Retirement Plan Services

We specialize in customized retirement plans that meet your fiduciary obligations as a plan sponsor and empower employees to control their financial future.

Investment products: are not insured by the FDIC; are not deposits; and may lose value.

Your organization's retirement plan is key to a comprehensive employee benefits program. It should help you attract and retain quality employees without requiring all of your time and energy to administer.

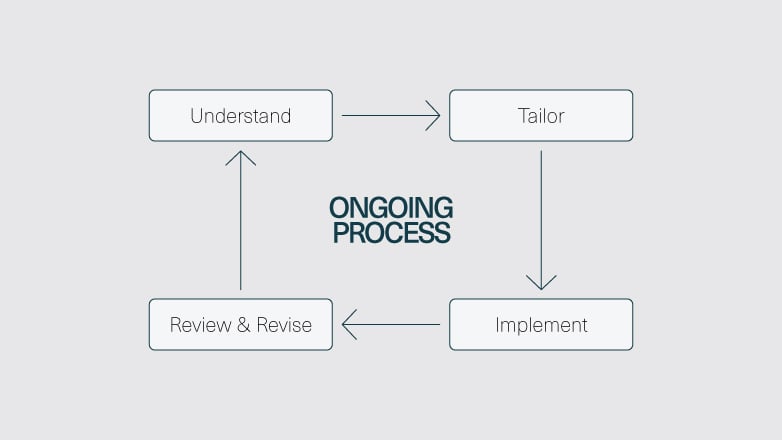

Our advisors will work closely with you to understand the unique needs of your organization and tailor a comprehensive retirement plan program that fits your overall employee benefits strategy. Our team then delivers and services your program to ensure accountability.

How We Can Help

Plan Sponsor Services

Our dedicated team partners with you across all aspects of your retirement plan—from fiduciary governance, investments, day-to-day operations, employee financial wellness and plan structure.

Plan Participant Services

Discover how our enhanced plan participant experience and streamlined enrollment process can provide your employees with a seamless and hassle-free journey towards achieving future financial security.

Wealth Management Solutions

Whether you're looking to invest your money, build a financial plan or prepare for retirement, our advisors can help you create a story that grows, manages and protects your wealth for future generations.

Open Architecture

Our open architecture investment approach means that we're not tied to any proprietary funds, so you can be certain you'll receive objective advice regarding your fund offerings.

- Our fiduciary advice is available as an ERISA 3(21) Investment Advisor or an ERISA 3(38) Investment Manager.

- Our top‐rated investment fund options include domestic and international equity, fixed income and cash equivalent asset classes along with specialty funds if appropriate for your plan participants.

- We utilize comprehensive quantitative and qualitative screening tools and analysis in our fund selection and monitoring processes.

- Fund data is carefully analyzed to make sure funds will meet the desired investment objectives within the parameters of asset class coverage, giving participants a complete array of investment offerings.

- Funds are then reviewed on an ongoing basis to ensure investment objectives and fund expenses continue to be consistent with our analysts' expectations.

Get Started Today

Partner with Johnson Financial Group and experience the difference of personalized advice that drives improved plan outcomes. Let us handle the complexities of retirement planning, so you can focus on what matters most – growing your business.

FIND AN ADVISORWe Can Also Help With...

Commercial Banking

Let’s partner to understand the unique needs of your commercial business, creating a plan with customized banking solutions to achieve your business goals.

LEARN MORE

Treasury Management

Manage your cash while gaining optimal returns with solutions based on your company's needs.

LEARN MOREYour Trusted Retirement Plan Advisor

Our advisors work hard to ensure your retirement plan is tailored to fit the needs of your organization's overall benefit program.

FIND AN ADVISOR