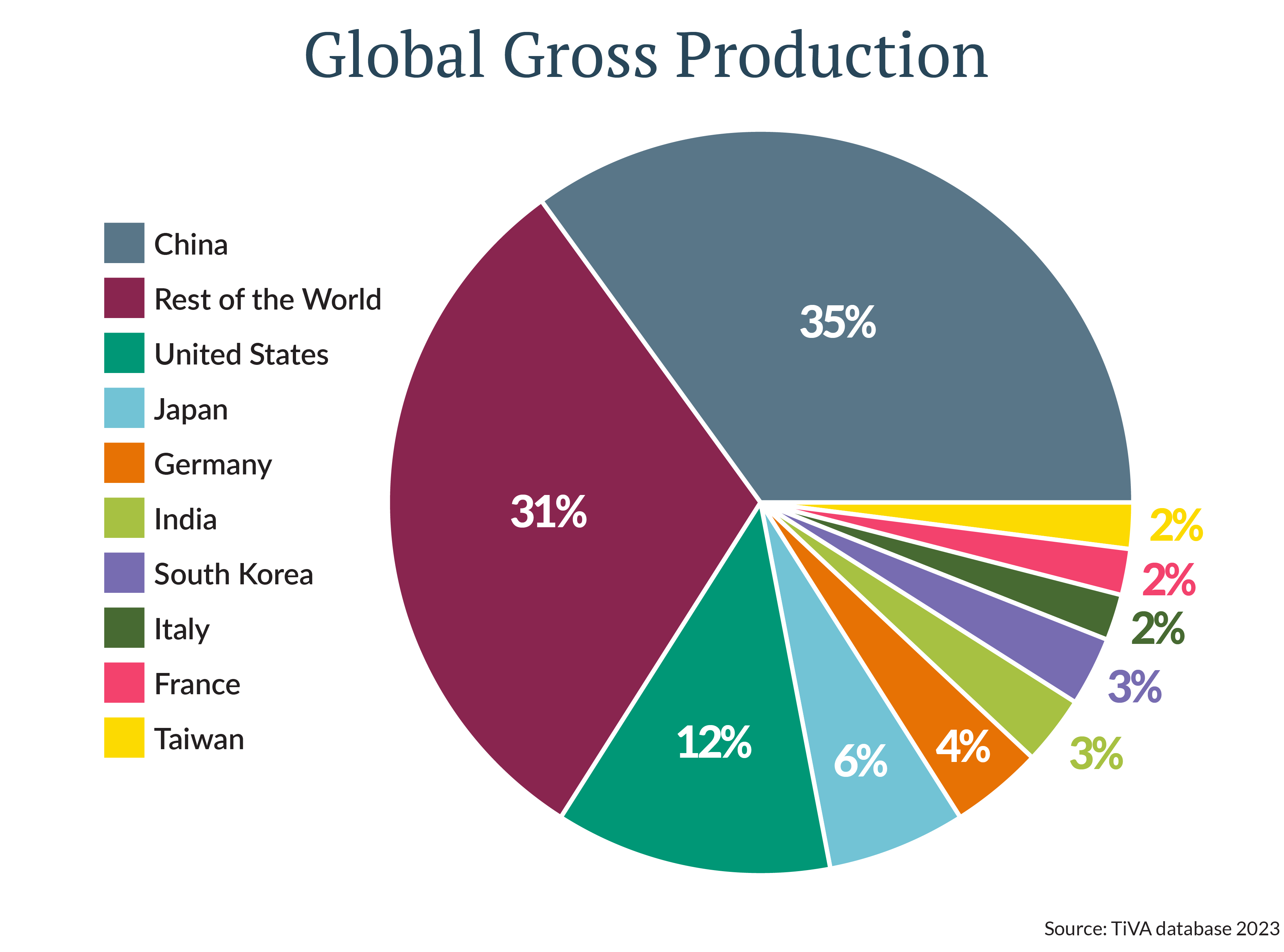

- China is the largest manufacturer in the world, responsible for approximately 35% of global production.

While exposure to China as a direct investment, or a portfolio investment’s source of revenue is likely small for most investors, it is difficult to escape China’s dominance in manufacturing. Many U.S. companies rely on China to manufacture goods. This is likely to be the biggest sticking point for markets should tensions escalate.

P.S. Click here to view pictures and read more about the Sierra Madre (The ship, not the 1940s movie). You don’t need any badges . . .

Additional Videos

For additional videos that deliver unbiased analysis and insights on the 2024 election and its impact on market dynamics, empowering you to make informed investment decisions.

Connect With an Advisor

No matter your goals, our experienced advisors work closely with you to build the right path to success.